We recently had two important reminders of the state of our world. First, our childhood sci-fi, space exploration fantasies are real-world projects with capital and rocket-catching chopsticks. Second, and much less enjoyable for those of us constrained to living on the blue planet, we live in a world with increasing geopolitical tensions where mechanical warfare is somehow still a reality.

I have written extensively about hedging inflation risk in your lazy equity long portfolio and touched on equity and volatility hedging strategies, which are structural sources of risk. Given the escalating tensions in the Middle East, China-Taiwan, and the ongoing war in Ukraine, amongst others, I would wager that in a long enough time horizon, the probability of an armed conflict dragging in NATO is close to one. I will not spend time trying to predict the who, when, and where of future conflicts; instead, I want to focus on understanding the companies that help governments prepare for this idiosyncratic risk.

One can take many paths to hedge geopolitical risk. I recently attended a gold trading conference where a key theme was to buy physical gold stored in tax-advantageous and geopolitically neutral jurisdictions to protect wealth in the event of an armed conflict. War is clearly on investors’ minds, and a helicopter view of the industry can prove insightful. Unfortunately, I don’t think this theme only serves as a hedge but as a standalone and valid theme for investing, which marries well with our view of continued and accelerating fiscal expenditures globally. I want to focus here on constructing a basket of equities set to benefit from increased spending in the defense sector while sprinkling in much-needed sci-fi hope and human awesomeness.

This is not meant to be read as a pitch to buy things that go boom before the Third World War but as a framework for understanding the defense industry and providing resiliency to portfolios across market cycles and unpredictability. Moreover, I find that the profit-seeking nature of defense contractors is cognitively at odds with pursuing peace. I do, however, appreciate how competition in the industry can yield improved outcomes and more technological advancements, which also provide improvements for everyday life. War is a complicated theme, and I much prefer discussing how to make a superb Mojito (the best one I had was in Bogota) while watching the original Star Wars trilogy. Let’s start with something cool.

Brief history of space exploration

Space exploration has been a tale of evolving frontiers, beginning with the intense, government-driven competition of the Cold War. In the mid-20th century, space became the ultimate arena of rivalry between the United States and the Soviet Union. The Soviet Union’s launch of Sputnik in 1957 signaled the dawn of the Space Age and an era where superpowers invested vast public funds into space technology, often driven by a blend of scientific ambition and defense strategy.

The United States responded by founding NASA in 1958 and achieving landmark accomplishments like the Apollo moon landing. During this era, space programs symbolized technological supremacy and military strength. However, the closing chapters of the Cold War brought with them shifting national priorities and budget constraints, driving the gradual emergence of private players in space.

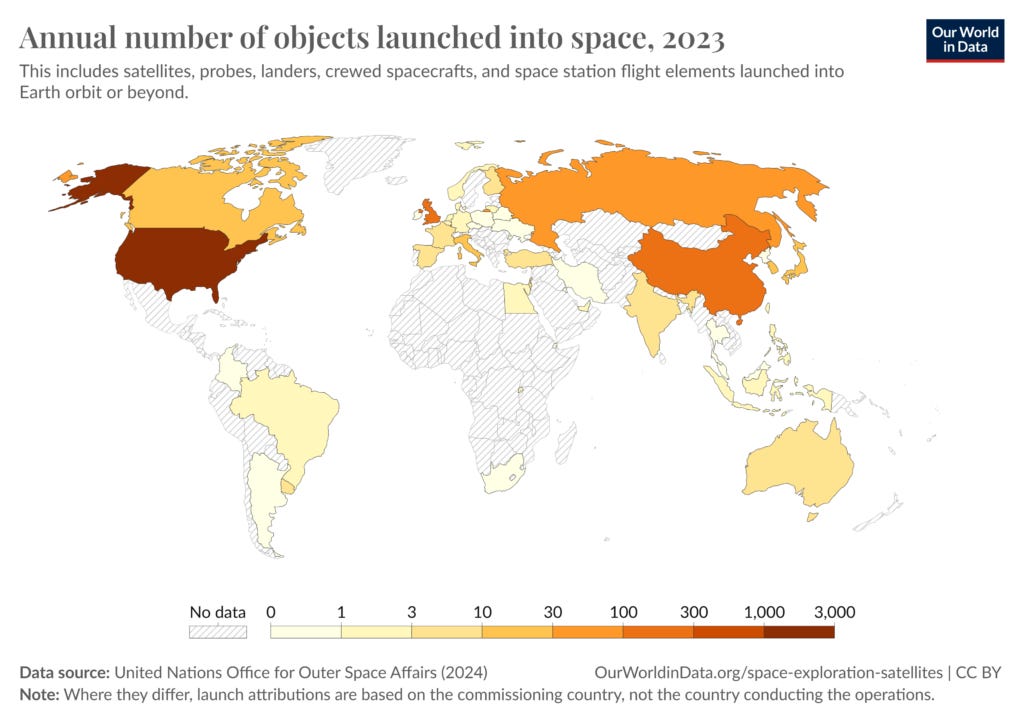

Internationally, this era set the stage for other nations to enter space. The European Space Agency (ESA) was founded in 1975 to provide a cooperative framework for European countries. Meanwhile, China developed its national space program, achieving notable milestones such as the launch of its first satellite, Dong Fang Hong 1, in 1970, and expanding significantly in the 21st century with a series of ambitious lunar and Mars missions. This internationalization laid the groundwork for future global cooperation—and competition—in space.

The Rise of Private Space adVentures

The early 2000s marked a significant shift, as private enterprises took center stage in space exploration. This change was led by entrepreneurs in the United States, and also private players in Europe and Asia. Elon Musk’s SpaceX and Jeff Bezos’s Blue Origin broke ground on affordable, reusable rocket technology, setting new standards for cost efficiency and innovation. SpaceX, with its reusable Falcon rockets, transformed the economics of space and disrupted traditional players like Lockheed Martin (LMT) and Boeing (BA). SpaceX’s successful launches and contracts with NASA and the Department of Defense showed that private companies could compete in areas historically dominated by government agencies.

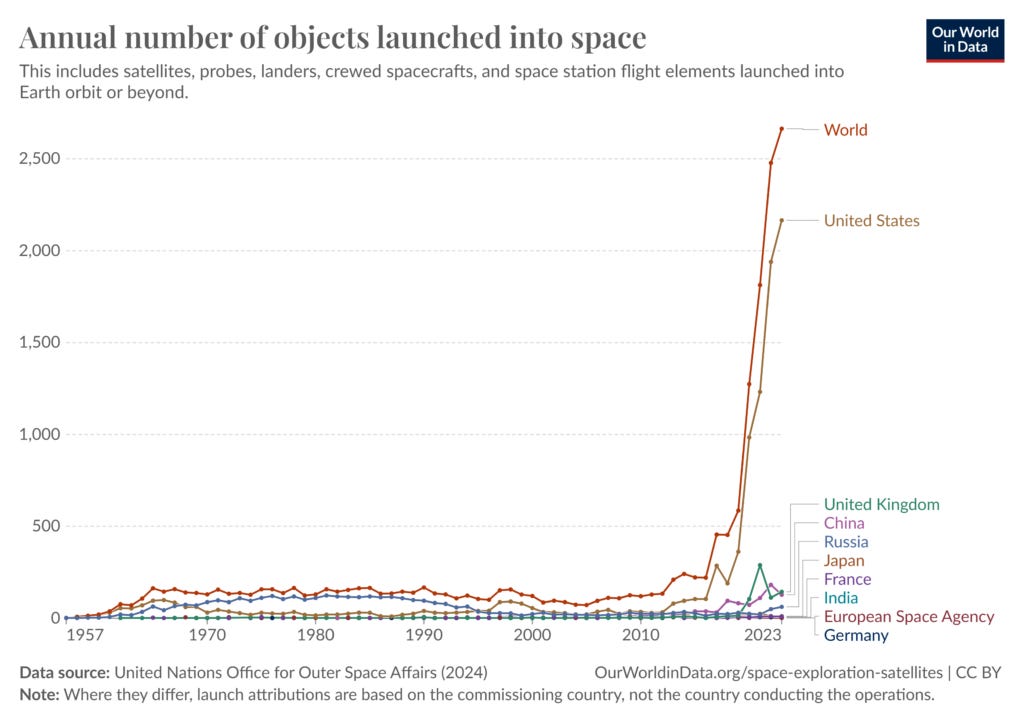

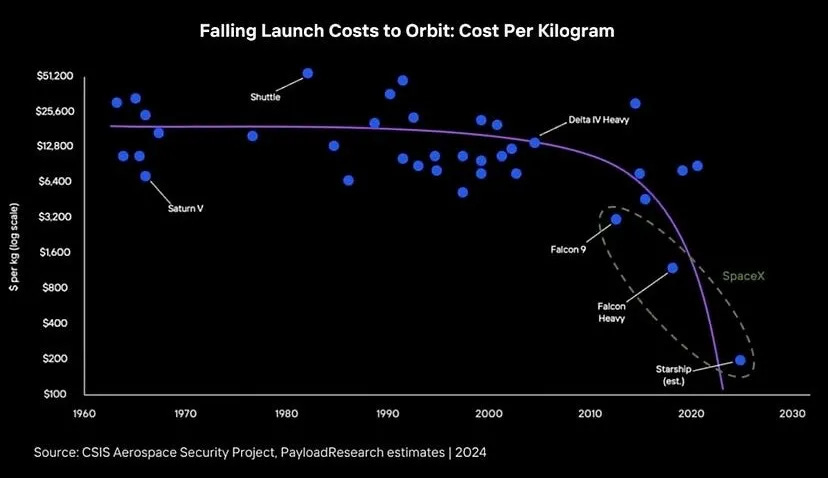

Adding to the speed at which advancements across the industry are the compression in costs per kilo being launched.

In Europe, firms like Arianespace, a subsidiary of the European aerospace giant ArianeGroup, provide launch services for ESA and commercial clients worldwide. Arianespace has developed the Ariane rocket series, which attempts to compete with SpaceX and is now preparing for its next-generation Ariane 6 launch vehicle, aiming to improve cost-effectiveness and launch frequency although without reusability. Meanwhile, European companies like OHB SE (ETR: OHB) focus on satellite construction, and Thales Alenia Space, a joint venture between Thales Group (Euronext: HO) and Leonardo (BIT: LDO), delivers satellite solutions to both commercial and defense clients.

China’s space program, run by the China National Space Administration (CNSA), has similarly fueled private enterprise by opening portions of its industry to domestic companies. Beijing-based private players like Galaxy Space and iSpace are competing to develop their own LEO satellites and reusable launch capabilities. China’s launch services company, CASC (China Aerospace Science and Technology Corporation), also works alongside private entities, though the space sector remains tightly integrated with national defense initiatives.

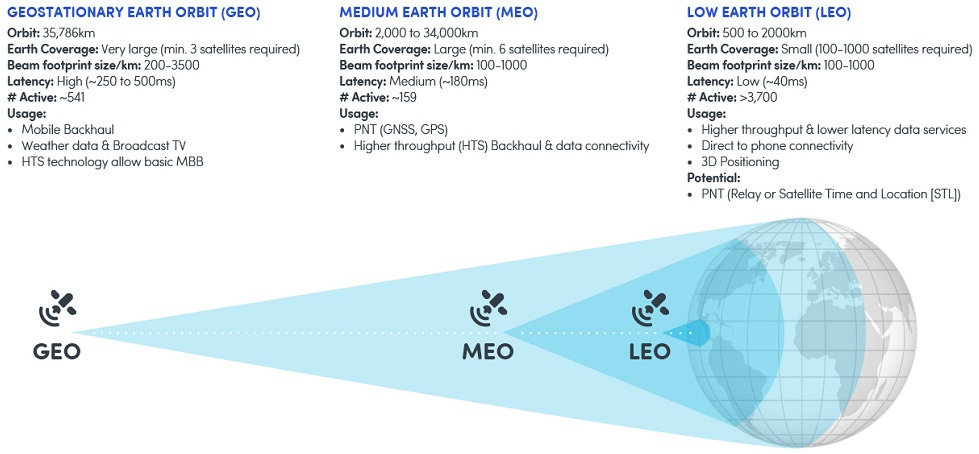

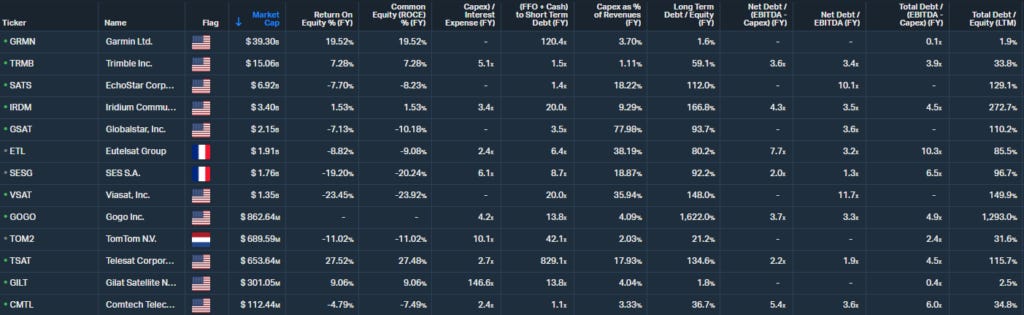

The Satellite Landscape: From GEO to LEO

The satellite industry has undergone rapid transformation with the rise of new constellations challenging traditional satellite models. Historically, the market was dominated by geostationary satellites (GEO), operated by legacy companies like SES S.A. (Gettex: SES), Eutelsat (Euronext: ETL), Viasat (VSAT), EchoStar (SATS), and Telesat (TSAT), positioned at approximately 35,786 kilometers (1.17408e+8 feet for my American colleagues) above Earth. These satellites provide high-capacity services over wide areas, suitable for broadcasting and telecommunications, but with higher latency and high deployment costs. Many legacy GEO operators in the United States and Europe are under financial pressure due to high debt loads and maintenance costs, and they face challenges as consumer needs shift toward on-demand services and high-speed data.

To address these shifts, European companies like SES and Eutelsat are exploring new Low Earth Orbit (LEO) and Medium Earth Orbit (MEO) systems. SES, for instance, operates an MEO system (O3b) targeting high-speed connectivity applications, and Eutelsat recently announced plans to merge with OneWeb to gain access to LEO assets. In the LEO landscape, U.S. players like SpaceX’s Starlink and Amazon’s Project Kuiper, as well as U.K.-based OneWeb, which is partially owned by the U.K. government and Bharti Global, are rapidly deploying thousands of satellites to provide low-latency, high-speed internet and data services. Meanwhile, emerging players like AST SpaceMobile (ASTS), which focuses on direct-to-cell connectivity, and small-satellite manufacturers like NanoAvionics, based in Lithuania, are capitalizing on the demand for agile, high-tech satellite applications.

