Why I’m Tactically Exiting My Short on Long Bonds

Scott Bessent: Wall Street’s Comfort Blanket

Markets have embraced Scott Bessent’s appointment as Treasury Secretary, interpreting it as a signal of renewed fiscal discipline. A seasoned Wall Street figure with a history of advocating for balanced budgets, Bessent’s “holy trinity” of goals—3% real economic growth, a 3% budget deficit by 2028, and 3 million barrels of daily U.S. oil production—has catalyzed a rally in Treasuries. The market’s enthusiasm reflects confidence in a Treasury Secretary who aligns with the narrative of spending efficiency.

This narrative has been further supported by the creation of the Department of Government Efficiency (DOGE), led by Elon Musk and Vivek Ramaswamy. Their mission to trim excess government expenditures through tech-driven solutions and streamlined operations reinforces the perception of a government focused on fiscal prudence. However, as I noted in “Post-Election Implications and Trade Sketches,” this newfound emphasis on efficiency stands in stark contrast to Trump’s broader policy objectives, which remain structurally pro-labor and growth-oriented.

Short-Term Optimism is Overdone

Markets are treating Bessent’s appointment and the establishment of DOGE as harbingers of a new era of fiscal restraint. However, as I’ve written previously, Trump’s economic priorities are rooted in Main Street-focused initiatives—reshoring, pro-labor policies, and protectionist trade strategies. These are fundamentally inflationary and require significant government spending to support industrial and economic revitalization.

The current bond rally, while understandable, reflects optimism disconnected from these structural realities. As I emphasized in the prior note, fiscal discipline is unlikely to take precedence over pro-labor economic imperatives, and inflationary pressures will persist. While markets are temporarily enthralled by the fiscal discipline narrative, reality will eventually reassert itself.

Fighting the Prevailing Narrative is Expensive

Markets run on narratives, and the current storyline—centered on fiscal discipline under Scott Bessent and the newly established Department of Government Efficiency (DOGE)—is dominating sentiment. While this narrative may eventually clash with the broader policy realities, challenging it prematurely can be costly. The rally in bonds reflects the market’s embrace of this perceived shift toward austerity, even if it’s at odds with the administration’s underlying priorities of growth and labor protection.

Tactically stepping aside and taking profits on the trade we set up when the Fed cut 50bps in the article titled: Fed and China go big or go Home allows me to avoid the expense of pushing back against a sentiment-driven narrative at its peak. Instead, I’ll wait for the disconnect between perception and policy outcomes to surface, presenting a more opportune moment to re-engage.

Why I’m Still Long-Term Bearish on Bonds

Robert Lighthizer: Trump’s True Spirit Animal

Robert Lighthizer, Trump’s long-time trade advisor and advocate for protectionist economic policies, exemplifies the administration’s broader vision. His focus on tariffs, reshoring, and trade realignment underscores the inflationary core of Trump’s economic strategy. While Bessent’s fiscal restraint narrative may dominate headlines, Lighthizer represents the administration’s deeper commitment to pro-labor, pro-industry policies that inherently drive inflation.

Lighthizer’s trade policies are structurally aligned with Trump’s economic vision, prioritizing American labor and domestic production at the expense of cost efficiency. This makes his influence a critical counterbalance to the perceived austerity of Bessent’s Treasury leadership. The result is a dual narrative: fiscal prudence as a short-term market driver, but inflationary labor and trade priorities as the long-term structural reality.

The Illusion of Government Efficiency

Efforts to address the U.S. federal budget through efficiency initiatives face significant hurdles. While politically appealing, the structural realities of federal spending severely limit the potential impact of the Department of Government Efficiency (DOGE). Here’s why these efforts are unlikely to succeed, leaving fiscal deficits as a persistent feature of the U.S. economy:

1. Discretionary Spending is Too Small to Move the Needle

The vast majority of federal spending is concentrated in mandatory programs—Social Security, Medicare, Medicaid, and interest payments—which account for 72–78% of the budget. Even if the entire remaining discretionary budget were eliminated, it would barely cover the current deficit.

