Fed and China go big or go home

Fed goes for 50bps and China gives you money to buy domestic stonks… So what’s the trade a week later?

Rates trades and hedges set up from the Fed’s first (Big-Mac) cut.

In line with market expectations but against economist consensus (yours-truly included), the Fed decided to skip the hors-d’œuvre and go for the plat de résistance with a 50bps cut to the policy rate. This clearly conveys that the core concern in the FOMC’s dual mandate today lies with full employment mandate rather than price stability. Here is how I framed the 50bps possibility on Sept 10th:

And here is the virtually non-existent reaction of the market on STIR futures (the implied reference rate is simply read as 100-price). This lines up with the view expressed above; neither a 25bps nor a 50bps cut would have done much to reprice the short end of rates, so why not 75 or 100bps to actually ease financial conditions? Maybe that would have been quite alarmist…

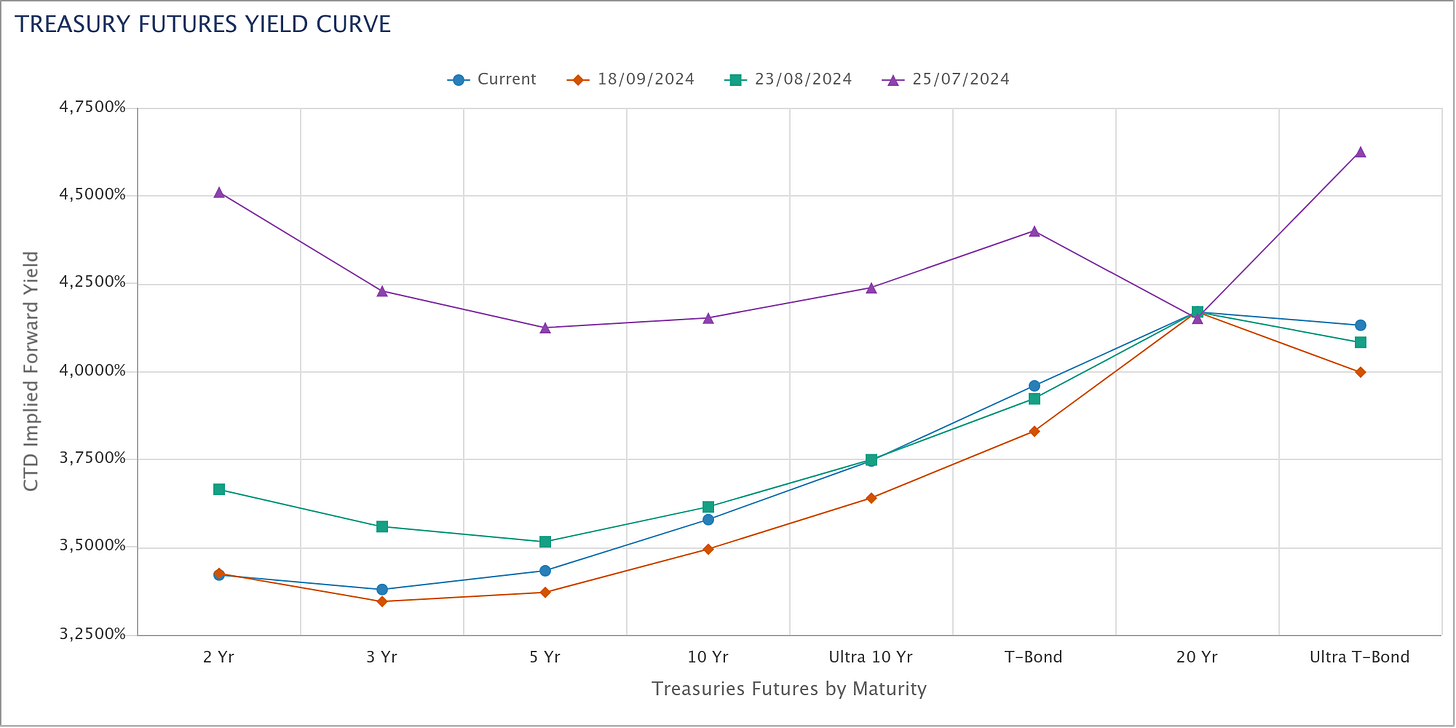

More important to the 50bps cut is Chair Powell’s guidance at the press conference, where he pushed against 50bps as the pace of cuts moving forward. This guidance is what has put pressure on the long end of rates, tightening financial conditions on the long end given those were also pricing additional 50bps cuts along the way:

This expectation management is the noteworthy event around the Sep 18 FOMC meeting, as it negatively impacts longer-duration bond returns even one week later. This has effectively tightened for the time being financial conditions on the long end bear-steepening the curve since the FOMC as opposed to the bull-steepening we have seen up to the FOMC meeting. (I have recommended since early July the steepner trade which is now taken off after 2s10s became flat) One caveat to the tightening of rates on the long end is that we continue to see 30Y fixed mortgage rates going lower, now sitting at 6.09%, which will strengthen homeowners’ balance sheets and provide some support for middle-class consumers. As the policy is meant to tackle unemployment and ease promote consumer spending this is a good first effect, the issue for now is that the middle-class which is not where consumer weakness resides.

What is my credit card limit?

A look at the the American consumer and what that means for growth and where consumer weakness resides.

There is also the net easing from balance-sheet-driven monetary policy for over a year as explored in this prior note won’t which I wont reiterate here:

What is the likely path for growth now? A Reverse Repo Story

We study the net easing effect the reverse repo facility has on monetary policy despite an overall shrinking balance sheet.

One hypothesis we can make regarding an easy Fed is that if signs of inflation start to pick back up, this would be negative for the long end of bonds as stagflation concerns trickle in. We will need to be careful where in the curve we own duration, as it is unlikely that the bond story will look like this: lower policy rates lead to higher bond prices across the curve, but something more nuanced. If inflation picks up, the impact on the long end will be disproportionate adjusted for duration given the curve’s flatness after the 2s10s inversion with very limited premium beyond the 10 year.

Due to this, I am long the short end (below 5y with ZT & ZF) to benefit from the continued steepening of the curve and short the long end (above 10y with ZN & ZB) to hedge against inflation picking up [if one is more amenable to using etf’s then TLT is a reasonable proxy for 20+years]. I would not focus here on duration matching the trade to implement a proper steepner for the following reasons: If there are signs that inflation does pick up, I will start overweighting the inflation hedge leg of this trade. One also needs to be cognizant that currently, much of the performance from rate cuts is already priced on the short end, and I would wait for STIRs to price successive cuts closer to 25bps before putting on a position. Whereas there is room to price in a stop in the trend of inflation reduction on the long end of the curve.

A compelling argument in favor of a pickup in inflation comes in the form of the shift in economic policy from being pro-capital to being pro-labor, where stagnation in wages in real terms (both adjusting from inflation and international purchasing power from FX) is little tolerated by the electorate. Policies that provide fiscal stimulus by increasing spending and borrowing in order to smooth over recessionary impulses, hence, a reduction in the quantity of employment and purchasing power are taking the front seat in driving the economy. From that perspective, there is little absolute difference between the two options the American people have access to this upcoming November. Regardless of what happens, government spending will be at the center of driving economic growth forward.

One likely economic scenario in line with the above argument is that the US will enjoy continued nominal growth at a reduced pace with the help of fiscal stimulus while the Fed will be forced to stop its cutting cycle with a policy rate above the highs of the pre-covid cycle to focus on its price stability mandate while the fiscal side takes care of employment.

It is important to note that even with the cutting cycle being initiated, we are still in a period of high growth and inflation uncertainty despite the confidence expressed by the FOMC meeting in the sustained reduction in inflation towards the 2% level while maintaining growth. This can be observed with bond volatility sitting at a 7% handle vs the 3% before covid.

