Last Friday’s positive nonfarm payroll numbers, unemployment print, and continued hourly earnings growth cast a shadow on the Fed’s 50bps cut decision as being too hasty given the current resilience in employment and made inflation look closer in the rearview mirror.

This data promptly cleaned the slate of bets on more than a 25bps cut for the next FOMC and even added a slight chance of no cuts in the next meeting while bringing the chance of a 50bps cut in the December meeting down to less than 20%.

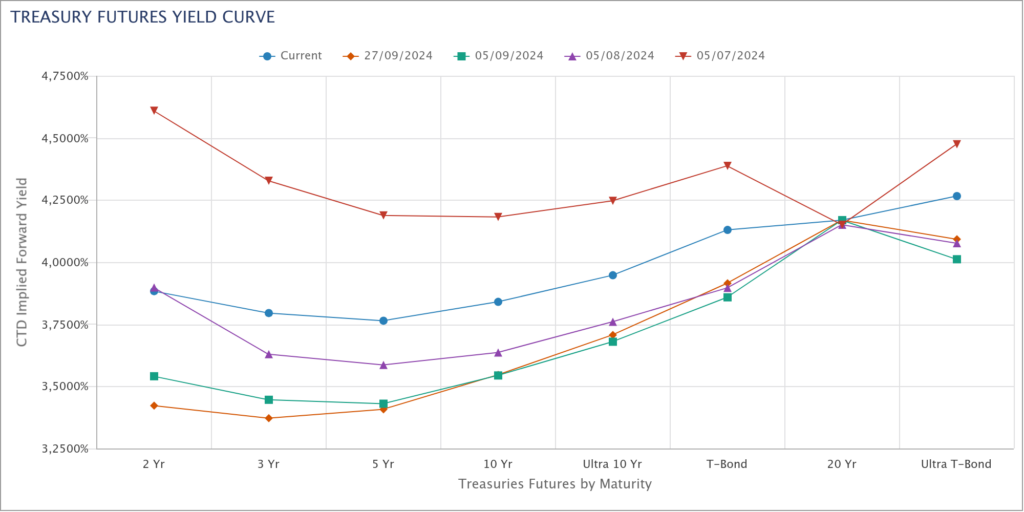

Looking at the yield curve, the 2-year has retraced two months’ worth of rally while the 10-year has moved halfway between two and three months ago. This presents a significant tightening of the financial conditions

Here is how we framed our yield curve plays on Sep 29, which emphasized waiting for the short end to reprice before taking a long position while immediately going short the long end.

Fed and China go big or go home

Fed goes for 50bps and China gives you money to buy domestic stonks… So what’s the trade a week later?

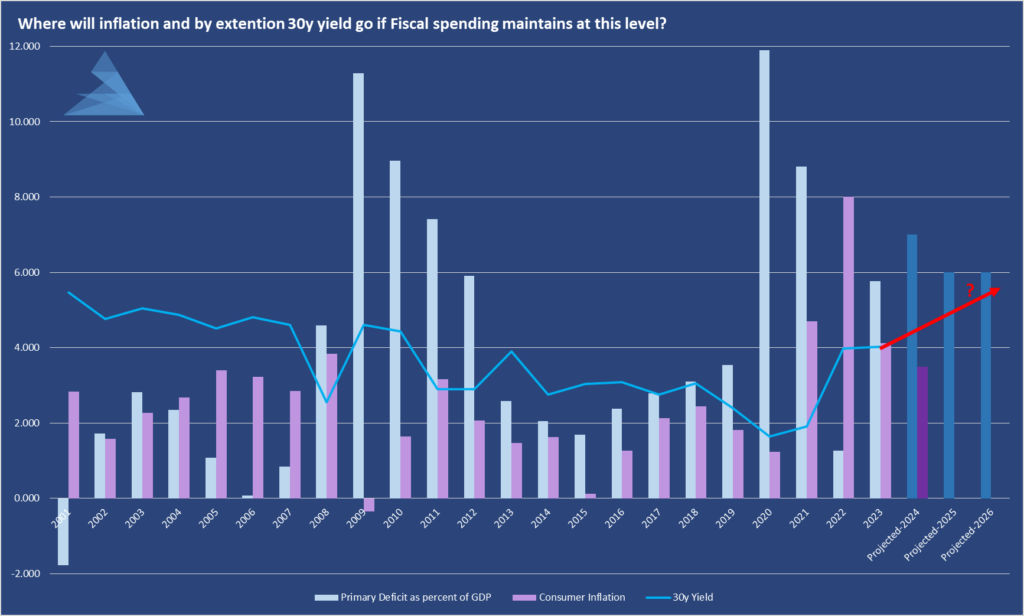

I am now interested in setting up an initial position (75bps of nav) on ZT’s (2y, 50%) and ZF’s (5y, 50%) now that our entering condition of closer to 25bps successive cuts in the STIR markets is much closer to being priced in. This position can serve as both a recession hedge from pricing in another significant cut, causing short rates to rally if negative data on growth comes in, and benefit from the cyclical goldilocks regime we currently are in of short-term stable inflation and continued growth. I will also increase (from 200bps to 300bps of nav) my existing short on ZB’s (you can also use TLT) and long (350bps to 400bps of nav) gold (80%), silver (10%) and platinum (10%) to protect against inflation rising given the sustained pace of employment and the expected fiscal spending post-election.

Our view on inflation comes from a pro-labor environment in which governments prioritize deficit spending in lagging sectors of the economy over fiscal discipline at the expense of growth in those industries. The objective behind this politically popular economic policy shift is to avoid corrections in the labor market, both in quantity and wages, by providing capital for those industries that would contract otherwise and maintain full employment and growing wages. The tradeoff of policy shifting away from being pro-capital to pro-labor comes in the shape of the structural risk in the economy moving away from growth to inflation. We concluded in the prior note that U.S. inflation will maintain above the 2% target while its volatility will remain heightened (hence our view to short long duration bonds).