2. Structural Drivers of Spending are Inflexible

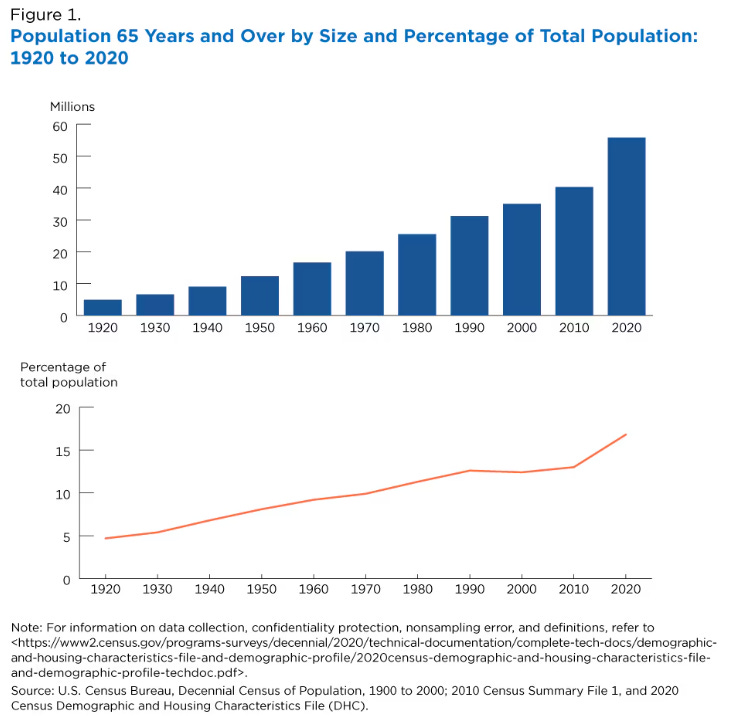

Aging Demographics: The growing retiree population is placing increasing pressure on Social Security and Medicare. Social Security payouts already exceed contributions, with the trust fund projected to be depleted by 2033.

Healthcare Costs: Medicare and Medicaid expenses are growing at 7% annually, far outpacing GDP growth. This trend shows no signs of abating, driven by rising enrollment and healthcare inflation. You can reference the Centers for Medicare & Medicaid Services guidance with their NHE Fact Sheet