One point I have seen mentioned is that given the Fed is cutting the benchmark rate and easing financial conditions into yet above-target inflation, that inflation is bound to start worsening again. This is not a straightforward deduction to reach given inflation is mechanically a monetary problem tied to the amount of spendable fiat in the real economy, while financial conditions impact first the value of duration, credit spreads, and, by extension, equities, which is not a first-order impact on inflation, unlike fiscal largess and the availability of credit which directly impacts it. Hence, the prior point on pro-labor policies is to look for signs of inflation from government spending rather than monetary policy. The metric I will closely monitor here will be the primary deficit (the difference between revenues and spending, excluding interest payments on the debt). The exclusion of interest payments is important because some 85%+ of treasuries are owned by institutions who do not spend their treasury fixed income in goods and services going into the CPI basket. Excluding interest payments is not anodyne but necessary to get a clear picture of where inflation could go. Currently, interest payment is 10.7% of the total federal spending, while only in 2021, it was half of that. Moreover, the total deficit currently is 6.5% of GDP in Q3 and moving towards 7% for year end, which leads me to believe that 2% will be the lower bound for inflation, and we should expect to be in an environment of elevated and persistent inflation volatility moving forward.

Regarding how to play inflation volatility with inflation being structurally floored at 2% (if we are lucky…), long gold paired with shorting long-duration bonds would be a reasonable risk-reward as a base case and a good hedge for inflation moving higher. Moreover, given the premium that gold has vs silver, platinum, and palladium, I would also consider adding some exposure to those metals for some added skew to the trade. I will need to make a separate note to go into detail about my views on silver and platinum (the end of the catalytic converter is not the end of platinum) and how to play these metals, namely the African geopolitical risk involved.

China wakes up to its balance-sheet recession

A quick wrap-up of the first salvo in easing from the PBOC:

7-day reverse repo rate cut by 20bps down to 1.5% and 1 year MLF rate reduced by 30bps

The Reserve requirement ratio (RRR) was reduced by 0.5% liberating up to $145bn (1 trillion yuan) in liquidity and is guided to be followed by a 0.25-0.5% cut later this year.

Lower mortgage rates for existing loans and cut the down payment on second homes by 10% to 15% (which is ironic because, in the 19th CCP congress, the following idea was proposed: “property is to be lived in, not to be speculated on.”)

Central government supporting local governmental entities to purchase unsold homes with loans backing the full purchase price.

Loan prime rate and deposit rate cuts to secure financial institutions’ liquidity.

500 billion yuan liquidity support for Chinese stocks: Institutions get access to central bank liquidity to buy stocks, and banks are incentivized to lend to shareholders for share buybacks. In addition, we are also guiding for an additional 500 billion if the program works as expected.

If we try to back-solve what problem the PBOC is attempting to fix by looking at the set of policy decisions, we would guess that they are trying to have less tight bank balance sheets and incentivizing lending while not only promoting home ownership broadly but incentivizing individual homeowners to use a second home as a form of investment. All while providing a PBOC put on house price to guarantee a bid from local governments in whatever private individuals or companies are not interested in buying. All that while directly supporting domestic equities, increasing Chinese net worth, and giving them the power to buy more unwanted real estate and potentially sustain consumption.

Well, let’s get a helicopter view of the Chinese economy and take a punt at guessing if this policy path would ease their economic woes (this frankly deserves a standalone article but let’s make this quick for now)

