The Tech Equities Odyssey: Riding the Sirens’ Liquidity Song

Like Narcissus staring into the reflection of their own valuations, they forget the pond dries up without liquidity.

Now, let me set the scene. I’m 30,000 feet up (in the first half of this article), typing this on my tablet thanks to Qatar Airways’ shockingly good Wi-Fi (seriously, why is airplane Wi-Fi better than half the cafés I’ve been to?) and then I remind my self that I explained why in our Space Economy primer.

I’m sipping an relaxing gin&tonic, watching the deepseek drama from above monetizing some hedges over the Mt.Blanc, and honestly, all I’m thinking is: stay hedged, hodl cash, and wait for something truly worth buying (yesterday should be seen as a black friday deal and I used 1/4 of my cash on the plane).

Being away from my usual setup has its perks. Instead of iterating code and crunching data, I’m just stepping back and thinking about narratives and how a simple Ctrl+H can wreck the party. Case in point: AI-adjacent (and some ai-hyped-energy-names) equities. Investors went all-in on the AI-is-gonna-change-everything hype, and now? Yeah, they’re rethinking those capex and opex numbers, but the good news is that AI can only get more epic (and commoditized?) from here.

If you haven’t already, check out our prior Tech Equities Odyssey note—it’s a little cheat sheet for understanding why these stocks are acting like they’ve got whiplash.