China’s space ambitions have also spurred a push toward LEO, with government-backed CASC developing its own LEO network, Hongyun, and private firms like Galaxy Space, Commsat, and Guodian Gaoke planning similar constellations. As China ramps up its LEO and MEO capabilities, it becomes evident that both private and government-led Chinese enterprises view space as an essential domain for communications and defense capabilities. Japan’s Sky Perfect JSAT (TSE: 9412) has also joined the mix, investing in LEO technology to supplement its GEO operations in Asia.

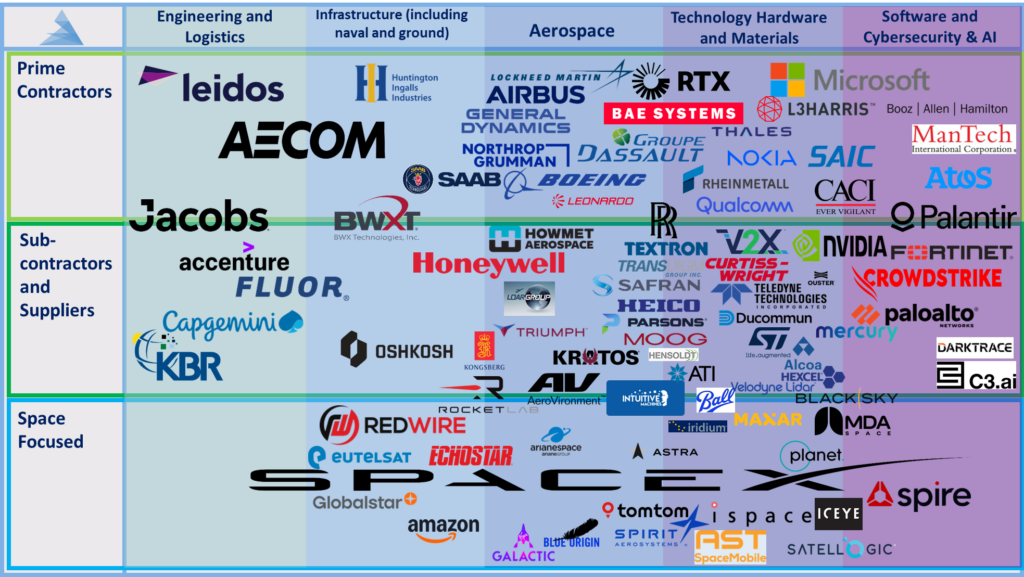

Defense and the New Space Race

Space is now a contested domain where commercial and military interests intersect globally. As governments recognize the strategic importance of space assets, they are leaning on private-sector innovations in surveillance, reconnaissance, and secure communications. In the United States, Northrop Grumman (NOC) and Raytheon Technologies (RTX) have taken on crucial roles in developing secure satellite infrastructure, while specialized firms like L3Harris (LHX) and Kratos Defense & Security Solutions (KTOS) provide critical support in satellite communications and anti-jamming technology. The establishment of the United States Space Force and the Chinese People’s Liberation Army’s Strategic Support Force exemplify the growing military focus on space.

Europe is also emphasizing space as a defense asset. The European Union recently unveiled its EU Space Program, which includes the European Defense Fund to invest in space-related defense technologies. Companies like Airbus Defense and Space (Euronext: AIR) play significant roles in Europe’s space-defense infrastructure, developing secure satellite communications and space-based surveillance for defense agencies. Thales Alenia Space also contributes to Europe’s defense capabilities, supporting secure, resilient satellite systems critical for NATO communications and surveillance.

China’s defense focus in space has grown steadily, with military and dual-use applications being prioritized in its space initiatives. As private Chinese space firms grow, many align closely with government defense objectives, offering satellite communication solutions for both civilian and military applications. This includes the expansion of secure LEO constellations to support surveillance and low-latency communications.

Star Wars is here

Space has transformed from a government-led domain to a dynamic, international ecosystem where public and private players compete and collaborate. Companies like SpaceX, Airbus, and China’s CASC, alongside firms like Maxar and Planet Labs, redefine what’s possible in commercial and defense applications. As new technologies reshape the industry across LEO, MEO, and GEO, the implications for both commerce and defense are profound. Today’s space economy is not merely an arena for exploration but a highly contested strategic asset, driven by innovations in data, defense, and satellite communications on a global scale. The emergence of private enterprises and international players marks a new era of competition, cooperation, and economic complexity in space.

Let’s celebrate this great human accomplishment for now.

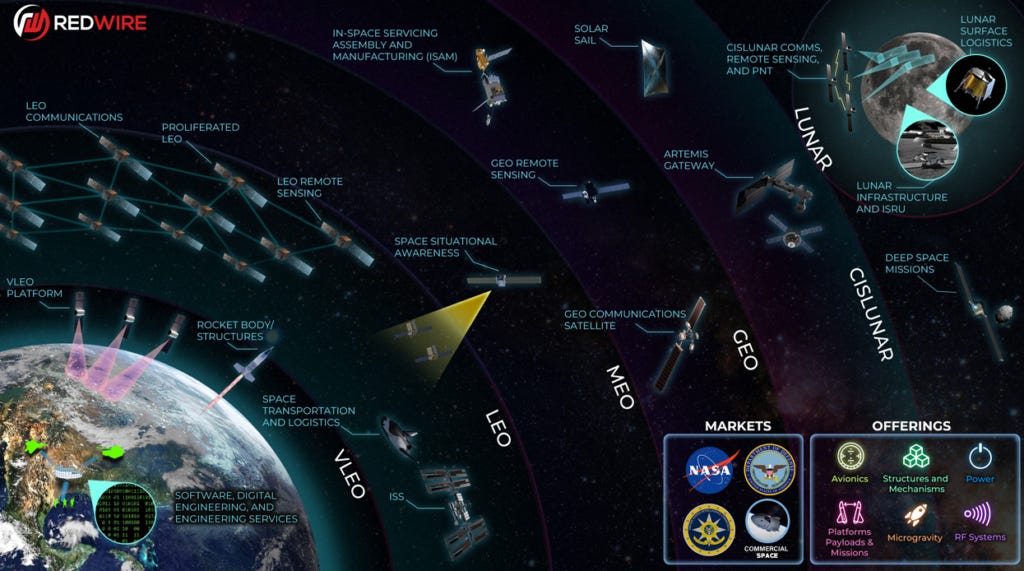

Helicopter view of the Space Defense Sub-sector

Looking at sub-sector spending reveals where priorities really lie. In the U.S., RDT&E has outpaced other categories, growing at 7% annually, with a heavy focus on AI, autonomous systems, and hypersonics. The DoD dedicated $1.8 billion to AI research alone in 2024, betting on AI’s game-changing potential for defense. Meanwhile, unmanned systems—spanning everything from drones to autonomous submarines—received $12 billion in funding, a 5% bump from the previous year, with companies like Northrop Grumman and General Dynamics (GD) at the forefront.

In Europe, air and missile defense is growing the fastest, with a nearly 10% annual growth rate. Key companies Rheinmetall (ETR: RHM) and MBDA (a leading European missile maker) are central to these efforts, developing systems like the Medium Extended Air Defense System (MEADS) and counter-drone technologies. These advances are crucial as the EU continues to adapt to new and evolving security challenges on the continent.

Key Areas of RDT&E & procurement investments and their beneficiaries

In both the U.S. and Europe, defense spending has clearly pivoted toward modernization, cybersecurity, and space capabilities, as both regions work to adapt to current and future threats. For the U.S., this means pushing ahead with advanced R&D and space initiatives to stay ahead strategically, while Europe is focused on boosting its own regional security to guard against immediate threats. For defense firms operating in these high-growth areas—like Raytheon, Northrop Grumman, Thales, and Rheinmetall—this shift in defense budgets offers substantial opportunities, positioning them to play key roles in shaping the future of both national and global security.

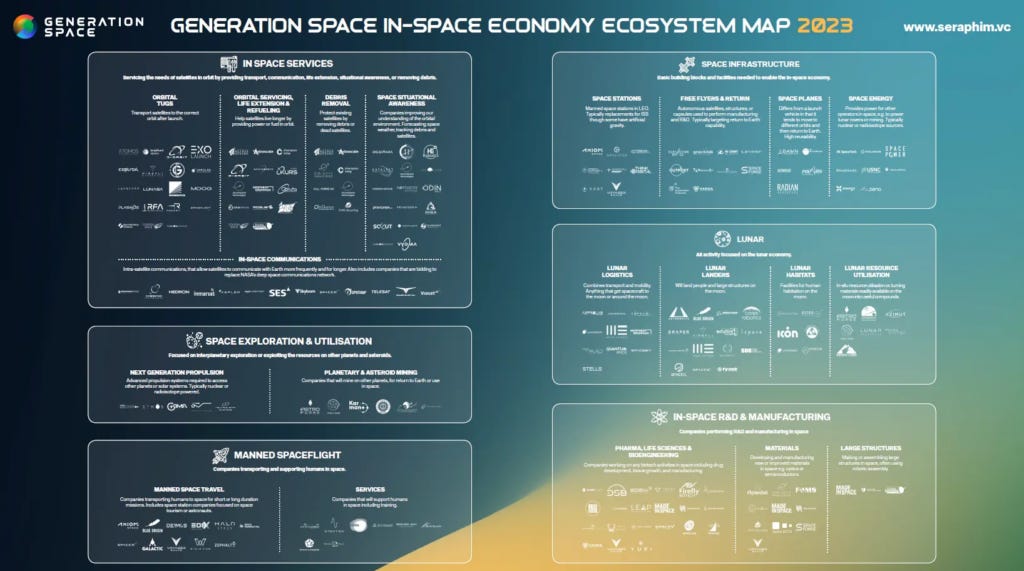

Here is a quick map of some of the major players in the defense sector. Given space is a more nascent field with potentially more convexity in the long run in addition to increased government focus and spending, I find it worthwhile to segregate space companies. It’s also the focus of this note.

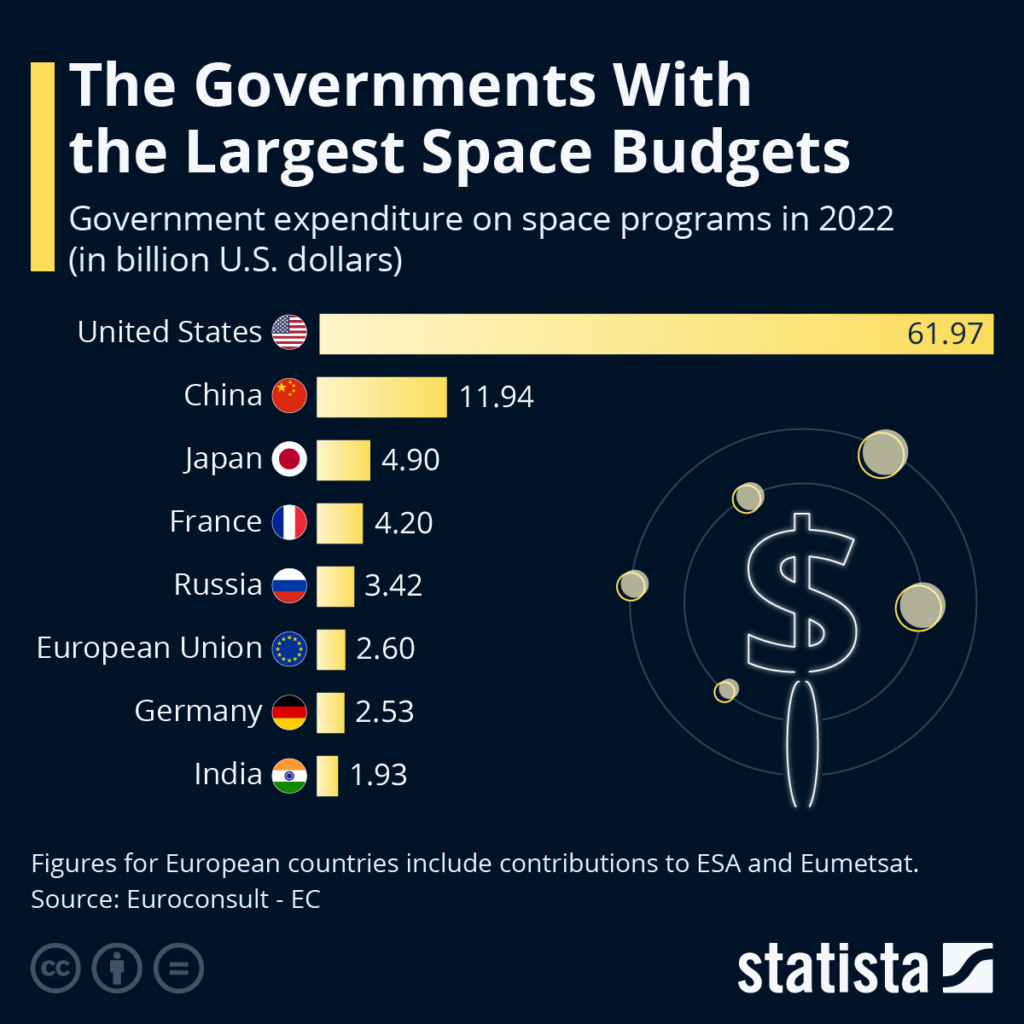

The U.S. leading the charge in space:

The United States is putting its money where its mouth is with a $30 billion budget for the U.S. Space Force in 2024. That’s a 15% bump from last year, signaling that space is no longer just a backdrop for sci-fi — it’s becoming one of the frontlines of defense. This budget isn’t just about flashy rockets; it’s about investing in secure satellite communications, missile detection, and keeping tabs on what’s happening up there in the “final frontier.”

L3Harris Technologies (NYSE: LHX), for instance, is all-in on satellite communications and missile warning systems. Their work means real-time data and reliable alerts for the military, which is crucial for staying ahead of potential threats. Then there’s Kratos Defense & Security Solutions (NASDAQ: KTOS), which focuses on satellite ground systems and management software, essentially making sure our satellite networks can talk to each other smoothly and securely. Maxar Technologies (formerly MAXR), known for its Earth observation satellites, also plays a big role in space situational awareness — think tracking what’s floating around up there and spotting any potential risks.

On the equipment side, Ball Corporation (NYSE: BALL) supplies the optics and sensors — precision instruments that are sturdy enough to survive space but accurate enough for defense-grade data. And AeroVironment (NASDAQ: AVAV) is on hand for satellite integration, making sure all these fancy tools can be launched and deployed without a hitch.

Then there’s the commercial launch scene. Companies like Rocket Lab (NASDAQ: RKLB) and Astra Space (formerly ASTR) (and SpaceX but we cant invest easily) are innovating to make satellite launches cheaper and more frequent. Rocket Lab’s Electron rocket is one of the few reliable, small-satellite launch vehicles, while Astra is out to create a low-cost, high-frequency launch system, though it’s still ironing out some tech issues. They’re expanding space access, allowing for more affordable and more regular satellite deployment, which ultimately benefits both the military and the commercial sector.