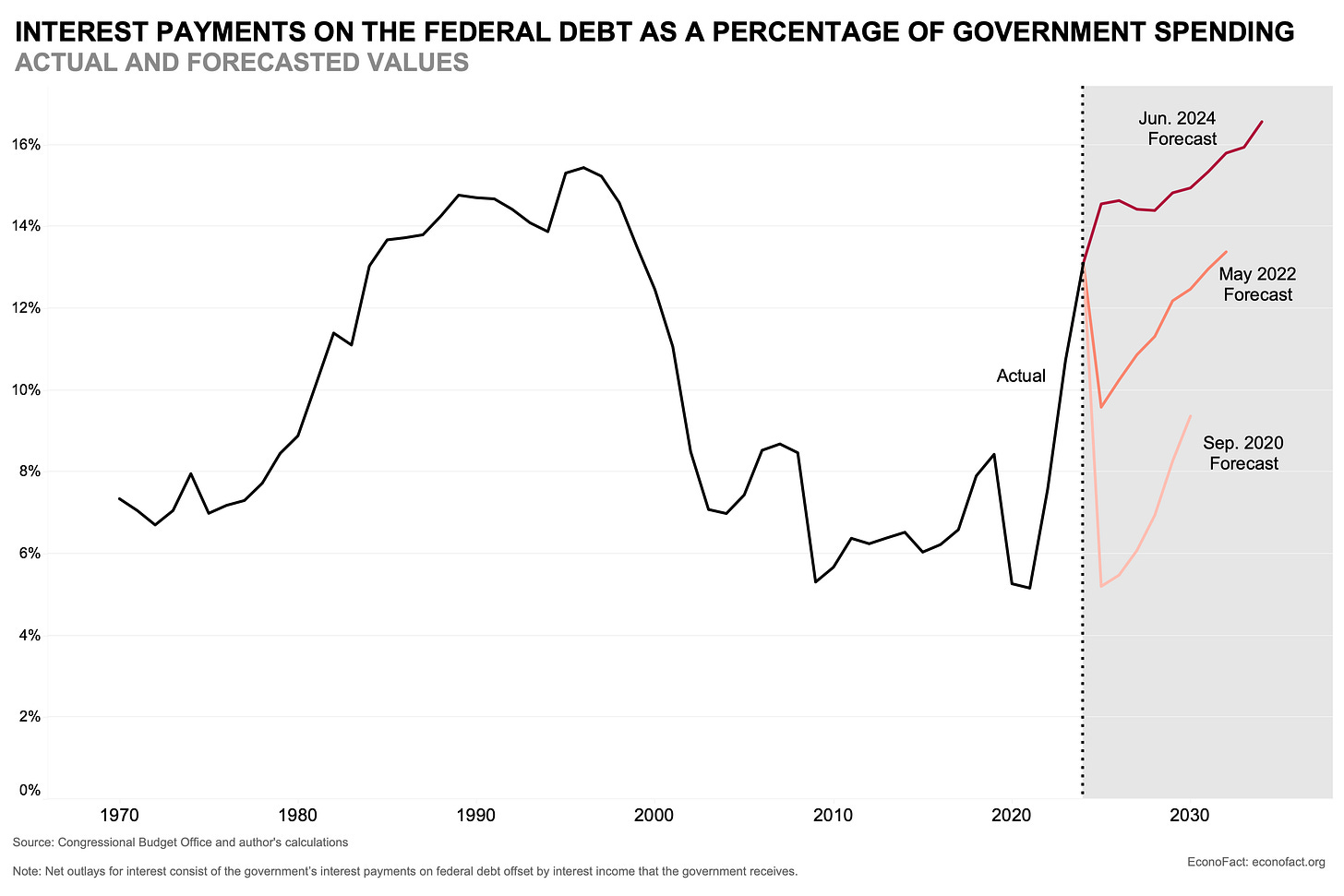

3. Rising Interest Costs

Federal debt servicing costs have doubled since 2021, reaching over $1 trillion annually. With higher interest rates being rolled into new Treasury issuance, interest payments are becoming the fastest-growing component of federal outlays. This dynamic reinforces a vicious cycle: deficits drive higher borrowing costs, which in turn exacerbate deficits.

4. Political and Legislative Constraints

Many spending programs, especially entitlements, are statutory and require Congressional approval to alter. While the DOGE and Bessent might achieve marginal gains, addressing the core drivers of deficits requires legislative consensus and coordination between branches of the Federal bureaucracy.

The Holy Trinity May Not Be Fully Achievable

Breaking down the holy trinity:

3 million barrels of oil per day: Achievable and consistent with Trump’s energy independence goals.

3% real economic growth: Difficult without significant fiscal expansion, as I’ve discussed in “Fed and China Go Big or Go Home.” Sustained growth at this level would require substantial government spending, adding inflationary pressures.

3% budget deficit by 2028: A political challenge, given the competing priorities of infrastructure spending, defense, and reshoring. Fiscal restraint faces inherent limits in a policy framework designed to support employment and wages.

This disconnect between the aspirations of the holy trinity and the realities of policy execution underscores why my long-term bearish outlook on bonds remains intact.

Inflation Risks Are Brewing

As I explored in prior articles, inflation risks are embedded in the shift toward pro-labor economic policies (this would have been true under either presidential candidate). Trump-specific policies of tariffs and reshoring industrial production could lead to increased production costs as an inflationary driver, even in the face of potential deflationary energy price declines. The structural forces at play ensure that bonds will struggle to maintain stability over the long term due to inflation volatility, even if the market temporarily overlooks these risks.

Pivoting to U.S. Bank Stocks

Exiting the ZB short trade aligns with a broader realization: the short-term narrative driving Treasuries higher—a perception of fiscal restraint under Scott Bessent—is dominating market sentiment. Yet, this very policy narrative also creates an exciting structural opportunity elsewhere: U.S. bank equities.

Scott Bessent’s appointment as Treasury Secretary and his explicit advocacy for deregulation herald a policy environment where financial institutions are poised to thrive. While bond markets rally on optimism about fiscal discipline, bank stocks stand to gain from the long-term structural shifts these same policies are set to unleash.

Bessent’s views on removing regulatory burdens align seamlessly with Trump’s broader deregulatory agenda. In his own words, Bessent has championed a “big push in bank deregulation,” emphasizing the need to “get a lot of the lending back into the banking system, and let our banks lend.” This vision underscores the critical role of banks in driving private-sector-led credit creation—a cornerstone of the administration’s strategy to sustain economic momentum amid a reduction in government spending.

