Hysteria from Hysteresis and Path Dependence – Clearinghouses

Goldilocks sounds all well and nice, however, there is no alpha to generate if there is no uncertainty.

Recent economic numbers provided confirmation bias to the goldilocks cycle of continued but slowing growth, as laid out in the previous note (attached). Together with the momentum of balance sheet monetary easing which has been ongoing for the better part of a year in the shadows of the reverse repo facility and is set to accelerate explicitly as the RRP gets drained coupled with the resiliency of the American consumer despite climbing delinquencies; we are in a regime accommodative to risk assets on a cyclical basis.

Goldilocks sounds all well and nice, however, there is no alpha to generate if there is no uncertainty, and I would like to tackle two structures of uncertainty in the next few notes.

First will study the risk created by path-dependency, where various trajectories that end up in the same place provide drastically different outcomes on portfolio performance, we saw this with the Yen carry trade unwind being reversed in the span of a week which gives us information on market microstructure. A hypothesis on why these behaviors can occur is in the calculation of margin from central clearinghouses which in a regime of low volatility and crowded trades can cause a spike in volatility. In the subsequent note on this topic, we will go deeper into the notion of volatility and look at it in conjunction with correlation and dispersion which will help formulate the hedging strategy. In the optimism of the data reducing the likelihood of paths along the narrative of growth scares and pointing towards sustainable reductions in inflation, we need to be cognizant of the path dependence of risk and the actionable signals this provides to structure our hedging of a lazy long equity book in the medium term and the information on market microstructure some price actions divulge.

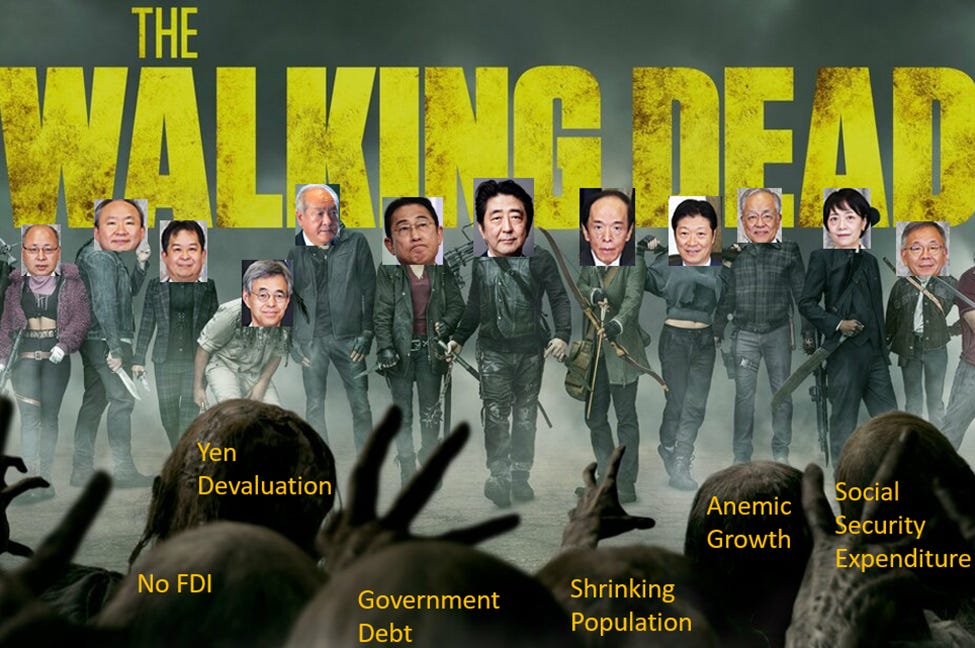

The next topic will be more macro in nature and look at hysteresis (gracias chatgpt for big brain word) which is characterized by two important mechanisms, non-linear impact over time/delay and irreversibility where bringing variables back to their original state does not bring to system back to its original state. The interactions between economic variables follow this notion which combined with the KISS (Keep It Simple Stupid) framework we can structure hedges around the tails of growth and inflation trajectories along with having a methodology to compose longer-term investments across sectors and geographies. Here is a brief preview of one of the things we will look at:

(I know PM Abe passed away in tragic circumstances but Abenomics lives on)

March 19 and July 31 BOJ raised benchmark rates by 20bps and 15bps respectively

· July 31 FOMC – rates unchanged and guiding to 25bps cut in Sept (subject to data etc etc…)

· Aug 1

Initial Jobless claims act: 249k, est: 236k, prev:235k

ISM Manufacturing PMI act: 46.8, est: 48.8, prev: 48.5

· Aug 2

NFP act: 114k, est: 176k, prev: 179k

Unemployment Rate: act: 4.3%, est: 4.1%, prev: 4.1%

A lovely weekend drinking salt coffee….

· Aug 5… Drink vodka Monday

ISM non-manufacturing PMI act:51.4, est: 51.4, prev: 48.8

· Aug 6… Hangover Tuesday and not much econ data

· Aug 7

10-year note auction at 3.96% vs 4.276% previously

· Aug 8… You shall not pass meme from the prior note

Initial Jobless Claims act :233k, est: 241k, prev: 250k

· Aug 13

PPI (MoM) act: 0.1%, est: 0.2%, prior: 0.2%

· Aug 14

Core CPI (MoM) act: 0.2%, est: 0.2%, prior: 0.1%

CPI (YoY) act: 2.9%, est: 3.0%, prior: 3.0%

· Aug 15… Yellen going shopping for H100’s

Core Retail Sales (MoM) act: 0.4%, est: 0.1%, prior: 0.5%

Retail Sales act: 1.0%, est: 0.4%, prior: -0.2%

Initial Jobless Claims act: 227k, est: 236k, prior: 234k

· Additional supportive numbers and BLS flunking their mafs test with jobs counting.

Below is the price action of US yields and tech stocks through these events mapped along with the Yen. We note that the downward trend on both yields and equities was already underway since early to mid-July but accelerated with the conflagration of data which increased the likelihood of US growth reduction and priced in lower yields joined with BOJ charting a path towards higher rates. Since early July, there had already been a sprinkling of relatively negative economic data on employment, PMI, and inflation causing concern. So why did this trend accelerate on vodka Monday? What can this tell us about how to structure hedges to a lazy long equity portfolio? What we are interested in here, is the speed of the unwind reflected by the Vix and the information it provides us on market structure.

It’s helpful to step back from macro and spend time understanding how the market is structured and how its participants interact. I don’t mean to spend time on the self-evident and fundamental laws of technical analysis, but rather market microstructure, much less fun than macro or breaking down an industry but very useful to structure hedges. One seldom talked about market participant is the CCP.

No, not that… Central Clearing Counterparties, or clearinghouses. I won’t be overly technical as we are not academics but professional gamblers.

Setting up the stage for CCPs

The great recession of 07-08 had regulators make the central clearing counterparty (CCP) the vector through which standardized derivatives would be settled. The fall of Lehman revealed a miasma of bilateral derivative contracts which were inadequately collateralized across counterparties. Clearing these derivatives in a centralized manner allowed for a cleaner, more transparent marketplace and standardization of risk frameworks for the derivatives hawker market. The reason why banks did not prefer to use clearinghouses, was that they could set up custom terms to tackle specific situations and avoid using margin, making it cheaper to transact between banks directly than to use the clearinghouse.

To get a sense of the systemic importance of clearinghouses, today north of 80% of rates derivatives are centrally cleared and the amount of compression trades (netting the margined collateral on identical or correlated products) today is larger than the notional outstanding in the rates market leading to the total notional on rates derivative trades to have been stagnant since 08 while having increased trading volumes. This illustrates at a high level the macroeconomic impact of CCPs in financial markets. Moreover, since 08, these clearinghouses due to the regulatorily forced increase in business have outperformed bank stocks substantially.

