Running Into a Wall

All we have to decide, is what to do with the debt that is given to us.

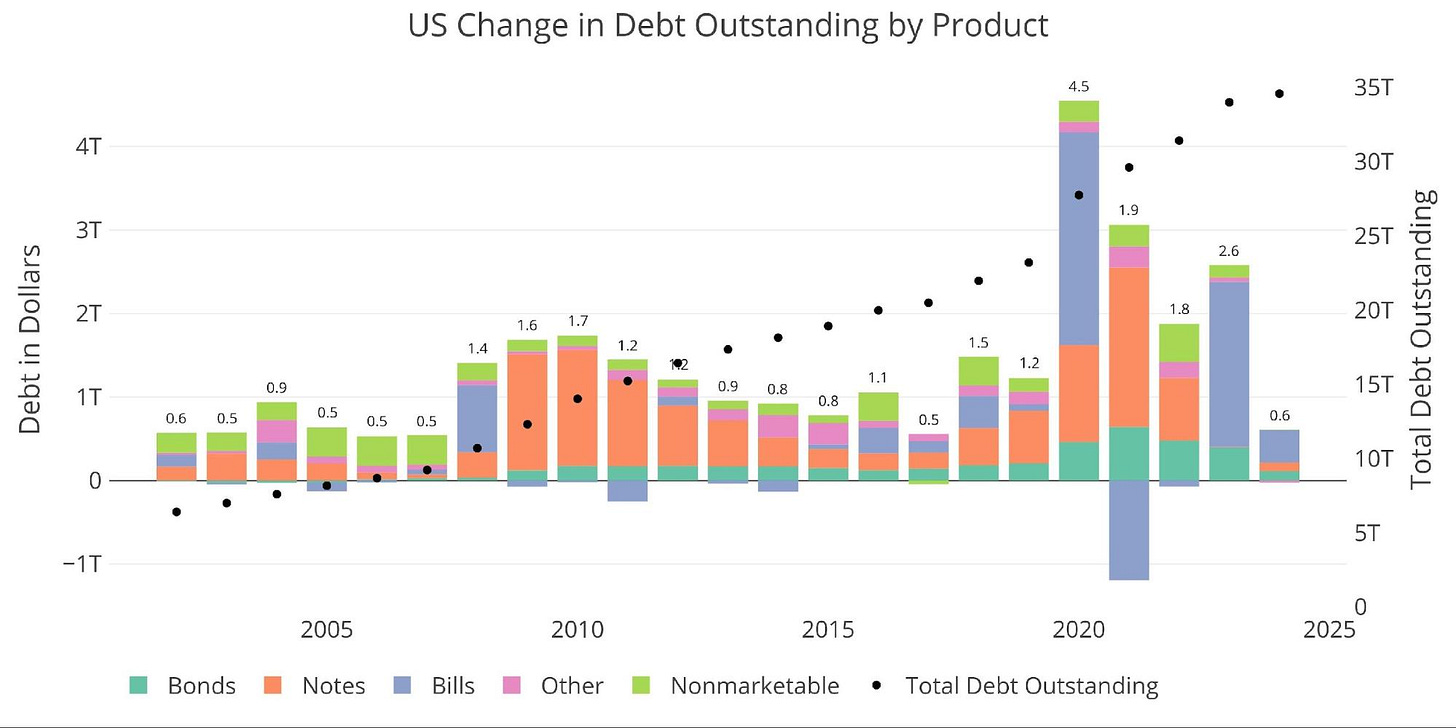

The Treasury market is bracing for its New Year’s detox—necessary, overdue, and mildly uncomfortable. After years of Janet Yellen’s fondness for short-term borrowing, 2025 brings a maturity wall with billions of dollars in Treasury bills set to roll off the books. Enter Scott Bessent, the long-end enthusiast and vocal critic of short-term overindulgence, ready to take the reins with a strategy that swaps short-lived fixes for more durable excesses. As the Treasury shifts gears to refinance on the long end, the supply surge looms like a treacherous mountain pass, testing the resolve of investors as they shoulder the weight of a long and uncertain journey. Meanwhile, the short end might be the last homely house amid the chaos—offering solace, if only the Fed resists the temptation to tinker with its inflation expectations yet again (our book should favor this outcome).