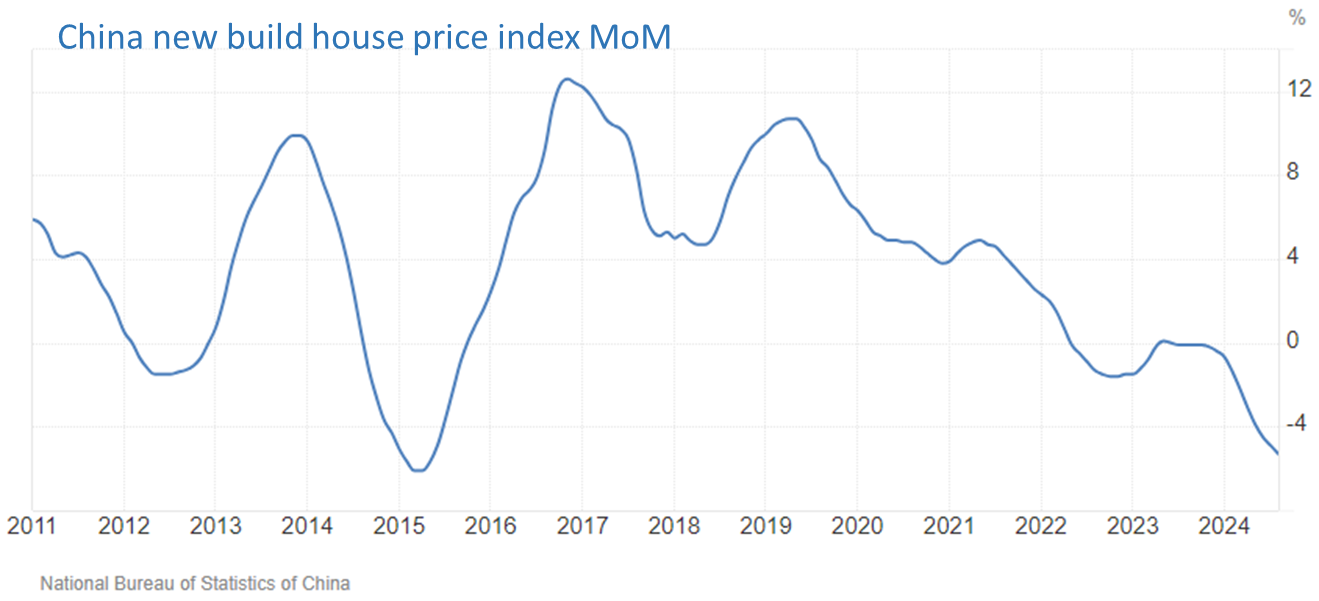

Today, 70% of Chinese consumer wealth is in real estate where 80+% of households owning a home and 20% own multiple homes today. Home ownership in China has seen sustained growth from 20% in 1980 to 45% in 1996 and 72% in 2000. This contrasts significantly to the American dream of home ownership where the consumer net worth percentage in real estate is of 30%. Why do Chinese people rely so much on housing to build wealth? Real estate appreciation was the way to participate in the Chinese success story. To maintain competitiveness in manufacturing, Chinese policy managed to suppress wage growth. When China joined the WTO in Dec 2001, they gained access to global markets and trade. To benefit from this new tool, China prioritized their internal competitiveness on the international stage to gain manufacturing market share. Homeownership has, therefore, been the most effective way for consumers to take a slice of Chinese prosperity. This was something that the central government realized and to support the creation of wealth for its citizens while not increasing wages to uncompetitive levels with the implementation of supportive monetary policy for prospective homeowners and fiscal support to get a first house and home constructions. One-Child policy had, however been a substantial policy error on the economic front as the growth of a manufacturing economy depends on population growth (at least in that time), hence structurally slowing GDP growth which is one of the guiding measures the politburo uses to benchmark performance. This impact was starting to be observed prior to the GFC. When the crisis came, China took advantage of the West’s deleveraging to take on the newly unused capital and seek to boost its slowing growth using debt and promoting real estate development through highly leveraged developers. The issues with this highly financialized approach to economic growth started materializing in in July 2021 with the start of a structural decline in real estate valuations with the fall of Evergrande, a recent story we now well know.

This story can be summarized with the term: balance-sheet recession (idea formulated by Koo in 1996). What is it? A typical recession, as the one investors are currently worrying about in the US, is caused by overproduction or rising inventories, decreasing consumer spending, inflationary pressures, and corporations being profit-maximizing; this forces job losses, productivity declines, and reductions in growth. Now, balance sheet recessions have the odd behavior that corporations stop being profit-maximizing but rather debt-minimizing, even with extremely low or zero interest rates.

Assuming rates are zero (or why not negative), why should a corporation not just borrow and put the free money to work? Simply because the said enterprise has seen the asset side of its balance sheet (in China’s case, residential real estate) be severely marked down, and the responsible thing to do for stakeholders is to pay-down debt.