How do CCPs operate?

Today CCP’s are central to the operation of financial markets but what is their added value? Starting with the theoretical framework of a distortionless financial market; that is, a market with symmetric information, no taxes, no frictional/trading costs, no arbitrage, and the capital structure not affecting the cashflows from the underlying asset. The capital structure here is important, we exist in a financialized economy where the capital stack directs the flow of capital to different investors which affects the valuation of the structure and is not equal to the idealized pricing of the underlying cashflows. A clear example of this can be seen with the full capital stack of a securitization having a premium over the underlying cashflows due to regulatory frameworks that incentivize certain parties holding the securitized form over the underlying. What does this idealized financial market imply for intermediaries? Simply that the intermediary does not add value to the system due to it providing a function of splitting cashflows between parties which were already perfectly priced before the intermediary stepped in and the cashflow waterfall can be replicated by the original parties to the transaction in the first place. Some details around the idea of perfect pricing can be useful to gain intuition here. The perfect pricing of a multi/bilateral agreement detailing the flow of cashflows across time needs to implicitly take into account the default probability for all the different counterparties. This counterparty risk is precisely what central clearing is meant to tackle. In a bilateral framework, the counterparties exchange collateral or have covenants to be indifferent to the creditworthiness of the counterparty providing for this perfect/idealized pricing of the contract. Hence in the said distortionless financial market, this intermediary provides no benefit or added value to the system.

We however do not operate in such a marketplace. Assuming the CCP is unable to default, it can add value to the equation by having the contract being novated to it and being the holder of counterparty risk. Naturally, unless the CCP is the central bank and can print its way out of a default, then it is itself a provider of credit risk. To tackle that and avoid insolvency the clearinghouse will require the posting of margin from its clients and default funds (we will focus on the margin portion). The idea for clearinghouses to exist is that they can spread the idiosyncratic credit risk of each party to the others functioning as an insurance company to its participants by honoring the terms of agreements and in the process allowing for the reduction of the cost of posting collateral. Those two elements are where the clearinghouse adds value to our market. As one can expect, there are tradeoffs to every structure and we will explore the implications of CCPs here.

Regulators pushed for the establishment of clearinghouses across standardized derivatives to mitigate the issue of counterparty risk. The CCP aggregates the margins across investors to guarantee the completion of a contract if some parties become insolvent, effectively distributing idiosyncratic risks between participants. The posting of collateral provides a natural barrier to entry into the system where all else being equal collateral is more costly to less credit-worthy entities; with enough required margin to transact with the clearinghouse, only parties that can afford to will remain in the equation. The flip side is that CCPs reduce informational barriers to entry from counterparty risk and allow trading firms to focus on the economics of the trade abstracting away counterparty risk. The clearinghouse does not play an active investment role and can guarantee that the collateral will be preserved within the CCP solely for its designed intent while also having the capacity to efficiently change variable margin across participants increasing the likelihood that the clearinghouse can guarantee the contracts between participants in the case one becomes impaired.

The cost saving on collateral posting is a unique feature that only a central intermediary can provide in the form of netting (compression trades) allowing an equal notional of collateral supporting a larger quantity of contracts. However, it’s important to note this netting usually happens within an asset class between parties as clearinghouses usually operate within a specific market, whereas bilateral agreements can accommodate netting between asset classes but are restricted to the two parties of a set of contracts. It’s simplest to provide a simple illustration of novation and netting.

How is the margin calculated currently and how does it pose a risk to markets?

Now that we illustrated the role of clearinghouses; we can ask why this matters when professionally losing money in markets. I just want to make smart-sounding theories about macro and the economy to justify my gambling addiction. Well… we are in luck and can make smart-sounding theories about market microstructure to send our hedges to hedge heaven with grace and elegance.