Our end-of-year tactical rates trade, structured to capitalize on the final FOMC meeting of 2024, proved highly rewarding amid the inflation tinkering we had anticipated since the first Big-Mac rates cut. Looking ahead, I expect inflation forecasts will require frequent and substantial revisions throughout 2025, aligning with our increased inflation volatility thesis. Revisiting this trade could provide valuable insights for the year ahead, as similar tactical opportunities are likely to arise.

Let’s now focus on what the Treasury is about to do and some trade implications.

Tails and Covers

Our first hint at investor malcontent emerged during the Treasury’s final TIPS auction of 2024—a $22 billion reopening of 5-year Treasury Inflation-Protected Securities (CUSIP 91282CLV1). Demand faltered, marked by a 7-basis-point tail, a striking divergence from the auction's expected yield of 2.05% that ultimately settled at 2.121%. The bid-to-cover ratio dropped to 2.1, its lowest since 2019, reflecting investor hesitation amid uncertainty about inflation and the allure of nominal Treasuries yielding 4.44%. Yet, as often happens in troubled times, those who acted found an unexpected reward: a real yield exceeding inflation by 2.121% and a price below par. It was a chance, perhaps fleeting, to secure a measure of stability while others waited, reluctant to tread paths where the way seemed uncertain.

The Fellowship of the Bills: A Quest for Cheap Financing

Under Janet Yellen’s tenure as Treasury Secretary, the Treasury leaned heavily on short-term Treasury bills (T-bills) to fund deficits—a strategy born of historically low interest rates and the urgent fiscal demands of pandemic-era stimulus. “The priority is to finance at the lowest cost to taxpayers,” Yellen asserted, highlighting the agility and efficiency of short-term borrowing. She added that “short-term securities provide critical flexibility in managing the nation’s financing needs,” particularly during periods of elevated fiscal churn.