This allows shareholders to maintain some future implied value for their equity, employees to remain employed generating cashflow to gradually paydown the debt and debtors not be subject to a default and have to do the work of liquidating assets to get paid back. The enterprise-level issue becomes a balance-sheet recession when a large sector of the economy is operating under that framework. For China, Evergrande was not the only property developer to go bust, and the ensuing house price decline has caused homeowners’ equity to be underwater. The consumer is where the balance-sheet recession is taking shape.

What problem does this issue cause then? Simply put, the economy is composed of savers and borrowers which interact in the financial system. Benchmark rate policy works well when all entities interacting in the financial system are profit-maximizing as a change in the cost of money can drive more savings or more borrowing to attain a desired equilibrium between savers and borrowers. Now, you might as well toss monetary policy out the window when you get to lower your rates to the point where money is basically free (taking inflation into account) and entities still prioritize paying down their debt because it is the responsible and necessary thing to do. There does not exist an interest rate where an enterprise or individual with a broken balance sheet would look to increase debt to generate more profits over simply paying down the existing debt, at least to the point of reaching equilibrium with the assets.

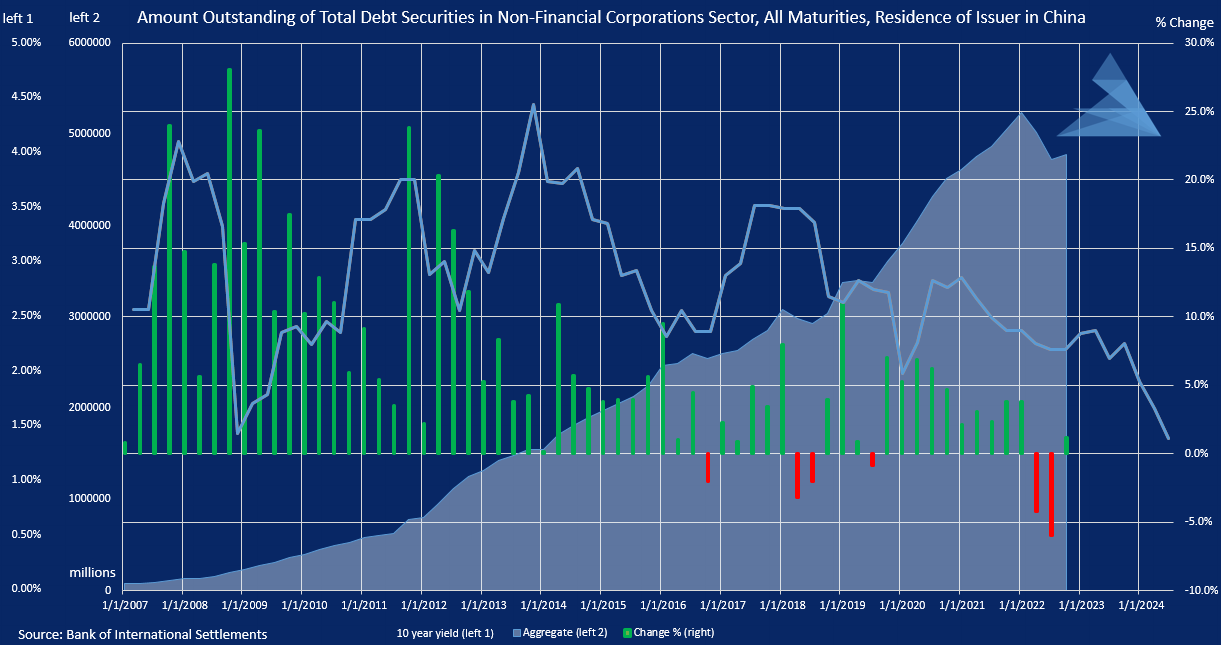

I am guessing that Chinese non-financial corporate debt repayments keep increasing after 2022 (data comes out slowly and uneven). Looking at the 10-year Chinese bond yield now below 2.2% I would wager that the corporate credit repayment which started in 2021 is still underway. The rational is that given China is a competitive developing economy with one of the largest investment opportunity sets globally, such a low 10y bond yield means that Chinese non-financial corporates are not prioritizing adding new leverage but rather repaying debt which liberates capital from investors which then allocate that capital to government bonds, lowering the yields to the levels we see today.