What are the implications of clearinghouses on the behavior of markets? Given the clearinghouse is a market participant and a profit-making enterprise (nuance here as some clearinghouses are member-owned institutions which removes to an extent the profit-seeking arguments below), it has to take some form of risk, which does not come in the form of market directional risk but rather liquidity. The liquidity risk is mitigated with the initial and variable margin model while needing to incentivize making trading as easy as possible through netting. Higher margin requirements on participants would decrease trading volumes, so clearinghouses optimize for the fine line between maximizing trading volume while maintaining an adequate margin to guarantee the completion of the terms of the contracts in case one party is unable to. One way we can glimpse into how initial margin operates is by leafing through ISDA’s Standard Initial Margin Model (SIMM) https://www.isda.org/a/b4ugE/ISDA-SIMM_v2.6_PUBLIC.pdf; truly a thrilling read while on an exotic beach. One key takeaway is the purely statistical nature of their approach, this implies that it is a fully backward-looking model and does not take into account changes in cycles and market dynamics that the macro gods are implementing. This is problematic in times of reduced volatility as what we have seen before Vodka Monday initial margin models would calculate a reduced margin for counterparties to the CCP which then sees the clearinghouse being forced to use its variable margin mechanic on a rapidly increasing number of members forcing liquidations from the most levered parties to the less levered until the market finds its natural buyers.

Moreover, as we have seen at the start of the hiking cycle, correlations between asset classes can diverge from the historically implied consensus, think of the 60/40 equity/bond portfolio over the last few years. With the objective of larger trading volumes, CCPs are incentivized to maximize netting, they do this by looking at correlations between different products. The higher the correlation between the two products, the more netting can be allowed by the clearinghouse. Netting of collateral although beneficial in times of low volatility as it frees up capital for participating entities, also provides them with the ability to take on more leverage, which in crowded trades can imply a more violent deleveraging than would otherwise occur if leverage was forced to be more constrained in the system through an alternate form of margin calculations which looks at the leverage in the whole system and not just by counterparty and trades individually. This can make the margin insufficient in cases where correlations flip as in the Einer Aas case, where the Nasdaq Oslo clearinghouse assigned a correlation of 1 between German and Nordic electricity futures putting them in the same European energy basket. This relationship was proven wrong in September 2018 and resulted in the near collapse of the clearing house https://www.risk.net/risk-management/7739721/nasdaq-held-aas-portfolio-for-nine-months-after-blow-up.

A fundamental problem with the current margin model is that it is calculated solely on the exposure taken by the counterparty expressed in size, vol, diversification, etc etc…) and done independently of correlation between the exposures amongst counterparties. This highlights a substantial weakness of the current clearinghouse model (the next financial crisis could very well take the form of a clearinghouse crisis) which does calculate larger initial margin across traders in a crowded position, reducing the incentive to take on leverage and reducing the likelihood of rapidly increasing variable margin cascading from the most levered to the least in the crowded trade.

A fundamental problem with the current margin model is that it is calculated solely on the exposure taken by the counterparty expressed in size, vol, diversification, etc etc…) and done independently of correlation between the exposures amongst counterparties. This highlights a substantial weakness of the current clearinghouse model (the next financial crisis could very well take the form of a clearinghouse crisis) which does calculate larger initial margin across traders in a crowded position, reducing the incentive to take on leverage and reducing the likelihood of rapidly increasing variable margin cascading from the most levered to the least in the crowded trade.

These three points we have overviewed on the calculation of margin from CCPs are a potential source of volatility spikes in markets:

· statistical in nature and not forward-looking to changes in market dynamics.

· Correlation netting leads to an increase in leverage which needs to be quickly reversed if correlations flip.

· Product/counterparty level margin calculations with no measure of crowding going into it.