The E.U. working on closing the gap for security autonomy

Europe’s defense strategy has always been a bit… scattered. But with increasing security concerns, the EU is finally seeing the importance of stepping up its own defense game. In 2023, the EU hit €265 billion ($281 billion) in defense spending, equal to about 1.55% of the region’s GDP. Sure, it’s not quite at NATO’s target of 2%, but the trajectory is pointing up. Major players like Germany, France, and Poland are ramping up their defense budgets by 10% or more every year through 2025, trying to reduce their dependence on the U.S. and bring more capabilities under the European roof.

That’s translating into more R&D focus in areas like cybersecurity, air defense, and especially space — fields that will be pivotal to ensuring Europe’s security in the coming years. More importantly, it’s part of a longer-term plan to stand on its own two feet, to be less reliant on non-European powers for defense and security.

Europe’s realized that space isn’t just for the big players like the U.S. and China. With €1.5 billion ($1.6 billion) earmarked for space in 2024 — an 8% bump over last year — the EU is investing in things like secure satellite communications, space situational awareness, and anti-jamming tech to keep its assets safe up there. Essentially, Europe wants to control its own slice of space.

Leading this charge, we’ve got heavyweights like Airbus Defense and Space (Euronext: AIR) and Thales (Euronext: HO). Airbus is out there building satellites and tech for orbital tracking, which helps keep tabs on threats. Thales, meanwhile, focuses on satellite resilience and secure military communications, which is critical when you’re trying to keep communications secure across an entire continent. Leonardo S.p.A. (BIT: LDO) and OHB SE (ETR: OHB) are key players, too, developing satellites and Earth observation tech to ensure Europe’s got a reliable eye in the sky.

Then you have SES S.A. (Gettex: SES) and Eutelsat (Euronext: ETL), which are pivoting some of their commercial satellite capabilities toward military needs. They’re ensuring that, if push comes to shove, these satellites can switch to secure, military-grade communications on the fly — adding a needed layer of redundancy to Europe’s defense setup.

Independent launch capability is a big part of the puzzle, too. Arianespace has been the go-to for decades, and its upcoming Ariane 6 rocket will be Europe’s mainstay for dependable space access, although SpaceX will likely be the first call for european commercial firms. But fresh faces like Rocket Factory Augsburg and PLD Space are stepping up with smaller, more nimble launch options that promise more affordable, regular access to space for both public and private sectors. This independence effort is crucial for Europe, as it gives them reliable access to space without needing outside help.

The space economy and company spotlights

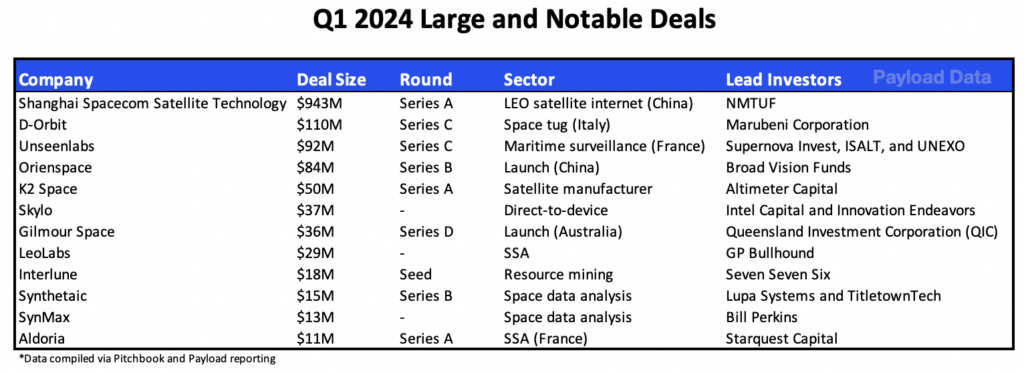

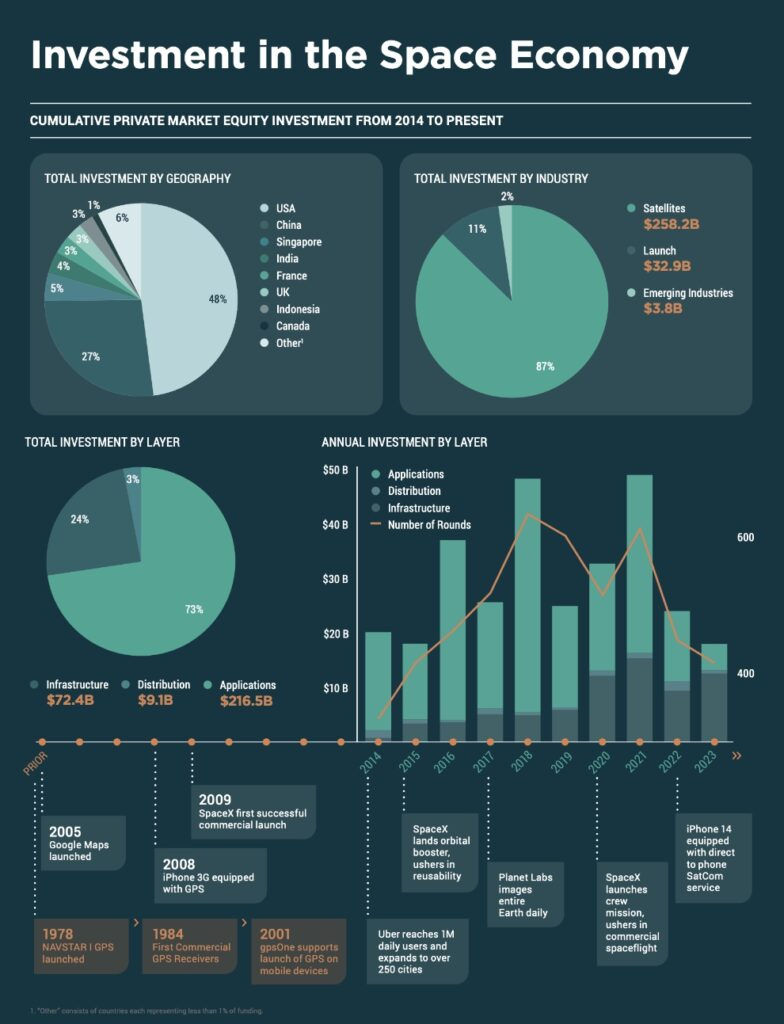

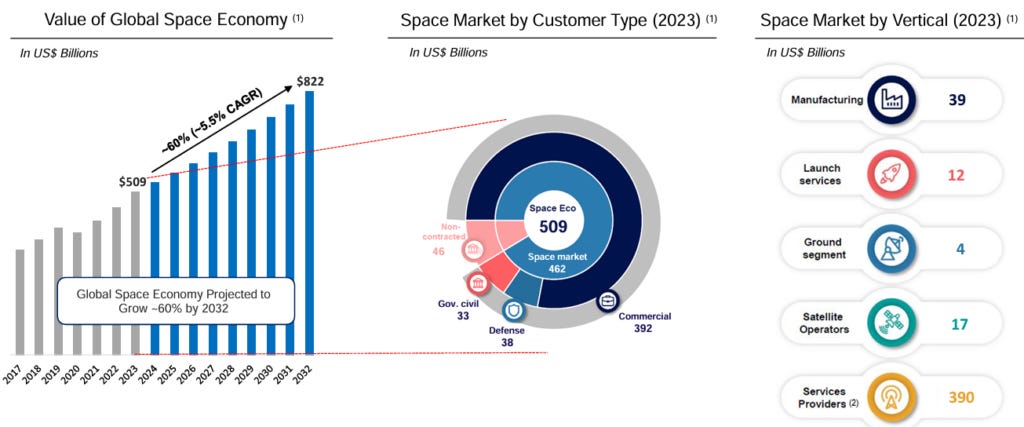

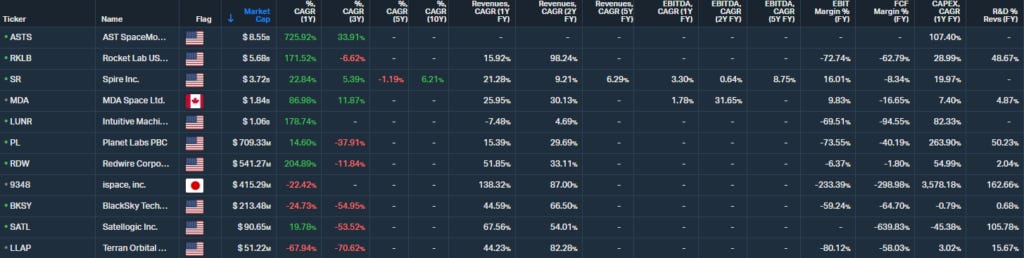

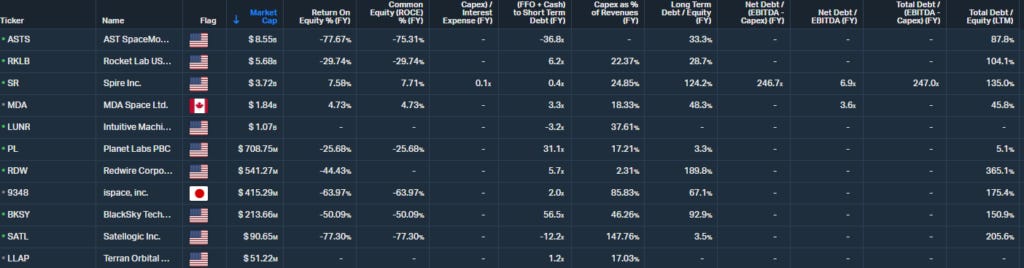

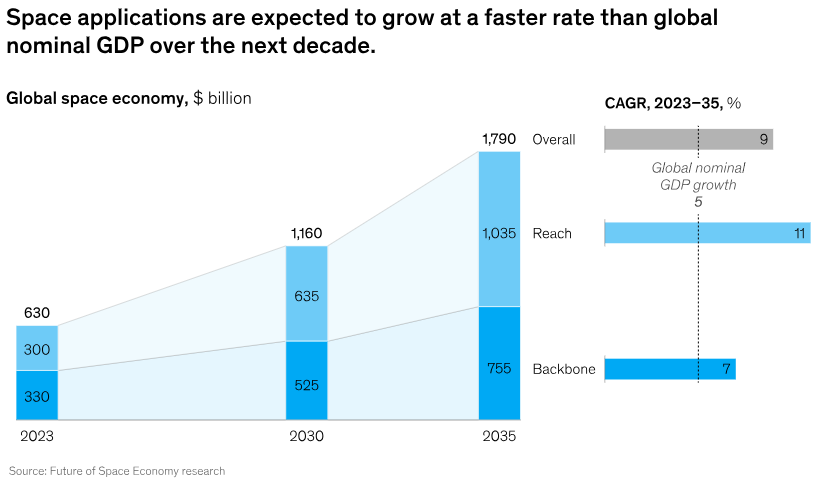

The overall space economy is expected to grow faster than GDP as space deployments accelerate and become cheaper. We are at the early stages of this new economy but have already seen a clear bifurcation between the legacy players from the first round of innovation in space technology relative to the new entrants. I will provide a more detailed company-by-company analysis given the more speculative nature of this segment compared to the more well-established defense companies we have reviewed in prior sections.

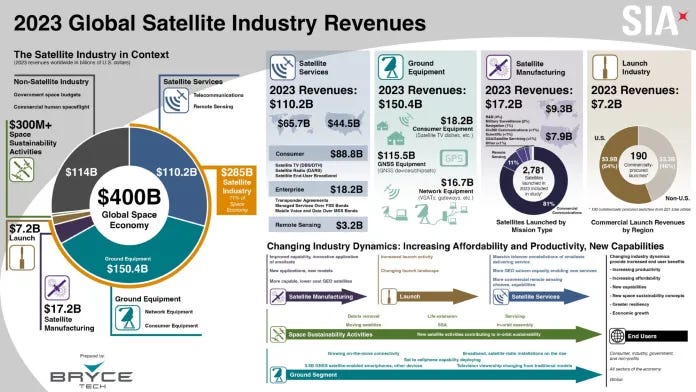

This expansion is driven by advancements in satellite technology, reusable launch systems, and increased private sector involvement. Projections suggest that the industry could surpass $1 trillion by 2040, reflecting annual growth rates of 5-7%.

In the United States, the space sector is a major driver of this growth, with government funding through NASA and the Department of Defense reaching nearly $25 billion in 2023. These funds underpin major projects in lunar exploration, Mars missions, and satellite constellations, forming the backbone of U.S. aerospace infrastructure. The private sector is also a force in the U.S. market: companies like SpaceX, Amazon’s Project Kuiper, and Blue Origin have lowered launch costs to as little as $1,500 per kilogram, making space more accessible and economically viable. By 2040, the U.S. share of the space economy could reach around $800 billion, reinforcing its leadership position.

Europe’s space sector is expanding on a similar trajectory but with a more coordinated, government-led approach. The European Space Agency (ESA) allocated €7.2 billion in 2023 to climate monitoring, sustainable satellite networks, and Earth observation. Europe currently represents around 20% of the global space market, and with estimated growth of 5-6% annually, the region’s space economy could reach an estimated $200 billion by 2040. As European companies strengthen sustainable space practices and debris-reduction policies, they are setting industry standards that may become the benchmark globally.

Commercial services are also transforming the industry landscape, with an influx of small satellites and rising demand for satellite-based internet, live imagery, and machine-to-machine communication. Analysts predict that by 2040, commercial services could account for over 75% of total space industry revenue. Even space tourism, though early in development, could contribute over $5 billion annually within the next two decades, opening an entirely new market of space travel for consumers.

As access to space increases, and with it a surge in demand for Earth observation and communication services, the space economy will continue its steady climb. By 2040, it could become a core economic sector, with new roles in climate science, agriculture, and communications that impact daily life on Earth, reshaping opportunities both on the ground and in orbit.

Quick macro note on investing in small space companies

Investing in high-debt tech companies carries substantial risks, particularly under two macroeconomic scenarios: rising inflation leading to higher interest rates, and a recession where liquidity tightens. Both situations put significant strain on companies with heavy debt loads and negative cash flow, particularly those in growth-focused, cash-burning sectors like tech.

1. Rising Inflation and Higher Interest Rates: If inflation makes a comeback and central banks respond by raising rates, high-debt tech firms face a double blow. First, as interest rates rise, the cost of servicing debt increases, eating into already strained cash flows. For companies with floating-rate debt or those needing to refinance, higher rates can drastically increase interest expenses, forcing tough choices between covering debt obligations and funding critical R&D or growth initiatives. Additionally, as rates rise, valuations typically compress, making it harder for these companies to raise equity on favorable terms. Investors tend to shift toward safer, income-generating assets, leading to capital outflows from speculative tech names. This environment can leave debt-laden tech firms vulnerable to liquidity issues, even if they continue to grow their revenues.