The Rise of Fiscal Dominance

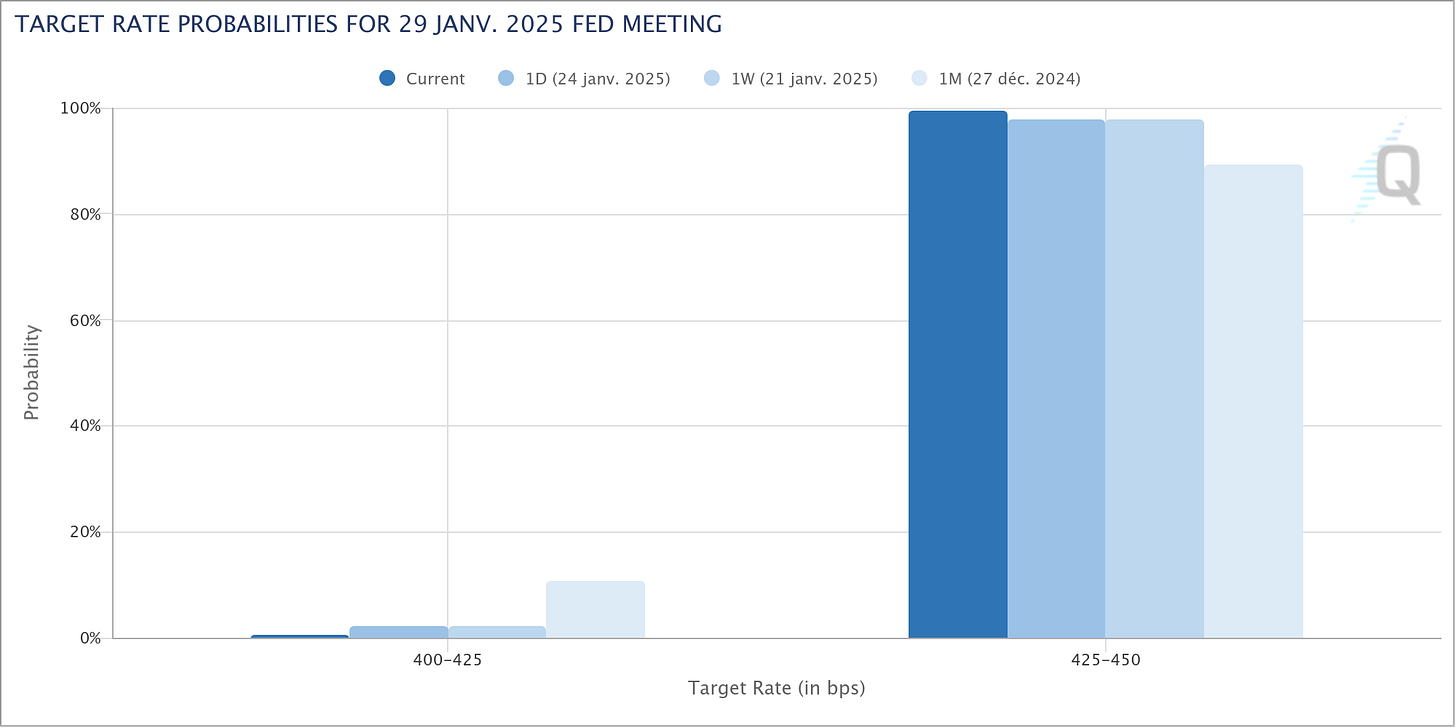

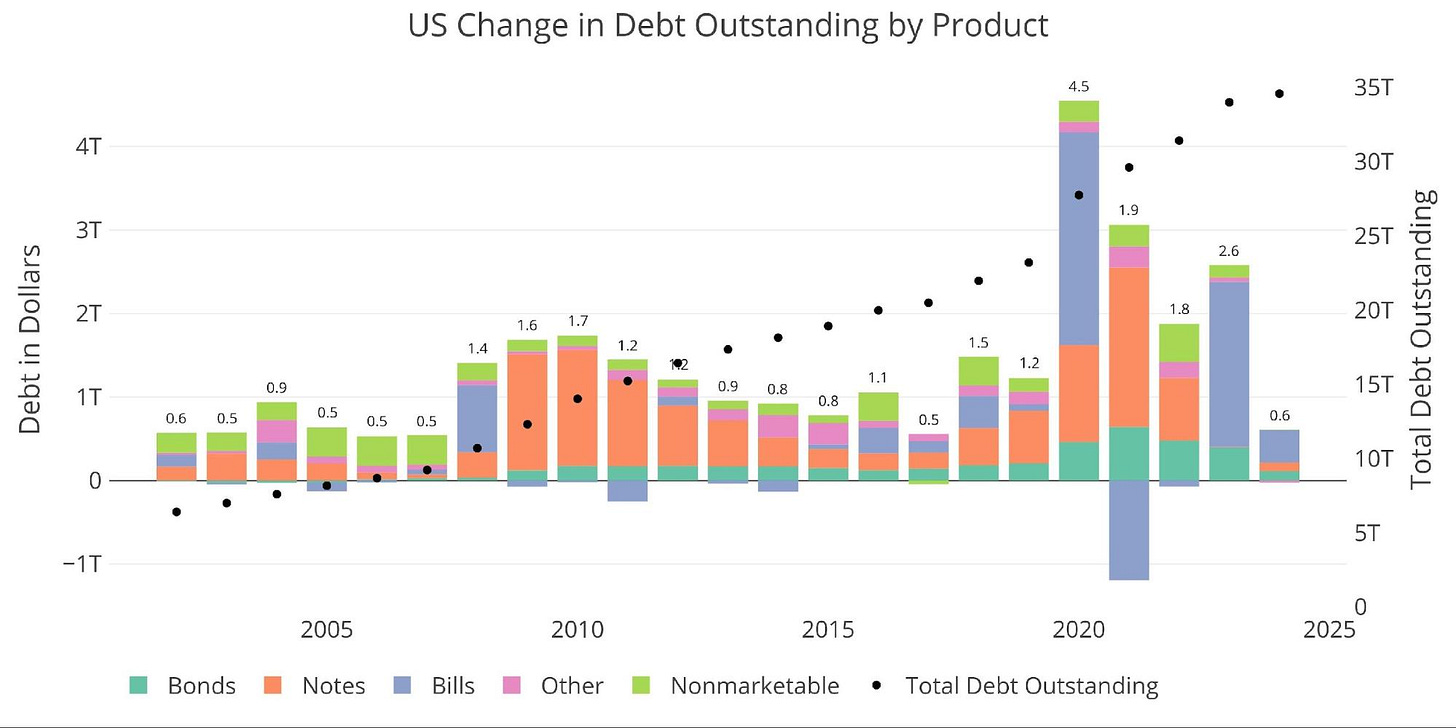

As the Federal Open Market Committee (FOMC) gathers to deliberate on its policy path, it does so in an environment where the dynamics of economic policy are gradually shifting toward fiscal dominance. Traditionally, the Federal Reserve’s control over funding markets and liquidity conditions—evident in its recent efforts to combat post-COVID inflation—has placed it on equal footing with the Treasury in shaping financial stability. Yet rising debt service costs and structurally large deficits are slowly positioning the Treasury, rather than the Federal Reserve, at the center of liquidity flows. This gradual shift is altering how financial conditions evolve, with profound implications for markets—particularly tech and growth equities. Maybe American exceptionalism relies on exceptionally fiscally out-spending the rest of the world.