The key takeaway here is the mispricing of risk that the clearinghouse creates by having a statistical and not forward-looking model for initial margin (which is logical given we can’t predict the future; we will cover the Gilt smackdown as an example where a change in mechanics could perhaps have been interpolated, detailed at the end of the note) and being incentivized by profits to do compression trades based on correlations to reduce posted collateral and make trading cheaper for its clients and no disincentive to crowding a trade in the market. These issues lead us to the variable margin which is what we seek to understand to structure our hedges. Variable margin is typically calculated throughout the day based on market movements to reduce the likelihood of margin breaches (where a member’s mark-to-market loss is above the posted collateral). This leads us to the meat of all this blabbering which comes with crowded trades of which the yen carry trade was a prime example. This occurs when a substantial amount of investors take up the same side of a trade and end up with highly correlated portfolios which broadens the reach of idiosyncratic risks increasing the likelihood of defaults across a variety of members, but most relevantly for the Yen carry trade, creates a sequence of unwinding in leverage through increases in variable margin requirements forcing a chain of liquidations down to the set of limit orders where enough members who are now not in the trade are willing to put on risk.

If there is one thing to note here is that clearinghouses allow for crowding and increased leverage in periods of low volatility which can eventually result in a spike of volatility when factors going into the trade start reversing where the most levered players are shaken out of the position and can create a chain of liquidations as margin requirements rise across the system. Essentially the clearinghouse uses margin models based on value-at-risk methodologies that can understate the risk in calm conditions and amplify them in times of market stress. How do we find a way to monetize this? I’ll tackle that point in the next note and go into the concepts of volatility, correlation, and dispersion.

The Gilt meltdown is a perfect example of the risks caused by central clearing.

In September 2022, the Gilt crashed and the pound dramatically devalued along with global equities taking a hit and US/EU yields remaining relatively steady which forced the BOE to intervene adding liquidity in the rates market. The catalyst for this event was the combination of rate hikes by the BOE and the fiscal plans that would increase the debt burden of the state to cover a portion of the nation’s rising energy costs (how is underinvesting in baseload looking now?) which was subsequently walked back due to the turmoil in markets.

UK pension funds utilized a strategy named Liability Directed Investments (LDI) which consisted of hedging the interest rate risk of their liabilities with swaps that were sitting in the LSE and LCH as opposed to buying fixed income instruments to generate cashflows matching the liabilities. The nuance is that even though both the interest rate swaps (IRS) and fixed income can have a duration match, they do not have a liquidity match. So everything behaved as expected; as yields rose, the mark to market on the swaps reduced their value in line with the liabilities. Although no mismatch in duration and total value; from an aggregate value perspective the trade works. The issue is that the rise in yields does not increase the cashflows from the liabilities despite a reduced valuation but the margin on the swaps does require the pension funds to cough up cash they don’t have. These funds subsequently sold their liquid Gilts to cover their margins (despite their duration risk being correctly hedged) beyond the liquidity of the market causing a substantial spike in yields spiraling to more variation margin requirements up to the point where the natural buyer stepped in, the BOE and they self admittedly bought more than they wanted to tame the crisis. For years, the gilt market had been a relatively stable asset and given the backward-looking initial margin mechanism, this margin would have been insufficient to handle the rise in rates that central banks globally had been embarking on and was being telegraphed to tackle inflation. This should have been a macro change that the clearinghouses could note, but the models did not allow for that. As a result, the number of margin breaches skyrocketed.

Yen Carry trade, the last samurai

The latest example of this was with the Yen Carry trade, again it all seems to start with rates that are fairly well telegraphed (granted the BOJ move was somewhat of a 50/50 call, but the Fed’s trajectory given it being supposedly data-dependent and Powel not pushing against the forward curve, is quite predictable and was clear before vodka Monday.

Here is a chart that should help set up the framework for the subsequent note which adds the VIX, correlation, and dispersion to the plot

At this point, everyone knows about the broad strokes of this unwind and it was also covered in a prior note, so let’s start wrapping this up with a meme

Cheers,