2. Recession and Tightened Funding Access: In a recessionary environment, access to capital for cash-burning tech companies becomes significantly constrained. As risk appetite declines, both equity and debt markets tend to tighten, leaving these companies with limited options to fund operations. Companies reliant on external funding to sustain growth may find themselves in a cash crunch, especially if they lack profitable operations to support self-financing. High debt, coupled with negative cash flow, amplifies this risk: interest payments must be met regardless of declining revenues, putting intense pressure on balance sheets. In severe cases, this can lead to insolvency or forced asset sales at distressed prices. The tech sector, already under pressure from potential valuation declines, could see many high-debt firms struggle to survive without substantial restructuring or strategic shifts.

In both scenarios, high-debt tech companies face significant risks, as they may be forced into defensive positions—cutting back on R&D, shelving growth plans, or even downsizing operations. For investors, these companies represent a high-stakes bet that their growth trajectory will outpace macroeconomic headwinds and that they can manage liquidity effectively in times of financial stress.

Here are some notes on our macro views:

Quick rates update: one month anniversary

I want to put some quick estimations around the rates term structure to frame the likely path for rates and what needs to happen to move them beyond their path of least resistance. This is also to respond to a couple of conversations regarding the long end of bonds being a good place to diversify an equity portfolio for growth scares.

The macro setup for equities

Saying that structural risks are shifting away from economic growth to inflation does not preclude economic contractions, but it does imply that a fiscal spending put (à la Fed put) is to be expected, which will attempt to limit the scope and frequency of economic contractions.

Launching Services – Uber in space

The launch services industry—basically, the business of sending stuff like satellites, cargo, and people into space—is a booming market these days. This is the foundational step for the other sectors of the space economy. Governments used to run this show, but now we’ve got private companies, public corporations, and a mix of international collaborations jumping in. It all works on contracts: companies and governments pay launch providers to haul their payloads to specific orbits, whether that’s low Earth orbit (LEO) for things like internet satellites or geostationary orbit (GEO) for those communication beacons hovering over us. Thanks to SpaceX and Rocket Lab and their reusable rockets, costs have come way down, opening the door for many new players. Suddenly, getting to space doesn’t seem quite so sci-fi.

In the U.S., SpaceX (privately held, valued at around $210 billion) is the major player. Its reusable Falcon 9 and Falcon Heavy rockets have a huge chunk of the market, and that’s not changing anytime soon. For publicly traded options, there’s Rocket Lab (NASDAQ: RKLB, ~$4.7bn billion), focused on smaller payloads with a flexible launch schedule through its Electron rocket. Meanwhile, Northrop Grumman (NYSE: NOC, ~$68 billion), best known as a defense contractor, is also building out its space segment, especially since it acquired Orbital ATK. Over in Europe, Arianespace has been leading the market with its Ariane and Vega rockets; it’s a subsidiary of ArianeGroup, which is itself a joint venture between Airbus (EPA: AIR, ~$111 billion) and Safran (EPA: SAF, ~$62 billion). Italy-based Avio (BIT: AVIO, ~$350 million) also supplies the Vega rockets and serves European clients.

Reusable rockets, the key to American space dominance

The space elephant: SpaceX ($210bn valuation)

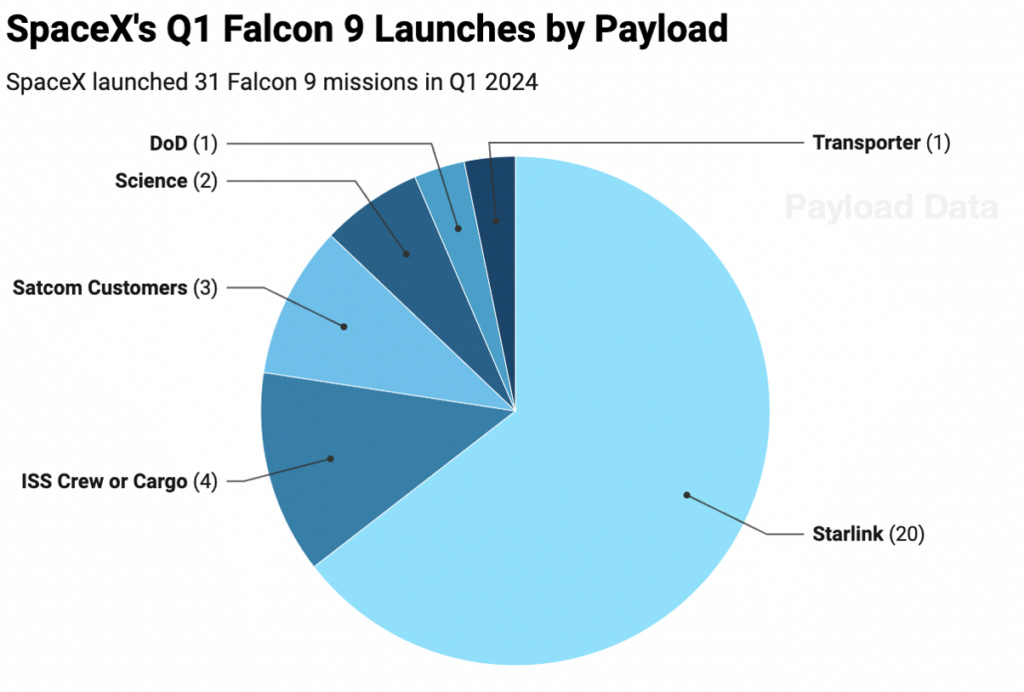

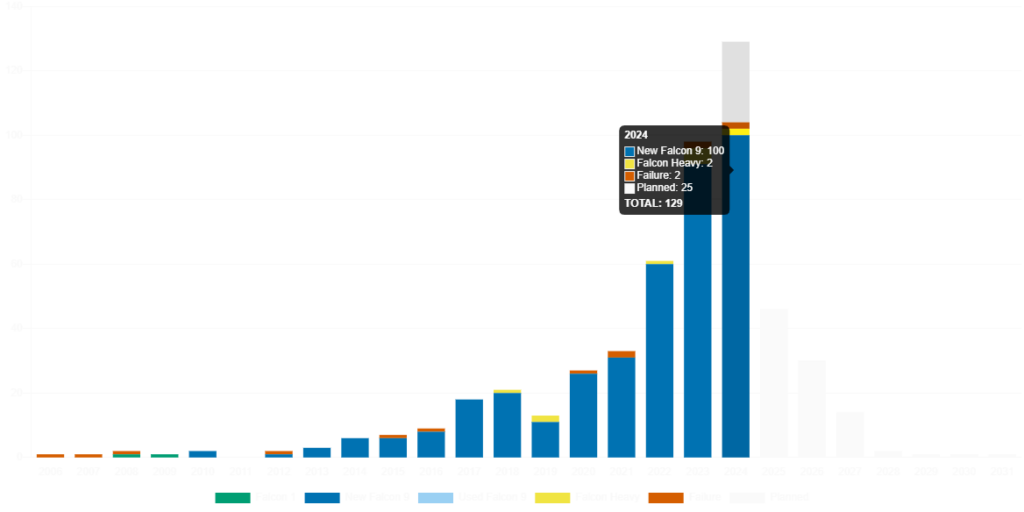

SpaceX needs no introduction at this point. SpaceX is practically dominating the launch and LEO satellite services industry; in 2023, they pulled off 110 launches—over half of the global total—marking an 850% jump from just 13 in 2019, and by payload mass, they accounted for around 87% of everything sent to orbit, thanks to their reliable Falcon 9. Much of that payload was their own Starlink satellites—now over 6,400 strong—since almost every launch had some Starlink onboard, giving SpaceX a unique advantage in satellite deployment. Their “rideshare” program has also opened up space access to over 130 customers, effectively squeezing out a lot of competing launch providers and making it easier for smaller players to get into orbit. On top of that, SpaceX made history as the first private company to transport astronauts to the ISS with its Dragon spacecraft, and they’re ambitiously developing the Starship, a massive rocket with Mars in its sights. In short, SpaceX is not just the dominant force in launches today—they’re leading the future of space exploration and infrastructure.

Future of Space’s estimates that by 2035, ‘space’ could be a $1.8 trillion revenue industry from today’s $630bn (a 9% CAGR, which is comparable to the semi industry). If we apply to this revenue estimate the EV/Sales multiples from the semi industry of 4.5x (making the parallel to semi given both are manufacturing heavy, high tech, capex intensive and have a perceived added value to human existence). At this rate, the implied valuation of the 2035 space sector could reach $8.1 trillion. I certainly appreciate that by 2035 satellites could be a utility-like sector, but even for internet utilities like Verizon multiples are in the 2.25-2.75x range for a 4.5tr valuation. For additional context, the Mag-7 market cap is of $16.5tr for $1.8tr of revenues, so we have some room for more expensive valuations to be possible. If we discount that hypothetical 2035 $4.5tr to $8.1tr value back to today with a 12% cost of capital (TSMC’s cost as proxy), then we get a pricing for today’s industry given growth expectations of $1.16tr to $2.08tr. Sticking with the 1.16tr for the sake of argument, SpaceX’s 18% market value share relative to its 50% share of global rocket launches and 60% share of satellites currently in orbit make me wonder if I should have used my Math degree for something else than gambling in financial markets and maybe be lucky enough to get some SpaceX private placements… Given SpaceX is the most dominant player in the space, we can see there is room across the industry to try getting some real estate above our heads at what could be relatively cheap valuations.

Rocket Lab (RKLB, $4.7bn market cap)

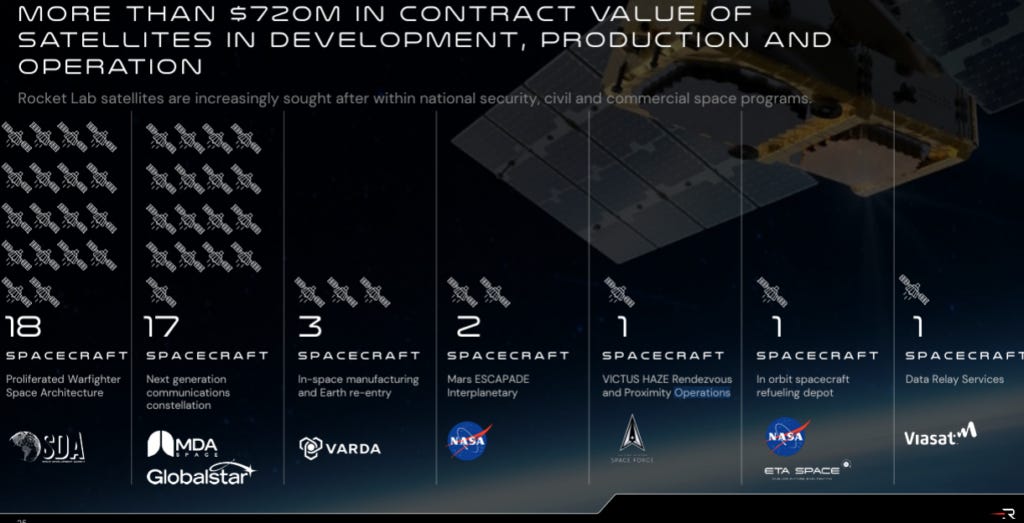

Rocket Lab has been making waves as one of the top players in the “small satellite” game, giving the space industry a different approach compared to giants like SpaceX. Instead of big rockets with huge payloads, Rocket Lab is all about launching smaller satellites, especially for customers who need frequent and flexible access to space. Its Electron rocket is designed for payloads up to 300 kg, making it the perfect solution for niche missions that don’t need a full-sized rocket. In fact, Rocket Lab handles around 64% of all non-SpaceX launches, which is no small feat for a company that’s carved out this niche in a sector dominated by heavy-lifters.

Financial Performance: Strong Growth with Some Trade-Offs

Rocket Lab’s financial story lately has been one of strong growth but also continued investment. Let’s dig into the numbers a bit.

Revenue growth has been impressive, to say the least. In Q2 2024, revenue shot up 71% year-over-year, going from $62.0 million to $106.3 million. That’s a $44.2 million jump, mostly thanks to a big increase in its space systems revenue ($37.3 million) and a $6.9 million boost from more frequent launches. For the first half of 2024, revenue climbed 70% to $199.0 million from $116.9 million in H1 2023, showing that Rocket Lab’s scaling up on both fronts — launch and space systems.

But with growth, of course, comes costs. The cost of revenues rose 67% year-over-year in Q2, hitting $79.1 million, mostly because of a $27.5 million increase in space systems costs and another $4.1 million from ramping up launches. Over the six-month period, costs reached $147.7 million, up 54% from last year. So while Rocket Lab is raking in more revenue, it’s also shelling out quite a bit to make that happen.

On the upside, gross profit is on a strong upward trend. In Q2 2024, gross profit jumped 86% to $27.2 million from $14.6 million in Q2 2023, and over the first half of 2024, gross profit rose 145% to $51.3 million. So, the company’s getting more efficient as it grows, which is a good sign that it’s finding ways to operate profitably down the line.

Operating expenses are up, largely because Rocket Lab is doubling down on R&D, especially for the much-anticipated Neutron rocket. R&D costs rose 29% in Q2, driven by Neutron’s development, including the Archimedes engine, which recently passed its first hot-fire test — a key milestone that’s keeping the project on track for its first flight in mid-2025. And while selling, general, and administrative (SG&A) expenses only rose 6% in Q2, the company is still making necessary investments to keep up with its revenue growth and prepare for bigger things.

Rocket Lab’s net loss is shrinking, though profitability is still a bit off. Net loss decreased by 9% in Q2 2024, coming in at $41.6 million compared to $45.9 million last year. For the first half, net loss fell 6% to $85.9 million. In other words, Rocket Lab is still running a deficit, but it’s heading in the right direction as revenues grow and expenses start to level out.

Decent Cash Position and Strategic Moves

Rocket Lab is also sitting on a pretty decent cash pile, which gives it flexibility to fund its growth. At the end of Q2 2024, the company had $340.9 million in cash and another $202.3 million in marketable securities. This liquidity gives it breathing room, especially as it ramps up spending on Neutron and other space systems. The company also signed an initial funding agreement with the Department of Commerce under the CHIPS and Science Act, potentially bringing in $23.9 million in support. The state of New Mexico is pitching in too, committing up to $25.5 million to back Rocket Lab’s efforts, which strengthens its financial footing even more.

When it comes to debt, Rocket Lab’s in a manageable position. It has $355 million in outstanding convertible senior notes with a 5% interest rate and another $64.2 million under the Trinity loan agreement with a much steeper rate of 14.8%. But with its cash reserves, the company seems well-equipped to handle these obligations, even as it invests heavily in new initiatives.