This explanation received further empirical justification from the markets, as the 10-year yield spiked from 2% to 2.18% after the PBOC policy announcement and the anticipated sovereign bond issuance announcement of 2 trillion yuan. This implies that capital moved away from Chinese government bonds into Chinese risk assets to benefit from the perceived stimulus.

The decreased propensity to borrow and active repayments of debt creates a consumption problem due to the money-multiplying effect of the banking system grinds to a halt. Effectively, one person’s income is partly saved getting stuck in the bank with his spending being someone else’s income and we iterate forward into reducing the amount of money in the economy and GDP growth and eventually contracting GDP.

This is precisely what happened in the US great depression, Japan and european debt crisis which lingers on to today, and is what the PBOC is attempting to tackle however entered around household debt from residential real estate depreciating rather than corporate or sovereign debt issues. However, as we have elaborated, no amount of monetary easing will turn the necessary cogs to solve the fundamental balance-sheet imbalance problem, and Japan has empirically demonstrated the futile nature of that exercise. The Chinese government will need to step in to borrow and spend. The 2 trillion yuan is a step in the right direction, but the beneficiaries of this spending will speak to the efficacy of this stimulus.

The only response that can slow the net impact of debt repayment is fiscal policy, which involves the government borrowing unused money from the financial sector and spending it on goods and services to assume the role of borrowers/spenders in the economy. I expect China to unveil ambitious fiscal stimulus beyond the anticipated 2 trillion sovereign bond issuance to motivate spending on industrial, staples, and discretionary. If it were not for that conviction, I would be taking a short on Chinese equities and letting go of metals after this pump. The key question is what shape will said stimulus take? For that, I will use patience and hold Chinese equities (HK listed) that should directly benefit from Chinese government spending as labeled above as well as maintain a long position on copper futures, materials (XLB ETF is a good proxy) and junior miners across the board. OSVs should also benefit from Chinese fiscal stimulus.

Now, what about the impact on non-China equities?

The first thing to look at is USD.CNY, which will follow a path similar to USD.JPY. The expectation is that the dollar will lose value broadly. It was no accident that the PBOC waited for the Fed to initiate the cut before it started easing financial conditions.

I don’t think there will be much room to come back from DXY under 100 once the dollar crosses that line.

Moreover, a weak dollar could pressure crowded U.S. equity trades (more mechanical details on that and dispersion in the next section to introduce the idea). We have indeed seen performance outside of the U.S. outshine American exceptionalism in the week after the Fed cut.

This is likely due to foreign capital flows. The US equity market is currently more than 40% owned by foreigners. The set of charts below should paint a good picture of the significance in foreign capital to U.S. capital markets. This implies that the sensitivity of American asset valuations are increasingly dependent on capital flows from abroad.

All charts above were sourced from the Fed and Treasury

Given the Chinese stimulus attempts, I expect a portion of the money owned by Chinese entities to be repatriated back home. When meaningful Chinese fiscal stimulus starts being deployed, I expect the speed at which foreigners allocate capital to the US to reduce in search for growth drivers, but this would depend on earnings picking up in Asia while earnings disappoint in the US. I will be gradually increasing my EM exposure, focusing on Asia x-Japan. (some country spotlights to come)

What does this mean for risk-assets?

The important thing to realize here for equities is that this cutting cycle, as long as it remains within market expectations, provides a neutral impact on U.S. risk assets. The performance of risk assets will be primarily determined by economic health. The simple framework is as follows:

If the U.S. economy remains growing and avoids a recession then we can expect a bid on domestic risk-assets while longer-duration bonds will be sold.

If we do see increased consumer weakness translating into reduced spending and slowing corporate earnings, then the converse can be expected. There is one nuance worth noting: some equities should be expected to be resilient through this scenario (and we will review those in the next note as a form of recession/slowdown hedge.)

The inflation scenario laid out in the first section.