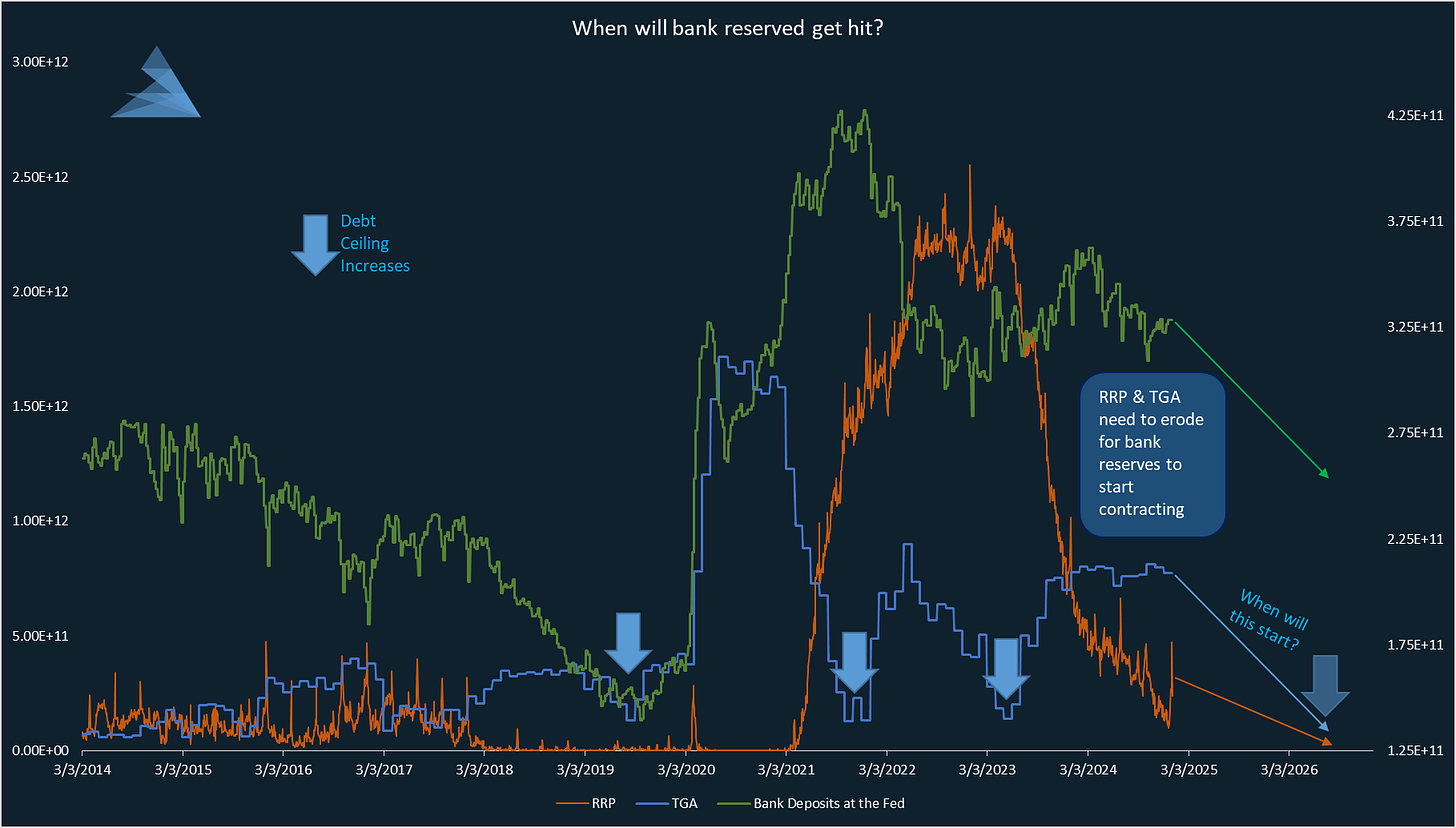

The playbook was elegantly simple: issue an avalanche of short-duration debt to tap into a financial system brimming with reserves parked in the Fed’s Reverse Repo Program (RRP). At its peak, the RRP ballooned to $2.5 trillion, serving as a reservoir for excess liquidity during quantitative easing (QE) and anchoring short-term rates. By deploying T-bills, Yellen effectively redirected cash from money market funds (MMFs) out of the RRP and into government debt, unleashing a flood of liquidity into financial markets and the real economy. This maneuver counterbalanced the Fed’s quantitative tightening (QT) efforts. Remarkably, in 2023, T-bills financed over 100% of the fiscal deficit—a feat rarely seen outside recessions in the past quarter-century.

The result was a powerful liquidity injection that fueled stock market momentum and kept a lid on bond yields. Think of it as liquidity crack for markets—cheap, fast, and dangerously effective. Yet, this heavy reliance on short-term debt planted the seeds for a looming refinancing headache in 2025. With a significant chunk of this short-term debt coming due, the Treasury now faces the unenviable task of steering through a precarious funding landscape, where flexibility may be in short supply, and costs are anything but.

The Shadow Beyond the Wall: A Looming Battle for Fiscal Stability

Scott Bessent, the incoming Treasury Secretary, has taken a critical stance on the heavy reliance on short-term debt. While Janet Yellen’s approach delivered flexibility and kept borrowing costs low in the near term, Bessent sees it as a precarious balancing act, exposing the Treasury to refinancing risks and the mercurial nature of short-term markets. He has likened the $3.6 trillion maturity wall in 2025 to a structural fault line in the nation’s fiscal stability—an ominous feature that demands immediate reinforcement. “Issuing at the long end reduces rollover risk and provides a more stable funding base,” Bessent remarked, outlining a decisive shift toward longer-term debt issuance as the linchpin of his strategy.