The Role of Bank Lending in Trump’s Economic Strategy

At the core of Trump’s economic vision lies a significant shift in the source of money creation, moving from government-led deficit spending to private-sector-driven credit expansion. This desired transition makes banks indispensable to achieving the administration’s ambitious policy goals. To understand their role, it’s essential to delve into the mechanics of money creation and why banks are positioned at the center of this strategy.

Quick Mechanics of Money Creation

In any economy, money creation happens through two primary channels:

Government Deficit Spending:

By spending more than it collects in taxes, the government directly injects liquidity into the economy. This spending is financed through borrowing, typically by issuing Treasury securities. The proceeds flow into the hands of businesses, households, and state/local governments, stimulating demand and supporting economic activity.

This method gained prominence during the COVID crisis, when fiscal stimulus programs such as direct cash transfers, enhanced unemployment benefits, and small business loans were deployed at an unprecedented scale. While effective in averting an economic collapse, this approach significantly increased the federal debt, pushing it to levels that are now raising alarm over sustainability.

Private Sector Credit Creation:

When banks issue loans, they essentially create new money. Here’s how it works: A bank extends a loan to a customer, and simultaneously credits the customer's deposit account with the loan amount. This action increases the money supply, as the loan becomes new purchasing power in the economy.

Unlike government spending, private-sector credit creation depends on demand for loans and the willingness of banks to lend. This process is driven by the availability of creditworthy borrowers and banks’ confidence in the economic outlook. As businesses and consumers borrow to invest, spend, and grow, economic activity is organically stimulated.

Trump’s government appointees’ having common guidance on fiscal discipline suggests a deliberate pivot away from government-driven liquidity injections toward private-sector credit creation. If the desire is for government spending to contract, a robust lending activity becomes essential to sustaining economic momentum, positioning banks as the linchpin of this strategy. Now, keep in mind, that policy can fail to implement spending deficit reductions but achieve to loosen regulations around banks.

Why Bank Lending is Critical

Trump’s policy framework relies heavily on banks to expand credit and drive economic growth. This reliance is not just a preference but a necessity in an environment of shrinking government deficits. Here’s why bank lending is so vital:

Bridging the Liquidity Gap: Without sufficient private-sector lending, a reduction in government spending would lead to a contraction in the money supply, slowing economic activity. Banks must step up to bridge this gap, ensuring liquidity remains adequate to support growth.

Empowering Local Economies: As Bessent noted, banks are sitting on “plenty of liquidity” but remain hamstrung by regulatory hurdles. Easing these restrictions will enable banks to lend more effectively to small businesses, infrastructure projects, and community initiatives—directly supporting Trump’s pro-growth, pro-labor agenda.

Sustaining Employment and Wages: Expanding credit fuels business growth, which in turn supports job creation and wage increases. Robust lending activity is particularly critical for labor-intensive industries such as manufacturing and small enterprises, aligning with Trump’s promise to deliver a higher standard of living for American workers and providing credit lines to re-shore industrial production.

The Economic Stakes of Credit Expansion

The stakes are high. If banks fail to expand lending sufficiently and the government manages to step back spending, the broader economy risks stagnation or even contraction. This is the clear bear case for banks and equities broadly.

Historical data highlights the importance of loan growth if government spending steps back:

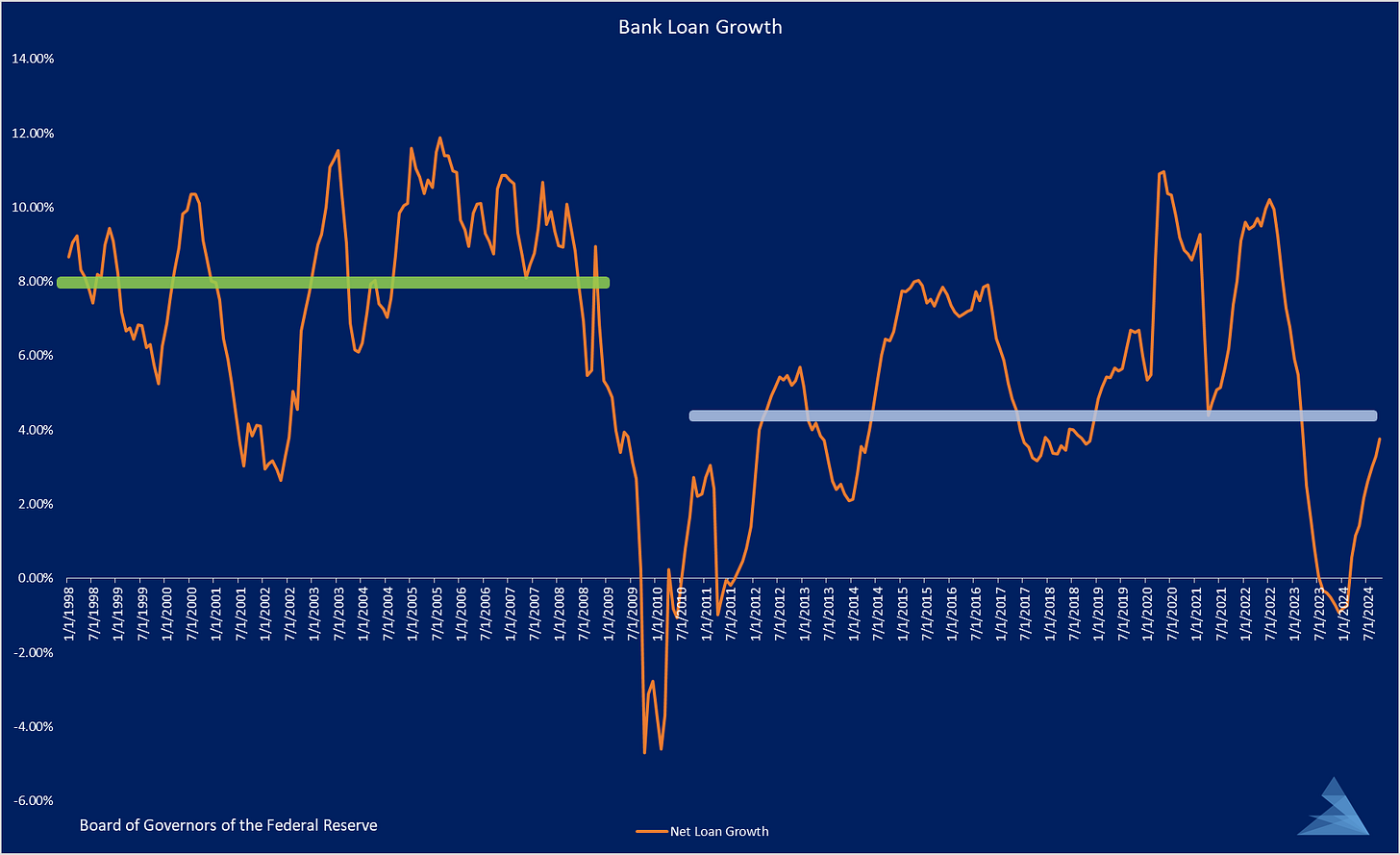

Before the Global Financial Crisis (GFC): Real bank loan growth ranged between 4% and 11% averaging at around 8%, fueling strong economic cycles.

Post-GFC: Regulatory overhang has averaged loan growth at approximately 4%, limiting banks’ ability to drive the economy forward.

Bessent’s deregulation agenda aims to reverse this trend, empowering banks to return to pre-GFC loan growth levels and tying in directly with our rotation trade to RTY.

Why U.S. Bank Stocks?

This combination of structural necessity and policy alignment makes U.S. bank equities a particularly compelling investment opportunity. Here’s why:

Deregulation as a Growth Catalyst: Over a decade of stringent post-crisis regulation has constrained banks, capping both profitability and loan growth. With Bessent leading Treasury, these barriers are set to be dismantled, unlocking growth potential.

Filling the Gap in Money Creation: With a reduced government footprint, the private sector must lead credit creation. Banks are pivotal to this transition, and Bessent has explicitly emphasized this, stating: “Our banks are dying to make loans, but regulatory restrictions prevent them from meeting local demands.”

Attractive Valuations: U.S. banks, trade at significant historical discounts to the broader market. This undervaluation, paired with deregulation-driven growth, presents a strong upside case for a convergence in multiples.