The Road Ahead: Building for Broader Horizons

Rocket Lab’s future hinges on expanding its service offerings and targeting larger markets with the upcoming Neutron rocket, designed to fill the gap between small-payload and heavy-lift launches. This new vehicle could attract clients needing more capacity than Rocket Lab’s Electron but not the scale of a SpaceX Falcon. Alongside its push for bigger launches, Rocket Lab is also growing its space systems division, recently landing a ten-launch contract with Japan’s Synspective. This deal underlines its ambition to evolve into a full-service space company, managing launches, satellite deployment, and orbital operations—an approach aimed at driving recurring revenue from clients seeking regular, reliable space access.

Financially, Rocket Lab has a solid runway for investing in technology and market expansion, with recent financials showing progress on both revenue and cost control. Profitability may still be on the horizon, but if Neutron succeeds and space systems revenue grows, Rocket Lab could carve out a strong niche in the small to medium-lift market, one that’s currently underserved. While cost management remains a challenge, its innovations and rising demand for small to medium payloads position Rocket Lab as a promising contender in commercial space. I think this is an exciting company due to its potential and a clear niche that SpaceX has no current plans to enter, but I will not dare assign a target valuation. I will place an initial bet on the company and keep close track of its cash runway, continued revenue growth, and reducing OPEX per flight. I’ll be watching its cash flow and operational efficiency closely, betting that it could become a lasting player in the space race.

Europe’s solution to launch services, lost in space

ArianeGroup via Safran 50% (SAF, $87bn) and Airbus (AIR , $111bn)

ArianeGroup, Europe’s leading launch provider with its Ariane rocket line, faces intense competition, particularly from SpaceX. ArianeGroup’s goal with Ariane 6 is to offer a cost-effective, flexible solution, but its choice to avoid reusability has led to questions about Europe’s future competitiveness in space.

Formed as a 50-50 joint venture between Airbus and Safran in 2015, ArianeGroup combines Airbus’s aerospace systems expertise with Safran’s propulsion technology, reinforcing Europe’s independent access to space. Airbus and Safran each report their share of ArianeGroup’s financials through the equity method, reflecting the venture’s strategic importance for European space autonomy and their own institutional contracts.

Ariane 6 has faced delays and economic challenges:

Launch Delay: Originally set for 2020, Ariane 6’s first flight is now pushed to 2024 due to technical issues and rising costs.

Modular Design: Ariane 6 offers flexibility with two configurations: Ariane 62 (medium-lift) and Ariane 64 (heavy-lift), serving different payload needs.

Non-Reusability: Unlike SpaceX’s reusable Falcon 9, Ariane 6 will not be reusable, a choice meant to control development costs but one that limits its ability to compete on price, as SpaceX’s lower-cost, reusable model reshapes commercial expectations.

Market Position and Demand

European institutional demand remains strong, with contracts like ESA’s Galileo satellites and France’s CSO military satellites keeping ArianeGroup active. However, SpaceX’s pricing appeal has attracted even European satellite operators, like SES, who are opting for more affordable, flexible options.

Cost Competitiveness

Ariane 6’s launch costs are expected to be around $80-100 million, translating to $7,600-$9,500 per kilogram to GTO. In comparison, Falcon 9’s $67 million launch cost equates to about $8,000 per kilogram for non-reusable flights, widening the cost gap for reusable launches and highlighting ArianeGroup’s commercial disadvantage.

Future Projects and Strategic Adjustments

Prometheus Engine: ArianeGroup is developing a low-cost, reusable engine, Prometheus, powered by liquid oxygen and methane, though it remains in early R&D.

MaiaSpace Subsidiary: ArianeGroup’s MaiaSpace is creating a partially reusable small rocket, Maia, aimed at the LEO market by 2026, signaling a gradual shift toward reusability.

Competitive Challenges with SpaceX and Other Global Players

SpaceX’s frequent, cost-effective launches (nearly 60 per year) set a high bar, with Falcon 9’s reusability allowing faster, cheaper operations. ArianeGroup’s reliance on ESA and government contracts, while strategically significant, limits its flexibility compared to SpaceX’s aggressive commercial approach. Emerging European players like Rocket Factory Augsburg and PLD Space, developing small, reusable rockets for LEO, also intensify regional competition.

ArianeGroup’s focus with Ariane 6 is on reliability and meeting Europe’s autonomous space needs. Yet, with the industry moving toward reusability, Ariane 6’s high costs and non-reusable design restrict its edge in the competitive commercial sector. Prometheus and MaiaSpace hint at a longer-term shift, but for now, Europe trails the U.S. and China. I hold a cautious view on ArianeGroup but see potential in Safran’s other businesses, which I’ll cover in a future note.

Satellite Infrastructure

What’s the Deal with GEO vs. LEO?

GEO satellites have traditionally ruled the skies. Positioned roughly 36,000 km above Earth, these satellites match the planet’s rotation, allowing them to stay “parked” over one spot. This stable position makes them ideal for broadcasting to huge areas (like an entire continent) with just one satellite. If you’re watching satellite TV, for example, you’re probably relying on a GEO satellite. However, the sheer distance from Earth means that data takes longer to travel, introducing around 600 milliseconds of latency—a delay that might seem tiny but is noticeable for tasks needing real-time response, like video calls or gaming. This lag doesn’t work well with many of today’s applications where users expect fast, seamless interactions.

LEO satellites are changing the game by bringing satellites closer to us. At altitudes between 500 and 2,000 km, they’re much nearer, which cuts down the signal travel time, slashing latency to under 50 milliseconds. That’s fast enough for most broadband applications, making LEO ideal for high-speed internet, live-streaming, and emerging tech like the Internet of Things (IoT). Because LEO satellites are so close, each one covers only a small slice of Earth. To provide broad, reliable coverage, companies need hundreds, if not thousands, of LEO satellites working in unison as a “constellation.” This setup might seem complicated, but it allows companies to deliver reliable internet coverage to every corner of the planet.

Why All Eyes are on LEO Now

Growing Demand for Connectivity: The need for fast, always-available internet isn’t just a “nice-to-have” anymore—it’s a necessity, especially in rural and remote regions. In places where it’s tough or too costly to install ground infrastructure (think: laying fiber optic cables in mountainous areas), LEO satellites can step in to bridge the gap. This capability is particularly valuable for connecting people in rural communities, providing internet to planes and ships, and helping underserved areas finally get reliable internet access. LEO’s reach is a huge deal for people who have historically been left out of the internet revolution, making it possible to stream, work remotely, and connect with others from almost anywhere.

Real-Time Communication for New Tech: LEO satellites aren’t just about “faster internet” but are a key piece in the infrastructure supporting real-time, data-heavy tech. The Internet of Things (IoT), for instance, depends on rapid, low-latency connections, as do autonomous vehicles and smart city applications. GEO’s inherent delay can make these applications impractical, but LEO’s fast response time allows for split-second data transfers that these technologies rely on. This real-time capability is what makes LEO especially attractive for the future of “smart” everything, from agriculture to transportation, where fast data flow and constant connectivity are essential.

Tech and Cost Breakthroughs: The cost of getting to space has plummeted thanks to reusable rockets, miniaturization, and improved satellite manufacturing. Companies like SpaceX, for example, have introduced rockets that can launch, land, and launch again, which has dramatically cut the cost per launch. Likewise, satellites are getting smaller and more affordable to produce, which makes deploying large constellations financially feasible. A decade ago, building and launching a LEO network would have been far too expensive to consider. Today, thanks to these advancements, deploying hundreds or thousands of LEO satellites is suddenly within reach for major players like Amazon, OneWeb, and of course, SpaceX. These cost cuts are not just a win for the companies but also for end-users who will benefit from the increased accessibility and affordability of satellite-based internet.

The legacy players

The new kids on the block

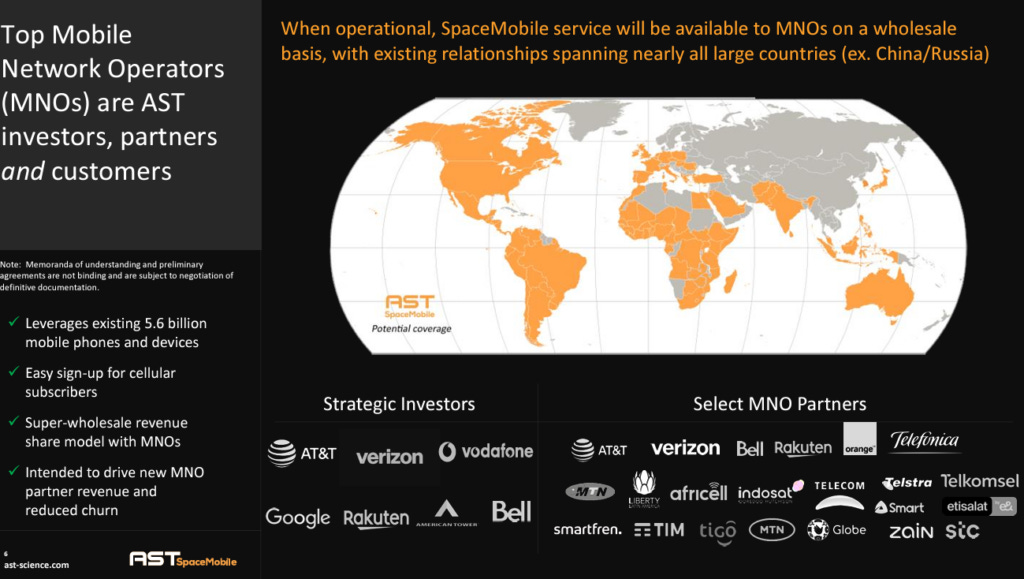

AST SpaceMobile (ASTS, $8.6bn)

AST SpaceMobile is developing the first space-based cellular network designed to connect directly to standard smartphones, without relying on traditional cell towers. Their approach involves deploying a network of satellites in low Earth orbit (LEO) to provide high-speed, low-latency mobile broadband, aimed especially at remote and underserved regions. It’s a significant undertaking with potential to improve connectivity in areas lacking infrastructure, but it also requires substantial capital, regulatory approval, and managing competition from established players like SpaceX’s Starlink.

AST has already shown it can make real strides with the right funding and time. The company achieved the first-ever 5G connection from space — a big proof-of-concept win that signals AST’s technology can be implemented on a small scale.

Financial Performance: Modest Revenue, Big Costs

AST’s financials are a bit of a mixed bag. Revenue is up, though still in modest territory. For Q2 2024, AST pulled in $900,000, compared to well… zero revenue for the same period last year. Over the first half of 2024, total revenue was $1.4 million. It’s not game-changing revenue yet, but it’s a start.

Operating expenses, on the other hand, are substantial. Engineering services costs decreased 7% in Q2 2024 to $21.2 million, though they’re up 4% to $40.7 million for the first half of the year. General and administrative costs saw a sharp rise, up 75% year-over-year to $17.8 million in Q2 and 50% to $30.1 million for the half-year, reflecting the higher staffing and infrastructure costs needed to support AST’s scaling. Research and development costs dropped significantly, down 59% to $4.5 million in Q2 and 68% to $8.7 million over H1, as the company shifted its focus from early R&D to deploying and commercializing its network.

One notable hit came from a $66.1 million loss on warrant liabilities in Q2, a stark contrast to a $6.5 million gain in the same period last year. Net loss attributable to common stockholders was $72.6 million in Q2 2024, significantly wider than the $18.4 million loss in Q2 2023. For the first six months, net loss was $92.3 million, up from $34.7 million a year earlier, underscoring AST’s high cost base and the challenges of launching a space-based network.

Balance Sheet: Growing Assets matched by Liabilities

AST’s balance sheet shows the weight of its ambitions. Total assets reached $579.6 million by June 30, 2024, up from $360.9 million at the end of 2023, reflecting its continued investment in satellite development and network infrastructure. Liabilities also rose to $337.8 million from $147.3 million, as the company takes on more debt to fuel its growth. That said, total stockholders’ equity climbed to $241.9 million from $213.6 million, signaling ongoing investor interest in AST’s potential.

Strategic Initiatives: Pushing Toward a Space-Connected Future

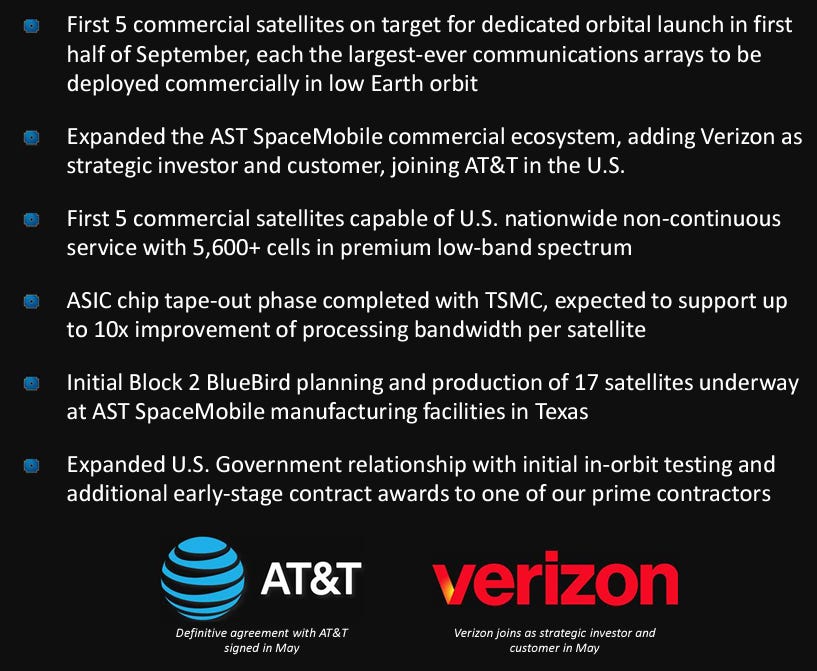

AST’s path forward is all about turning its space-based connectivity vision into reality. The company recently completed assembly and testing of five Block 1 BB satellites, set for launch in September 2024. It’s also moving ahead with the next generation of satellites, the Block 2 BB models, which promise more performance and capacity, thanks in part to AST’s new AST5000 ASIC chip. The first Block 2 satellite is targeted for launch in early 2025, setting the stage for AST to expand coverage and capacity.

Commercially, AST has locked in some impressive partnerships. A major agreement with AT&T aims to bring SpaceMobile Service to the U.S., and a Memorandum of Understanding (MOU) with Verizon includes a $100 million investment and prepayment commitment. These deals with two of the largest U.S. telecom players add serious weight to AST’s business case, suggesting that its technology could play a key role in extending coverage to areas where traditional networks fall short.

On the regulatory side, AST recently received a U.S. license to launch and operate frequencies for its first five Block 1 BB satellites. It’s also working on ground infrastructure development and aiming to integrate SpaceMobile Service directly into mobile network operators’ systems, making it easier for telecom providers to deliver service via AST’s satellites.