The RRP has operated as a liquidity sponge, soaking up excess reserves in the financial system, particularly during the Federal Reserve’s quantitative easing (QE) era. Money market funds (MMFs) flocked to the RRP, attracted by its risk-free nature and yields directly tied to the Fed’s policy rate. At its peak, the RRP held a staggering $2.5 trillion in 2021-2022, reflecting a surplus of reserves and the lackluster appeal of alternative short-term investments like T-bills, which often offered lower yields during this period. By enabling MMFs to park cash securely, the RRP indirectly bolstered the Treasury’s capacity to issue short-term T-bills for deficit financing, all while leaving bank reserves largely untouched in a system awash with liquidity.

As quantitative tightening (QT) gained momentum and Treasury issuance ramped up, short-end yields, including T-bills, began to outpace the RRP’s rate. This sparked a migration of funds from the RRP back into T-bills, as MMFs pursued higher returns in the Treasury market. The RRP balance has since dwindled to $250 billion, reflecting this reallocation. While this shift has reduced liquidity held at the Fed, its broader impact has been more about redistributing liquidity across financial markets. Notably, this reallocation has mitigated some of QT’s tightening effects by enhancing short-term market liquidity. However, the overall financial conditions remain shaped by a complex interplay of factors, including reserve levels, Treasury General Account (TGA) operations, and the pace of Treasury issuance.

As the Treasury shifts from refinancing maturing T-bills to issuing longer-term bonds, market flows will adapt. Long-term bonds, less attractive to MMFs due to their duration risk, will rely on demand from pension funds, insurers, and mutual funds, which draw liquidity from sources like bank deposits, corporate cash reserves, or portfolio reallocations. This transition reduces MMF participation and channels liquidity from shorter-duration instruments into longer-term securities, tightening short-term liquidity availability. In a market already grappling with elevated yields and constrained reserves, this reallocation could intensify pressures, reflecting a shift in liquidity distribution rather than its overall mechanics.

Front End of the Curve

The interaction of short-term yields, liquidity conditions, and capital flows will undergo significant shifts as the Treasury refinances maturing T-bills with longer-term bonds. The expected reduction in T-bill issuance is set to create scarcity, driving yields lower as robust demand from money market funds (MMFs) intensifies. While the Reverse Repo Program (RRP) theoretically remains an alternative, its yield disadvantage compared to T-bills, particularly in an environment of steepening, discourages a reallocation of MMF cash. T-bills also offer critical operational advantages, such as superior liquidity, tradability, and portfolio management flexibility, making them indispensable tools. As anticipated Fed rate cuts further erode the competitiveness of the RRP relative to T-bill yields, MMFs will prioritize T-bills, exacerbating the scarcity and placing continued downward pressure on short-term yields.

Over the past two years, the decline in RRP balances has mitigated the impact of QT on overall system liquidity, acting as a critical buffer that absorbed excess liquidity and prevented acute disruptions in short-term funding markets. However, with RRP balances now nearing depletion and the Treasury’s General Account (TGA) also reducing, this cushion is rapidly diminishing. These reductions have temporarily slowed the decline in bank reserves, but once the RRP is depleted and the TGA drawdown concludes, reserves will have no buffer left, leaving them with no direction but downward. Historically, reserves approaching critical thresholds, such as 8% of GDP in 2018, have amplified funding market volatility. While reserves currently remain above these levels, the depletion of the RRP and the end of TGA reductions increase the risk of reserves falling to stress-inducing levels. This evolving dynamic will amplify competition for scarce high-quality assets like T-bills, further shaping the equilibrium in short-term funding markets.

The importance of this administration’s progress on bank deregulation also becomes evident here. By easing regulatory constraints, banks have retained greater flexibility in navigating tighter liquidity conditions, delaying the onset of systemic funding stress. However, as reduced T-bill supply intersects with tighter reserve balances, short-term rate volatility becomes increasingly likely. In this environment, competition for scarce high-quality assets like T-bills will intensify, with the evolving dynamics of the RRP, TGA, and reserve levels shaping the short-term funding landscape.