Regional Banks Positioned to Benefit: Smaller regional banks, often burdened by commercial real estate exposure and heavy regulatory oversight, are positioned for outsized gains as they capitalize on enhanced lending capabilities and regulatory relief.

Long Term Investment Implications beyond the exit of ZB shorts

The alignment of policy priorities, leadership focus, and market opportunity makes U.S. banks a cornerstone of Trump’s economic strategy. Deregulation under Bessent’s leadership is not merely a boon for the sector; it’s a structural necessity for the administration’s broader vision. As Bessent himself stated:

“We need a big push in bank deregulation to unlock the growth potential that’s been held back for too long.”

This trade is not new and has been fueled since the election outcome, but I believe there is room to run for years to come on a multiples convergence basis and further revenue expansion from what is currently priced in. In no way a contrarian trade but one that pairs nicely with our bearish view on bonds which I expect to re-enter if market conditions align as can be seen in the two following basic scenarios:

Banks and Falling Bond Prices (Rising Yields)

Positive Impact: Improving Net Interest Margins (NIMs):

Rising bond yields often signal higher interest rates, which can improve banks’ net interest margins. Banks borrow at short-term rates (e.g., deposits) and lend at long-term rates (e.g., mortgages, business loans). When long-term rates rise faster than short-term rates, this "steepens" the yield curve, boosting profitability.

Negative Impact: Mark-to-Market Losses on Bond Portfolios:

Banks hold significant bond portfolios for liquidity and regulatory purposes. When bond prices fall (yields rise), these portfolios may experience mark-to-market losses, especially for securities classified as "available-for-sale."

While unrealized losses don’t always affect earnings, they can hurt equity valuations and weaken regulatory capital positions, as seen during the 2023 regional banking crisis. I do expect this to have raised awareness to hedge ones duration risk???

Impact on Credit Demand:

Rising yields can discourage borrowing as loans become more expensive. This can slow credit growth, which is a key driver of bank revenues. The extent of the slowdown depends on whether yields rise in a controlled environment (e.g., strong economic growth) or a crisis setting (e.g., a credit crunch). I expect that we will be in the former and deregulation to counteract tighter financial conditions which benefit out short long duration leg of the trade.

Banks and Rising Bond Prices (Falling Yields)

Negative Impact: Squeezed Net Interest Margins:

Falling bond yields, often associated with lower interest rates, can compress banks’ NIMs, particularly if short-term deposit rates don't fall as quickly as long-term loan rates. If yields do come down hurting our bearish view on bonds, I believe that the credit expansion from both lower borrowing costs and deregulation outweigh tightening NIMs.

This is a common challenge during economic downturns when central banks lower rates to stimulate the economy.

Positive Impact: Gains on Bond Portfolios:

Banks benefit from rising bond prices through unrealized or realized gains on their bond holdings. This can boost earnings, especially during periods of declining interest rates. I don’t expect this to be a plus given the expected hedges but digging into this for a potential bank specific thematic equities note.

Impact on Credit Demand:

Lower yields often stimulate borrowing by reducing the cost of credit, which can support loan growth and offset some of the margin compression. This is the objective for the Trump administration and one that can be achieved independent of yields with de-regulation.

Given the doubts over the administration achieving its fiscal deficit reduction goals, there is an other inflationary risk to the economy which I had not mentioned before and supports this pair trade:

Trump’s pivot toward private credit creation reflects a broader economic philosophy of empowering the private sector while reining in government expenditures. However, this dual goal requires a delicate balance. The success of this strategy depends on banks stepping up as robust credit providers without triggering excessive risk-taking or financial instability. At the same time, the administration must grapple with the reality that fiscal discipline is difficult to implement, as entrenched structural deficits make deep cuts to government spending politically and economically challenging. If deficit reductions fail to materialize, deregulation could still succeed, resulting in increased lending and credit expansion while fiscal deficits persist. This scenario would likely amplify inflationary pressures, aligning with a secular bearish view on long-duration bonds.

This duality underscores a key point: even if deficit reduction efforts falter, deregulation and enhanced credit creation could still drive significant economic activity, keeping banks at the center of the administration’s strategy. For investors, this makes U.S. bank stocks a compelling play, while also reinforcing a bearish long-term outlook on long-duration bonds as inflationary pressures continue to loom.

Current Implementations of Trade Ideas from "Post-Election Implications and Trade Sketches"