Funding the Mission: Raising Capital and Securing Support

Launching a space-based cellular network is no cheap feat, and AST has been proactive about raising funds. The company pulled in $110 million in January 2024 through convertible notes from major partners like AT&T, Google, and Vodafone, followed by another $35 million from Verizon in May. Additionally, it raised $93.6 million from a public stock offering and $14.1 million from underwriters’ options earlier in the year. Through its ATM equity program, AST secured an additional $79.4 million during the first half of 2024.

Looking ahead, AST plans to raise more capital through equity, debt, and strategic deals to support the design, assembly, and launch of up to 20 Block 2 BB satellites, aiming to create a constellation of 25 satellites overall. This phased deployment will allow AST to expand service gradually while minimizing upfront costs, though funding remains a critical priority.

The Road Ahead: Big Ambitions, Big Hurdles

AST SpaceMobile is at a critical stage, making progress with partnerships and regulatory approvals, but still a way off from full deployment. Funding this venture requires careful balancing of fundraising, cost control, and market expansion. If AST can manage its cash burn and continue gaining support from telecom giants, it could provide a transformative service for remote connectivity, opening up major new revenue streams. Yet, competition from other satellite providers is fierce, and AST will need to establish itself quickly in the space-based cellular market before it becomes too crowded.To me, ASTS at its $8-9bn market cap seems like a relatively worthwhile call option on the deployment of a one-of-the-kind LEO satellite communication infrastructure. Given the valuation SpaceX is seeing of which Starlink is a significant portion, this credible competitor provides exposure to the LEO connectivity theme.

In-flight connectivity – a shifting market

LEO satellites aren’t just the latest trend—they’re a revolutionary step for global connectivity. This technology enables people in the most isolated parts of the planet to access high-speed internet and participate in the digital world. Whether it’s connecting remote communities, supporting real-time tech, or simply providing affordable options for internet access, LEO constellations are setting a new standard in how we stay connected. One exciting example is in-flight connectivity.

In-flight connectivity (IFC) has come a long way, from patchy, low-speed connections to today’s high-speed satellite-based internet options. Traditionally, providers like Gogo were pioneers in the space, initially using an air-to-ground (ATG) network that connected planes to cell towers below. While this works well over land, it limits service on transoceanic flights and has lower bandwidth than satellite systems. Gogo’s later move into satellite-based IFC, which uses geostationary (GEO) satellites, brought more reach but still suffered from high latency due to the distance GEO satellites are from Earth. For passengers, this often means laggy connections, which makes streaming or real-time work apps a bit of a challenge.

SpaceX’s Starlink IFC, using low Earth orbit (LEO) satellites, has changed the game for in-flight internet by delivering high-speed, low-latency connections anywhere in the world—even over oceans and polar routes where traditional options struggle. Starlink satellites sit much closer to Earth, meaning data travels back and forth much faster, making it ideal for activities that need low delay, like video calls and gaming. United Airlines recently made headlines by announcing that it would install Starlink on its entire fleet, making it the largest airline to commit to Starlink. Starting in 2025, United passengers will have free, gate-to-gate internet that lets them stream, shop, or work as if they were on the ground. This is a big jump from typical in-flight Wi-Fi, which often cuts out or slows down once you’re out over the ocean.

What really sets Starlink apart is its consistency and global reach. While other airlines have IFC through a patchwork of providers, like Gogo (GOGO $850m) or Viasat (VSAT $1.3bn), United’s Starlink partnership will bring a unified experience, supported by constellations of LEO satellites in constant motion above Earth. Passengers won’t just be able to connect on personal devices; United plans to integrate Starlink into its seatback screens, making it easier than ever to stay connected. For airlines that want to offer something competitive in the sky, SpaceX’s solution is setting a new standard, and United’s move suggests that the LEO approach could soon be the benchmark for inflight internet.

Gogo (GOGO $850m)

Gogo Inc.’s latest financials paint a mixed picture for Q2 2024. Total revenue edged down slightly to $102.1 million from $103.2 million in Q2 2023, but the six-month total still saw a modest bump to $206.4 million compared to $201.8 million for the same period last year. Service revenue, a positive standout, rose to $81.9 million for Q2 (up from $79.1 million), showing solid growth, while equipment revenue fell to $20.1 million as hardware sales softened. It seems Gogo’s core connectivity services are gaining traction, even as hardware sales hit some turbulence.

On the profitability front, the company faced some challenges. Operating income dropped from $34 million in Q2 2023 to $21.7 million in Q2 2024, with net income taking an even sharper dip to $0.8 million (down from $89.8 million). Gogo’s adjusted EBITDA also declined, signaling pressure on margins as operational costs rose. However, free cash flow came in strong at $24.9 million for Q2 2024, nearly doubling from $13.3 million last year. This boost in cash flow suggests the company is managing its resources efficiently, possibly as a strategic move while it invests in upcoming tech.

Operationally, Gogo’s fleet metrics show steady connectivity engagement with over 4,200 ATG Avance and nearly 4,250 narrowband satellite-equipped aircraft. Average monthly service revenue per aircraft reached $3,468 for ATG and $335 for narrowband, indicating a stable revenue stream from its in-flight internet offerings. Moving forward, Gogo is investing in next-gen projects like Gogo 5G and Gogo Galileo, which they hope will drive long-term growth and keep them competitive in a fast-evolving IFC market. Overall, while there are profitability challenges, Gogo is betting on tech upgrades and stronger service revenue to steer future gains.

Given the shifting landscape and the already mixed financial performance for GOGO, I am interested in putting a short while monitoring their LEO efforts. I suspect they are far behind in that area and do not have the capital required to operate effectively in this new industry.

Viasat (VSAT $1.3bn)

Viasat’s recent financial performance showcases both notable growth and the challenges it faces in its strategic ambitions. For the quarter ending June 30, 2024, Viasat reported total revenues of $1.13 billion—a strong 44% increase from $779.8 million in Q2 2023. This growth was fueled largely by service revenues, which jumped 51% year-over-year to $820.7 million, and product revenues, which saw a 29% increase to $305.7 million. However, the company also reported a net loss of $32.9 million, reflecting heightened operating costs and setbacks from satellite anomalies.

A major setback has been the ViaSat-3 F1 satellite’s reflector deployment issue, which reduced its capacity for the Americas by over 90%, creating a significant operational gap in a critical market. Compounding this, the I-6 F2 satellite, developed with Airbus, faced a power subsystem failure that prevented it from functioning as planned. Despite these challenges, Viasat has been pressing forward with ambitious plans, including its transformative acquisition of Inmarsat in 2023. This acquisition has not only broadened Viasat’s global footprint but also diversified its network with a mix of GEO, LEO, and hybrid satellite fleets. The combined satellite resources enable Viasat to serve multiple frequency bands across consumer, enterprise, and defense markets.

Breaking down segment performance, the Communication Services segment saw revenues of $826.8 million, up 48% year-over-year, with operating profit improving significantly to $41.9 million from a previous loss of $9.9 million. Meanwhile, the Defense and Advanced Technologies segment generated $299.7 million in revenue (a 37% increase), with an operating profit of $84 million compared to a loss of $3.8 million a year prior. These gains underscore the growing demand for Viasat’s communication services, particularly in commercial and defense aviation.

Looking at operating expenses, the cost of service revenues increased by 49% to $516.7 million, aligned with the higher revenue from these services. Selling, General, and Administrative (SG&A) expenses rose modestly by 14% to $251.1 million, while R&D expenses reached $38.6 million, a 33% increase driven by next-generation technology development. Interest expenses also surged to $105.8 million, reflecting higher debt loads from recent investments, particularly the Inmarsat acquisition. Still, cash flow from operations was robust at $151.1 million, and the company has $1.8 billion in cash and cash equivalents, suggesting prudent cash management to fund ongoing growth initiatives.

In terms of its future, Viasat is focused on expanding its satellite fleet’s resilience and throughput capabilities, with additional ViaSat-3 satellites (F2 and F3) planned to enhance coverage across EMEA and APAC. With Inmarsat’s assets integrated, Viasat aims to leverage this expanded constellation to achieve comprehensive global coverage, providing high-quality broadband in underserved regions and scaling its in-flight connectivity (IFC) solutions for airlines. Looking forward, the company’s strategy includes navigating the operational challenges posed by its satellite issues, fully integrating Inmarsat’s offerings, and cementing its position in the fast-evolving global connectivity space.

Despite rapidly rising revenues, I have less confidence in their ability to manage costs. For now I am looking to short VSTS

The limitations of LEO connectivity

However, when investing in LEO, we need to be cognizant of its physical limitations relative to existing infrastructure in terms of connectivity.

Signal Interference and Obstacles in Urban Areas

LEO satellites need a clear line of sight for stable communication, making them vulnerable to interference from buildings, trees, and other obstacles. In dense urban environments with tall buildings and limited open sky, satellite signals can suffer attenuation or complete blockage, impacting reliability. By contrast, ground-based networks, such as 5G and fiber, use strategically positioned small cells and direct cabling, minimizing issues caused by physical obstructions.

Limited Bandwidth and Network Density

Unlike 5G networks, which use high-density small cells to handle high traffic volumes and optimize bandwidth, LEO constellations face capacity challenges in heavily populated areas. Each satellite in a LEO network covers a wide area, spreading bandwidth thin when many users attempt to connect simultaneously. This can lead to slower speeds and lower quality in urban areas, where thousands of users may need simultaneous, high-speed connectivity within a small geographical area.

Latency and Frequency Handoffs

While LEO’s low altitude reduces latency compared to GEO satellites, it still doesn’t match the low-latency capabilities of fiber and 5G, especially in latency-sensitive applications like gaming and high-frequency trading. Furthermore, because LEO satellites move rapidly across the sky, frequent handoffs between satellites and ground stations are required. These frequent transitions add to overall latency and pose challenges for maintaining stable connections in areas with high user density.

Limited Spectrum and Capacity Constraints

LEO networks operate within a limited spectrum allocation, often shared among multiple satellite operators and subject to regulatory constraints. In urban areas where there is heavy competition for frequency bands, spectrum congestion can arise, impacting the speed and reliability of LEO services. By contrast, 5G networks can leverage a broader spectrum range, including sub-6 GHz and mmWave bands, allowing more bandwidth to serve densely populated regions efficiently.

Cost and Energy Efficiency

Operating thousands of LEO satellites is both expensive and energy-intensive, requiring ongoing maintenance and regular replacement as satellites reach end-of-life (5-7 years). While satellite-based networks offer valuable coverage for remote areas, in densely populated regions, the cost-effectiveness and energy efficiency of LEO networks are inferior to that of fiber and 5G infrastructure. Terrestrial networks provide high-quality connections with far fewer infrastructure redundancies and maintenance costs, making them more scalable and sustainable in urban settings.

These limitations indicate that while LEO has a transformative role in connecting remote areas, in well-served regions, traditional terrestrial networks—5G, fiber, and even cable—remain more effective and efficient for delivering high-quality connectivity.

One way to hedge the risk of LEO underdelivering is having exposure to traditional tower and cable utilities. However there are plenty of reasons to avoid them for now which could be the content of an other note.

LEO – Beyond Connectivity

Low Earth Orbit (LEO) satellites are revolutionizing a range of industries beyond connectivity, finding applications in Earth observation, environmental monitoring, defense and intelligence, and scientific research. Positioned between 300 to 1,200 kilometers above Earth, LEO satellites have the advantage of shorter orbital periods and higher resolution imaging capabilities compared to satellites in geostationary orbit (GEO). This proximity to Earth enables faster data collection, greater detail in imagery, and lower latency, making LEO satellites a powerful tool across various fields.

Earth Observation and Environmental Monitoring

LEO satellites are essential for Earth observation, offering high-resolution imaging and multispectral sensing to monitor natural resources, land use, and climate change. They enable real-time tracking of deforestation, sea-level rise, and polar ice melt, while also supporting agriculture by assessing crop health, soil moisture, and pest activity. LEO satellites play a key role in disaster response, delivering timely images for damage assessment, wildfire tracking, and flood prediction to aid resource allocation. Additionally, new LEO constellations are enhancing navigation and remote sensing, improving positioning accuracy and offering redundancy in case of MEO satellite issues. They provide detailed elevation models, track ground movement, and support urban planning, construction, and mining through resource mapping and environmental impact analysis. With lower latency than MEO satellites, LEO satellites are advancing next-gen positioning services in areas demanding real-time accuracy.

Planet Labs (NYSE: PL): Operates a large constellation for high-resolution Earth imaging, supporting agriculture, climate monitoring, and disaster response.

Maxar Technologies (Private): Offers high-resolution imagery for natural resource management and urban planning.

Airbus SE (EPA: AIR): Through its Defense and Space division, provides imagery for climate and land-use monitoring.

BlackSky (NYSE: BKSY): Specializes in real-time geospatial intelligence using LEO satellites to capture high-frequency imagery of specific locations. BlackSky’s constellation is designed for rapid revisit rates, making it valuable for monitoring environmental changes, urban growth, and disaster impacts.