Trade: Long ZT with half year 20delta calls which serves as a hedge for monetary tightness affecting corporates, namely main-street small businesses. (35bps NAV)

The Tail End of the Curve

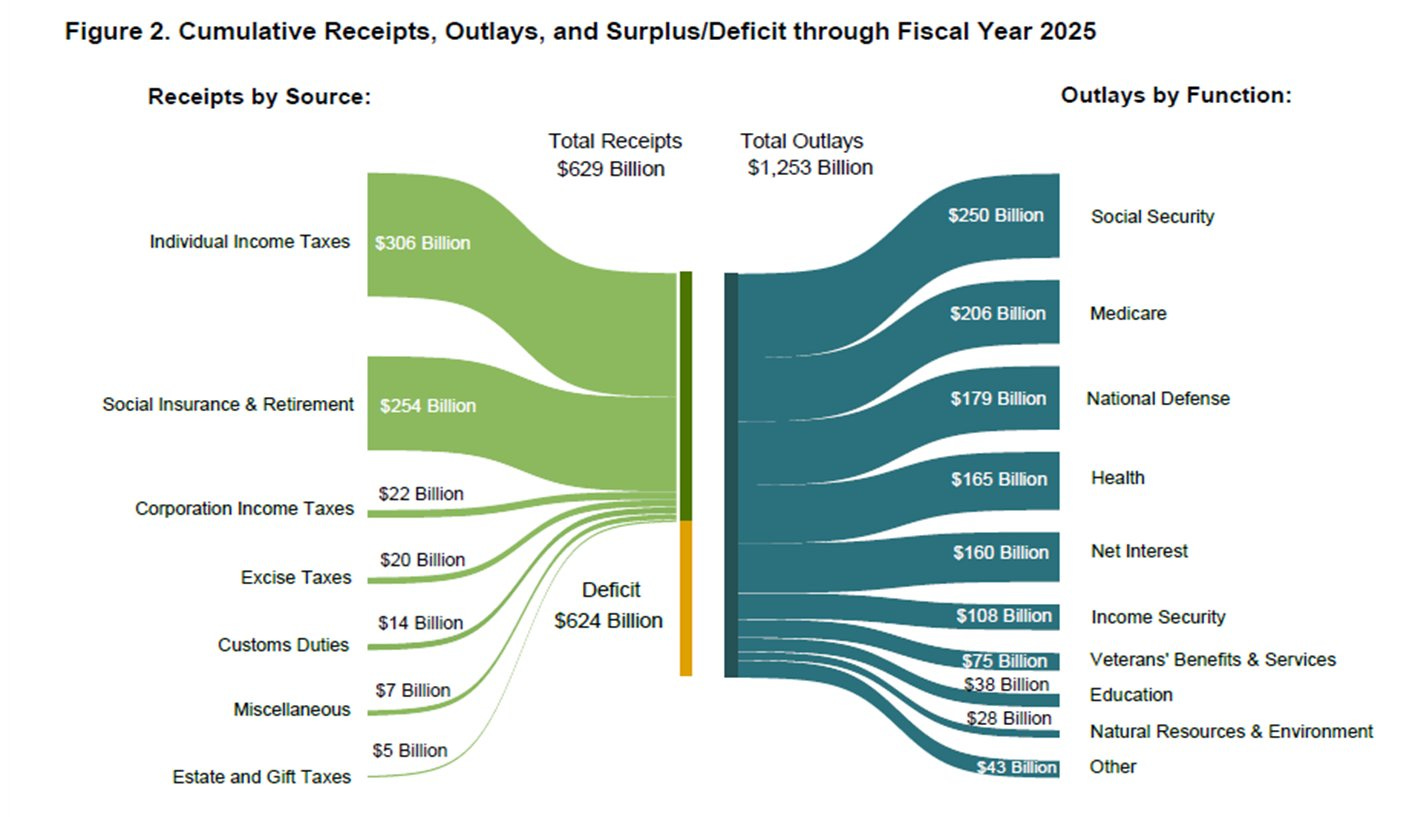

The tail end of the yield curve—anchored by longer-dated Treasuries such as 10- and 30-year bonds—will bear the weight of the Treasury’s pivot from short-term refinancing to longer-term issuance. The increased supply of long-term bonds will place upward pressure on yields, driven by the fundamental mechanics of supply and demand (sometimes Econ 101 really is enough). Investors tasked with absorbing this surge in long-duration debt will demand higher term premiums to compensate for heightened interest rate risk, inflation volatility, and fiscal uncertainties tied to elevated debt-to-GDP ratios.