For now, we remain in the first scenario, given nominal growth of 3% and inflation (PCE) sitting on 2.7% currently and 2.2% by the end of next year as projected by Fed economists. However we are actively on the lookout for data that the economy rolling over à la dot-com bust, leading to the fundamentals of corporates following suit and degrading valuations.

Looking at the moves toward all-time highs in equities, it is clear that we will need to select our equities carefully to minimize the impact of a reduction in valuations on our portfolio from popular longs (AI and co). The evidence of the discrepancy in sensitivity of valuations between different sectors was clear during the partial unwinding of the Yen carry trade, which increased dispersion across equities.

I use dispersion here in the technical sense as defined by the CBOE:

The Dispersion Index calculates as the square root of the difference between (i) the weighted average expected variance of constituents of the Basket Index – ranging among all such constituents whose expected variance can be calculated at that point in time – and (ii) the expected variance of the S&P 500, as represented by the square of the current level of the Cboe Volatility Index (“VIX”). The Dispersion Index is floored at zero.

The dispersion between equities allows to frame three concepts for portfolio construction:

First, increases in dispersion provide a statistically significant opportunity to enter or exit specific equities based on their relative performance independent of their fundamental thesis.

Second, given a portfolio of lazy equity longs, dispersion allows for the optimization of putting on hedges to minimize negative-carry over time and reduce portfolio volatility by hedging against those sectors that have the highest propensity to correct while using less capital.

(this bullet point will be the focus of a future note, which builds on our work on clearinghouses being engines of volatility:

Hysteria from Hysteresis and Path Dependence – Clearinghouses

We will study the risk created by path-dependency, where various trajectories that end up in the same place provide drastically different outcomes on portfolio performance, we saw this with the Yen carry trade unwind being reversed in the span of a week which gives us information on market microstructure. A hypothesis on why these behaviors can occur is in the calculation of margin from central clearinghouses which in a regime of low volatility and crowded trades can cause a spike in volatility

Lastly, dispersion is a tool that can help inform the distribution of equities in our portfolio by rank-ordering those equities that first have less sensitivity to the economy turning around with stable revenues across cycles and second have valuation multiples being less sensitive on the downside to changes in capital flows. (this will be touched on in this note)

Long story short, despite being in a risk-on environment, the margin of safety in some themes, such as artificial intelligence, is much reduced relative to other sectors due to crowding, and we should size our bets accordingly. (this does not mean no AI… I actively ask our robot servants(/overlords?) to plan my trips abroad and give me ideas for a good night out!) Due to this theme being the most overbought and expensive. Hence, the point at which they will be bought again in an economic downturn will be much lower than other sectors. I will maintain a strategy of rolling 20 delta RTY puts and monetizing when ATM and capture vol spikes using 0 delta straddles, maximizing gamma on NQ. (more on this in a subsequent note)

The reason for puts on the Russell is that this is the most sensitive sector to growth concerns.

While straddles on the nasdaq to monetize volatility spikes and foreign flow of capital bringing valuation multiples in line with other major indices.

In the following note, we will cover the sectors I find interesting. Some themes we will cover is the move from cyclicals into defensives and the opportunity that presents in some asset-heavy businesses like OSVs, materials, medium-sized industrials given our negative view on long bonds which defensives are a proxy for.

Some energy plays will also be reviewed, namely nuclear and natural gas. What happens to renewables? The connectivity sector is also quite interesting given its depressed valuation and revolutionizing technology in the transportation of data. Here is a quick note I wrote to a colleague mid August:

Quick note on an inflection point I am seeing unfolding in public equities which could be an opportunity for telecom valuations. The telecom supply chain is quite interesting right now, it’s a somewhat pre-historic type of technology that has gone through a secular devaluation which should see renewed interest in the process of upgrading telecom infrastructure supported by fiscal stimulus (there won’t be a shortage of stimulus under either potential president). Moreover, technological upgrades in the movement of low-latency data and high latency (for volume) are coming to a turning point that doesn’t need AI to justify their existence but it sure does help. Results from CSCO show the start of this trend. The suppliers to the telecoms should benefit from large capex spend, fiscal support, and multiple rerating. This is also a competition issue on a geopolitical level and won’t go under Washington’s radar.

Cheers!