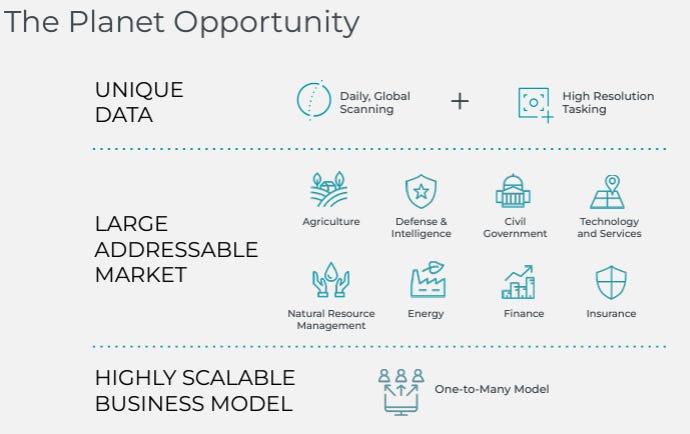

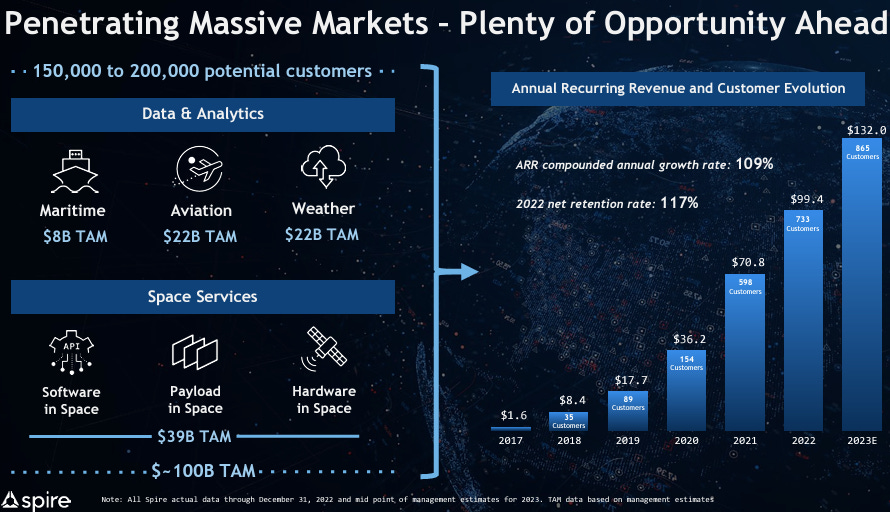

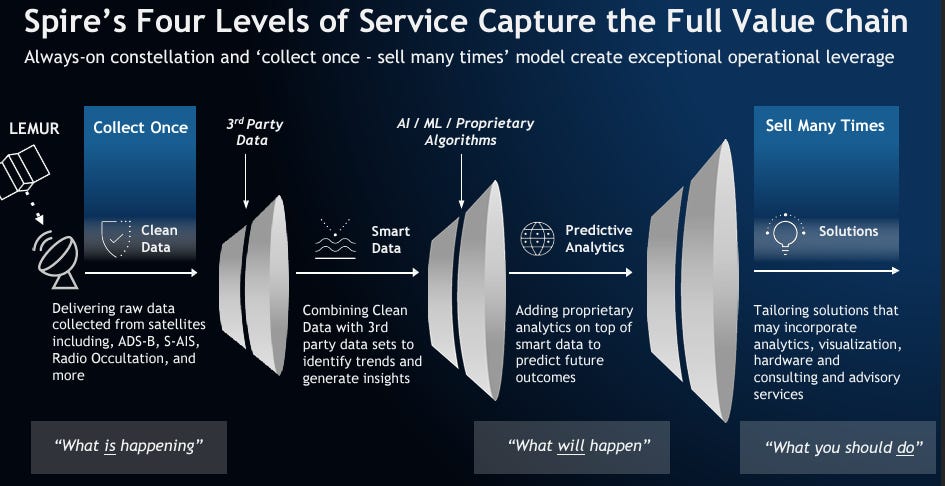

Spire Global (NYSE: SPIR): Spire’s LEO constellation provides data on weather patterns, maritime activity, and aviation tracking. Its weather data is instrumental for climate research, environmental forecasting, and real-time weather monitoring in remote areas.

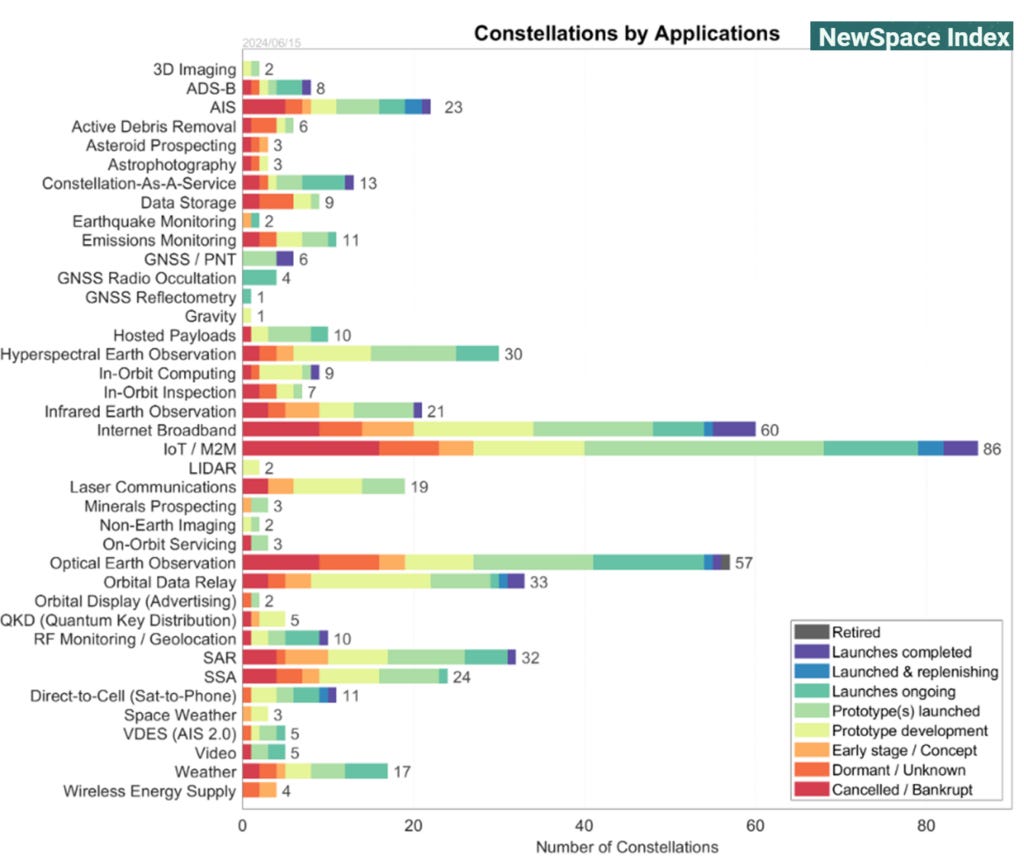

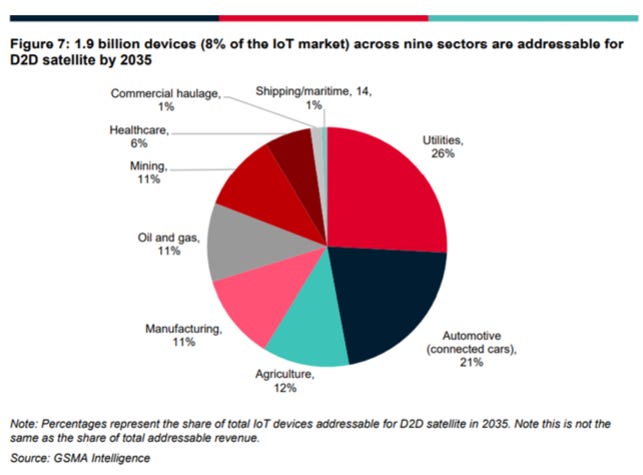

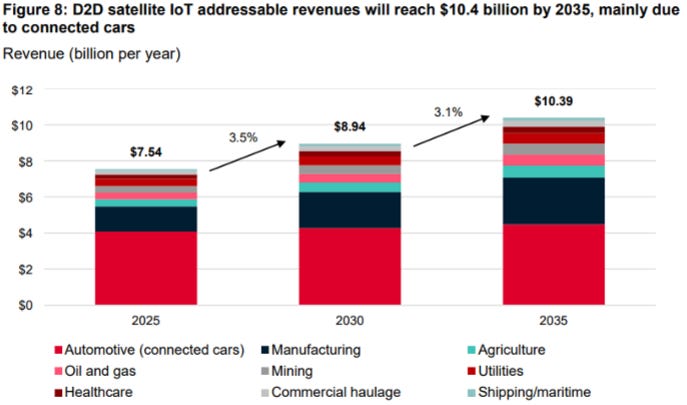

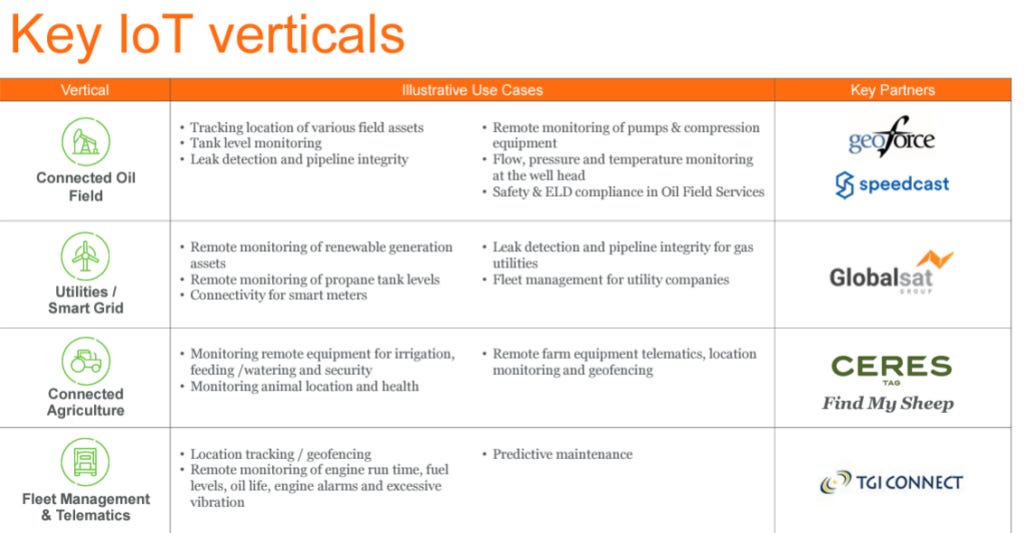

IoT and Machine-to-Machine (M2M) Applications

Beyond traditional connectivity, LEO satellites are driving the Internet of Things (IoT) and Machine-to-Machine (M2M) networks in remote or underserved regions. By providing a low-latency network for IoT devices, LEO satellites support industries such as oil and gas, maritime, and agriculture, where terrestrial infrastructure is sparse. Applications range from tracking shipping fleets and monitoring offshore rigs to collecting data from remote sensors in forests or agricultural lands. This data can be used for predictive maintenance, supply chain optimization, and operational safety, making IoT-enabled LEO networks essential for global industries seeking reliable, real-time data in remote environments.

ORBCOMM (private): Operates a constellation for IoT and M2M applications like fleet management and remote monitoring.

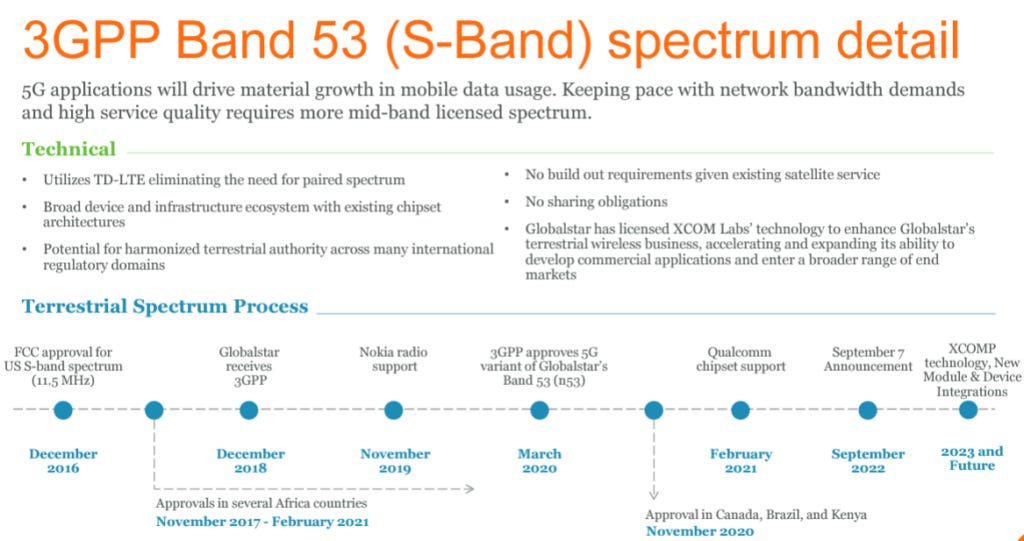

Globalstar (NYSE: GSAT): Provides IoT connectivity for asset tracking and industrial monitoring in remote areas.

Iridium Communications (NASDAQ: IRDM): Offers IoT connectivity globally for applications from shipping to agriculture.

Spire Global (NYSE: SPIR): Spire’s constellation supports IoT and M2M by providing global data on weather, maritime, and aviation metrics. These capabilities enable Spire to serve IoT needs in sectors like agriculture, logistics, and energy, where real-time data is crucial for operations in hard-to-reach locations.

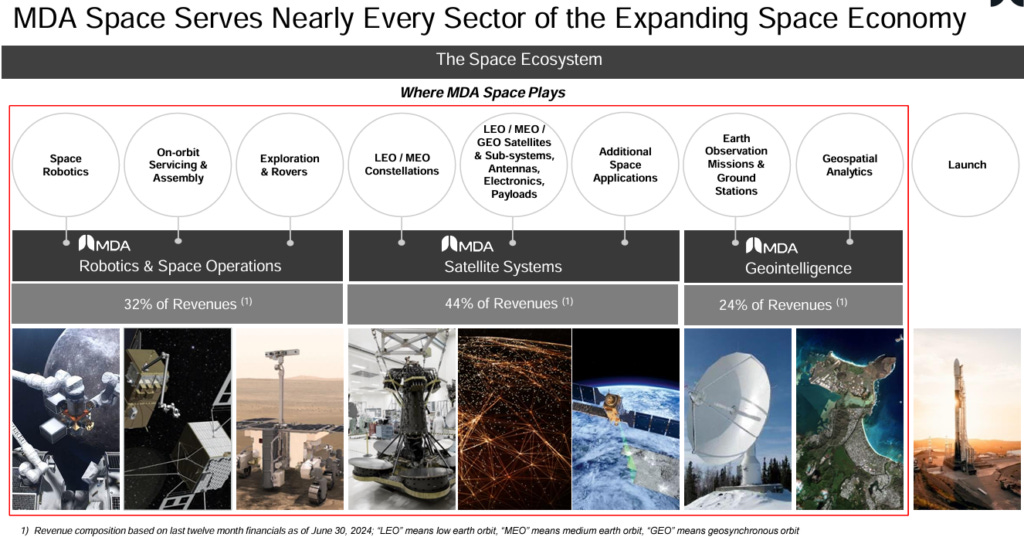

Space Equipment and Support Industry

Companies specializing in satellite equipment and in-orbit services play a crucial role in maintaining and advancing satellite constellations. These firms provide essential components, systems, and services that ensure the durability, functionality, and sustainability of satellites used across Earth observation, communications, and navigation. From manufacturing critical satellite parts to offering in-orbit repairs and debris management, these companies support the long-term operational needs of the growing satellite industry.