Compounding the challenge is the current scarcity of natural buyers for long-term Treasuries at prevailing yield levels. Unlike T-bills, which enjoy robust demand from money market funds and liquidity-driven investors, long-term bonds depend on participation from pension funds, insurers, and mutual funds. These buyers, while steady, are less agile in responding to abrupt issuance shifts, especially when yields fail to adequately reflect inflation risks and increased supply. To clear the market, the Treasury will need to offer more attractive yields, effectively steepening the yield curve and introducing additional cost pressures for servicing the federal debt.

The Treasury’s management of the General Account (TGA) becomes a critical lever in moderating these pressures. A significant TGA drawdown could inject temporary liquidity, easing upward pressure on yields. However, the scale of maturing debt and ongoing fiscal requirements severely limit the Treasury’s ability to rely on this strategy for long-term stabilization. Without a marked reduction in issuance, the trajectory for long-term yields remains biased upward, driven by structural supply-demand imbalances, tightening liquidity, and investor unease over fiscal sustainability.

Trade: Continue the short on ZB, this serves as a hedge for equity multiples contracting from liquidity reducing

Reverberating to Risk Assets

Quantitative tightening (QT) adds another layer of complexity to the long-end dynamics. As the Federal Reserve continues reducing its balance sheet, the absence of a major institutional buyer for longer-term Treasuries shifts the burden onto private markets. This exacerbates liquidity pressures, particularly as declining reserve balances constrain market participants' capacity to absorb the additional supply. Unlike the RRP, which primarily parks excess reserves, the absorption of long-term bonds actively drains liquidity from the financial system, requiring investors to reallocate funds from other assets or increase leverage to finance purchases.

Until now, the decline in RRP balances has largely offset the impact of QT on total liquidity, preventing significant disruptions in financial markets. However, with RRP balances nearing depletion, future QT will directly reduce bank reserves, tightening liquidity more acutely. This shift increases the risk of funding stress, particularly as reserves trend toward critical thresholds where interbank markets become more sensitive to shocks. While the Fed has introduced tools like the bank reserve monitor to track stress, their ability to react preemptively remains uncertain, raising the stakes for risk assets.

The resulting upward pressure on long-term yields will ripple through the broader economy and financial markets. Elevated yields raise borrowing costs for corporations and households, curbing investment and consumer spending. For equity markets, higher discount rates disproportionately affect growth-oriented sectors, where valuations hinge on future earnings expectations. Credit markets face similar challenges as wider credit spreads emerge, reflecting heightened risk aversion and competition from increasingly attractive Treasury securities.

Trade: Mix of March/April 20 delta puts on ES and NQ (85bps NAV total). After such a green day, well worth to load up on cheap hedges. Currently working with a 30% cash position while waiting for an outsized opportunity. This is a time to be hedged and focus on high conviction trades

Cheers!

A Birthday Ode to Tolkien

Master of words, a weaver of lore,

Who opened for us a Middle-earth door.

Through hobbit’s courage and wizard’s might,

You taught us to stand, to cherish the light.

"All we have to decide," Gandalf did say,

"Is what to do with the time of our day."

And you, dear Tolkien, chose to create,

A world of wonder we celebrate.

So today we honor the sorcerer of words,

Whose voice still echoes like ancient birds.

Happy Birthday, Tolkien, may your magic endure,

A treasure eternal, steadfast and pure.

In collaboration with Claude.ai, who was better at writing poetry in my (evidently) expert opinion regarding poetry