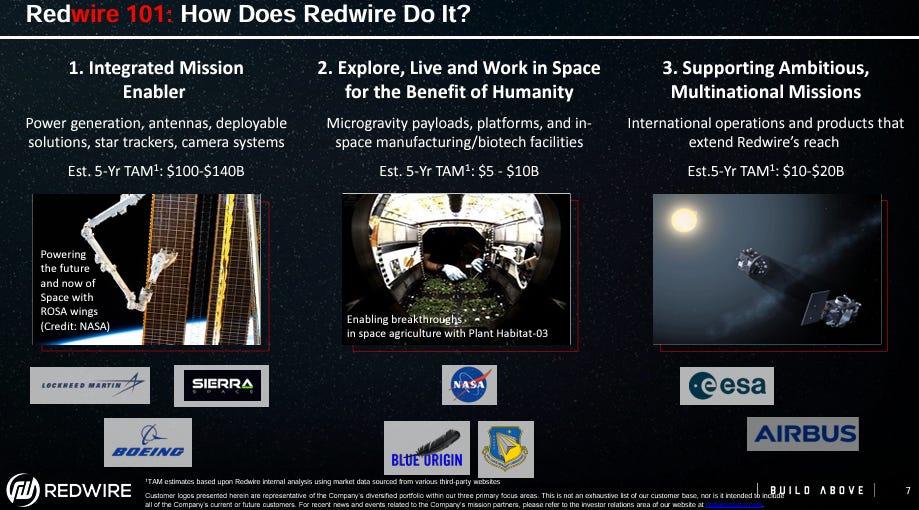

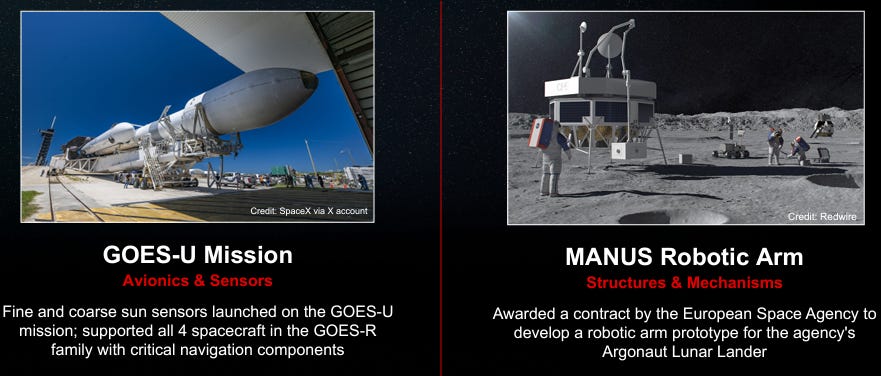

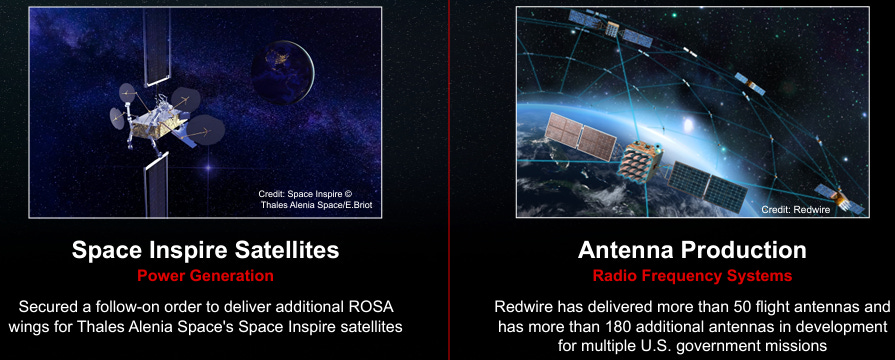

Redwire Corporation (NYSE: RDW): Supplies mission-critical components such as solar arrays, advanced materials, and in-space manufacturing technology, supporting satellite power systems and on-orbit repairs.

MDA Space (TSX: MDA): Provides advanced space robotics, satellite systems, and radar solutions, offering high-precision sensors and radar for satellite imaging and telecommunications infrastructure.

Astroscale Holdings Inc (TYO: 186A): Specializes in satellite servicing and orbital debris removal, focusing on satellite longevity and sustainable space operations to address the increasing challenge of orbital congestion. (not interested in this company for now, information is a bit scarce)

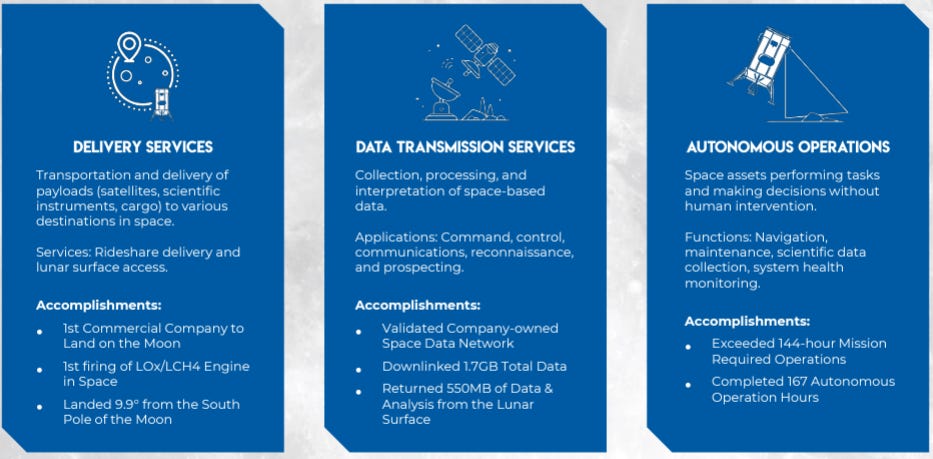

Intuitive Machines (NASDAQ: LUNR): Advances lunar and deep-space missions with specialized landers and communications technology, facilitating satellite support for exploration beyond Earth’s orbit. Not much to do with earth based LEO, but are building a satellite network around the moon

Suppliers to the Space Industry

The companies providing essential parts to major space firms like SpaceX are the unsung heroes of the space industry, supplying advanced materials, electronics, propulsion systems, and structural components essential for mission success. These suppliers represent a stable pathway for investors who want exposure to the space sector without the high capital risk of pure-play operators. With stable, recurring contracts across launch vehicles, satellite components, and propulsion systems, these suppliers are positioned to benefit from the increasing cadence of space missions.

Hexcel Corporation (NYSE: HXL): Hexcel is known for its lightweight carbon fiber composites, which are crucial for building fuel-efficient rockets and spacecraft for companies like SpaceX and Blue Origin. These high-performance materials allow for enhanced payload capacity, optimizing cost-efficiency in space launches.

Applied Materials (NASDAQ: AMAT): Applied Materials offers critical semiconductor manufacturing equipment for high-performance microchips used in satellites, such as SpaceX’s Starlink constellation. Advanced satellite functionality and long-term durability depend on this high-quality manufacturing capability.

Hexagon AB (STO: HEXA-B): Delivers high-precision sensors and geospatial technology essential for accurate positioning and mapping, supporting Earth observation, defense, and environmental monitoring applications.

Ball Corporation (NYSE: BALL): Known for their aerospace segment, Ball provides precision optics, sensors, and satellite systems that support high-resolution imaging and data collection for space missions. Ball’s contributions help ensure reliable data acquisition and environmental resilience, crucial for Earth observation and exploration missions alike.

TE Connectivity (NYSE: TEL): TE Connectivity produces high-durability connectors and sensors for launch vehicles and satellites, essential for managing electrical and thermal stresses during space missions. Their connectors and sensors ensure stable connections, maintaining power and signal integrity under extreme conditions.

Honeywell International (NASDAQ: HON): Honeywell offers navigation, guidance, and control systems for the aerospace and space industries. Its technology provides precise navigation and stability for both rockets and satellites, helping maintain the mission integrity of launches and in-orbit operations.

Ducommun Incorporated (NYSE: DCO): Ducommun supplies structural assemblies, electronics, and complex wiring systems used in launch vehicles and satellite platforms. Their products are integral to maintaining structural integrity and functionality under the high-stress conditions of launches.

TransDigm Group Incorporated (NYSE: TDG): TransDigm provides critical aerospace parts, including highly engineered valves, pumps, and electronic control systems used in rocket propulsion and satellite operations. These components are engineered for resilience in space conditions, supporting long-term satellite functionality and high-thrust launch requirements.

Woodward, Inc. (NASDAQ: WWD): Woodward supplies high-performance propulsion control systems and power management for aerospace applications. Known for its precision and reliability, Woodward’s technology helps manage energy efficiency and thrust control in challenging environments like space.

Moog Inc. (NYSE: MOG-A): Moog supplies precision propulsion control systems used in the maneuvering and stability of launch vehicles, including SpaceX’s rockets. Their specialized hardware supports fine-tuned trajectory control, helping ensure each launch hits its target destination accurately.

Defense and Intelligence

In defense and national security, LEO satellites provide critical capabilities in reconnaissance, surveillance, and early warning systems. Their low orbital position enables them to capture highly detailed images and, when deployed in constellations, cover vast areas with rapid revisit times. This makes them ideal for tracking troop movements, monitoring borders, and observing maritime activity. Furthermore, their shorter latency period means that LEO satellites can send real-time alerts for missile launches or other potential threats. Many defense agencies are increasingly deploying LEO-based satellite constellations to enhance space situational awareness (SSA) and provide continuous coverage of areas of strategic interest, supporting mission-critical decision-making. I’ll leave the company spotlights for the next Star Wars, defense-focused article.

Northrop Grumman (NYSE: NOC): Provides missile warning and reconnaissance satellites, especially for the U.S. Department of Defense.

Lockheed Martin (NYSE: LMT): Develops LEO satellites for defense applications, including missile tracking and intelligence.

BAE Systems (LSE: BA): Offers imaging and situational awareness for defense through collaborations on satellite-based intelligence projects.

Thales (Euronext Paris: HO): Thales provides advanced satellite systems for defense and security, focusing on secure communications, Earth observation, and reconnaissance. The company’s satellite solutions support military and government clients with secure, resilient data for surveillance, intelligence, and space-based situational awareness, leveraging partnerships across Europe to enhance strategic defense capabilities.

L3Harris Technologies (NYSE: LHX): L3Harris designs and manufactures high-resolution, multi-mission satellite systems for defense and intelligence, specializing in surveillance, missile tracking, and secure communications. The company supports U.S. and allied defense agencies with advanced geospatial and reconnaissance capabilities, focusing on real-time situational awareness and resilient space-based defense solutions.

BlackSky (NYSE: BKSY): BlackSky’s high-frequency imaging capabilities support defense and intelligence needs, offering situational awareness and rapid response imagery. The company provides real-time data to government clients for reconnaissance and mission planning, with an emphasis on timely intelligence in sensitive areas.

Kratos Defense & Security Solutions (NASDAQ: KTOS): Specializing in satellite communications, signal monitoring, and cybersecurity, Kratos supports defense and intelligence clients with resilient space and ground infrastructure. Their systems protect against jamming, signal interference, and cyber threats, ensuring secure communication channels for government and military satellite networks.

Company Spotlight

Planet Labs (PL, $650m)

Planet Labs has been pushing forward on growth, reporting a 14% revenue increase to $61.1 million for the three months ending July 31, 2024, up from $53.8 million the previous year. This jump is largely thanks to new customers, including those brought in through the recent Sinergise acquisition, and stronger traction in its Civil Government and Defense and Intelligence sectors. The company’s customer base grew by 7%, reaching 1,012 clients by the end of the quarter, which highlights the appeal of Planet’s high-frequency, Earth observation data across diverse applications.

However, scaling up hasn’t been without cost. Planet Labs saw a 5% increase in the cost of revenue, reaching $28.8 million, driven by severance expenses from a June headcount reduction and higher fees to solution partners and subcontractors. This workforce cut, reducing the global headcount by 17%, was part of a strategy to align Planet’s resources with growth areas and improve efficiency—though it came with a $10.5 million one-time charge for termination benefits. Operating expenses also nudged upward, with R&D expenses up 2%, sales and marketing up 6%, and G&A up 2%, reflecting Planet’s ongoing investments in analytics, data products, and platform enhancements to attract new clients and deepen relationships with existing ones.

Despite these efforts, Planet Labs still reported a net loss of $38.7 million for the quarter, close to the $38.0 million loss in the same period in 2023. On the positive side, the company has $148.3 million in cash on hand as of July 31, 2024, which, along with operational cash flows, they believe will be sufficient to meet obligations over the next 12 months.

In terms of strategy, Planet Labs remains focused on scaling within existing markets, expanding into new sectors, and enhancing its platform with additional data sets and sensors. It’s not all easy growth—balancing cost efficiency with high operational expenses like satellite maintenance and data processing is a challenge they’re working through. With consistent revenue growth, a growing customer base, and efforts to streamline costs, Planet is aiming to become a sustainable leader in Earth observation, even as they navigate the rocky road toward profitability.

Blacksky (BKSY, $190m)

BlackSky Technology Inc. operates a subscription-based business that provides real-time Earth observation and geospatial intelligence through its Spectra AI platform. With its high-frequency satellite imagery and analytics, BlackSky supports government and defense clients by delivering rapid intelligence, often within 90 minutes of image capture. In addition to subscriptions, the company earns revenue from professional services, where it delivers custom solutions for defense and intelligence projects.

In the second quarter of 2024, BlackSky saw a significant 29% year-over-year increase in revenue. Subscription revenue from imagery and software analytics grew by 14%, driven by client renewals and additional subscriptions, while professional services revenue surged 86.8% due to new contract wins. Cost efficiencies were evident, with a slight 0.7% decrease in service costs and a 32% reduction in professional services costs, thanks to streamlined material expenses. BlackSky also managed to cut SG&A expenses by 3%, although R&D spending rose sharply by 62.5% as the company invested heavily in satellite and AI enhancements. The balance sheet remains strong, with $25.6 million in cash and a $20 million credit facility to support ongoing growth and liquidity needs.

BlackSky is actively expanding its satellite constellation, aiming for 30 satellites by 2025. The launch of Gen-3 satellites in late 2024 is expected to boost imaging capabilities with advanced features like shortwave infrared imaging. Meanwhile, investments in Spectra AI continue to focus on integrating new data layers and enhancing analytics, allowing BlackSky to go beyond raw imagery and deliver actionable intelligence tailored to diverse industry needs.

Primary cost drivers include satellite operations, with substantial spending on launches and maintenance, R&D investments in technology upgrades, and data processing expenses for advanced analytics. BlackSky has achieved cost efficiencies in professional services and SG&A, reflecting efforts to balance growth investments with a path toward profitability.

Competition in the Earth observation sector is strong. BlackSky’s emphasis on real-time intelligence differentiates it from Planet Labs, which serves a broad commercial base, Maxar with high-resolution imaging, and Capella Space’s all-weather SAR capabilities. Partnerships, such as with Palantir, enhance BlackSky’s data analytics offering but also bring indirect competition in the intelligence space.

Recent growth shows BlackSky’s appeal, particularly among government clients needing rapid intelligence. However, the challenge of profitability remains, with BlackSky needing to control costs while expanding commercial reach to reduce reliance on government contracts. By focusing on real-time data and AI-enhanced analytics, BlackSky is well-positioned to capture ongoing demand in the competitive Earth observation market.

Spire Global (SPIR, $240m)

Spire Global’s business is built on a unique data model that goes beyond typical satellite imagery, focusing instead on radio frequency (RF) data and AIS signals from its constellation of over 100 satellites. This lets Spire track ships, planes, and weather conditions globally in real time. Clients—mainly in logistics, government, and aviation—subscribe to Spire’s data feeds, and there’s also a space-as-a-service option for clients who want to lease Spire’s infrastructure for their own payloads.