This FOMC meeting is widely expected to mark a pause in the interest-rate cutting cycle. But the real spotlight should be on what the Treasury does in the coming months. As the costs of financing federal debt continue to climb, the Treasury’s decisions on cash management and debt issuance will play an outsized role in shaping liquidity, leaving the Fed with diminished influence over financial markets.

The Mechanics of Fiscal Dominance

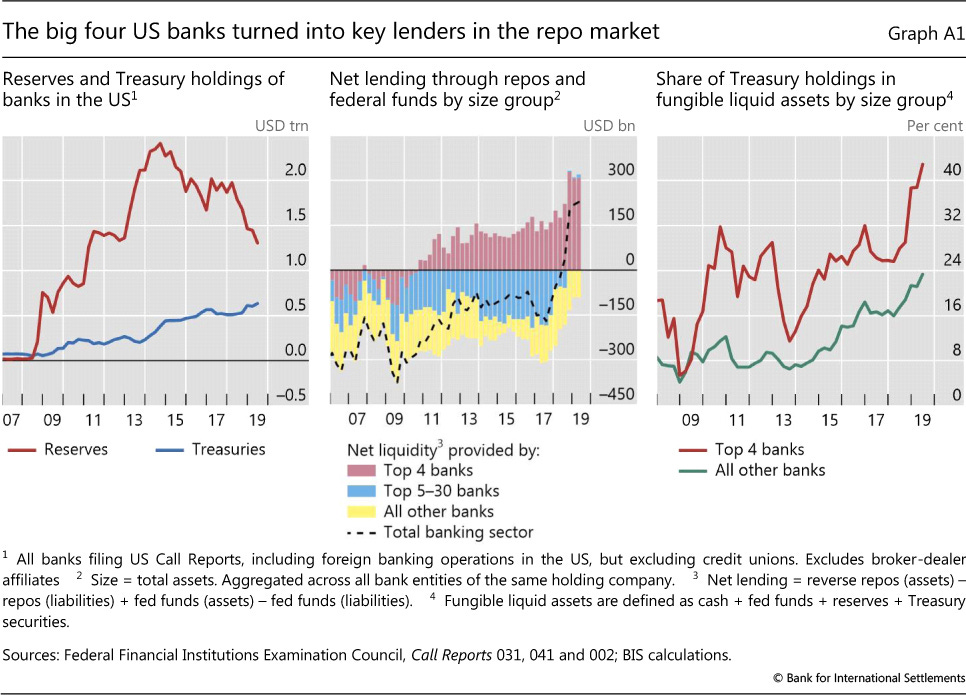

Fiscal dominance arises when fiscal priorities—namely deficit financing—dictate systemic liquidity flows, reducing the effectiveness of monetary policy as the primary driver of economic conditions. At the heart of this shift lies the Treasury General Account (TGA), the Treasury’s operational account at the Federal Reserve. Traditionally a passive tool for cash management, the TGA has become a powerful lever for liquidity, reshaping the financial system’s inner workings.

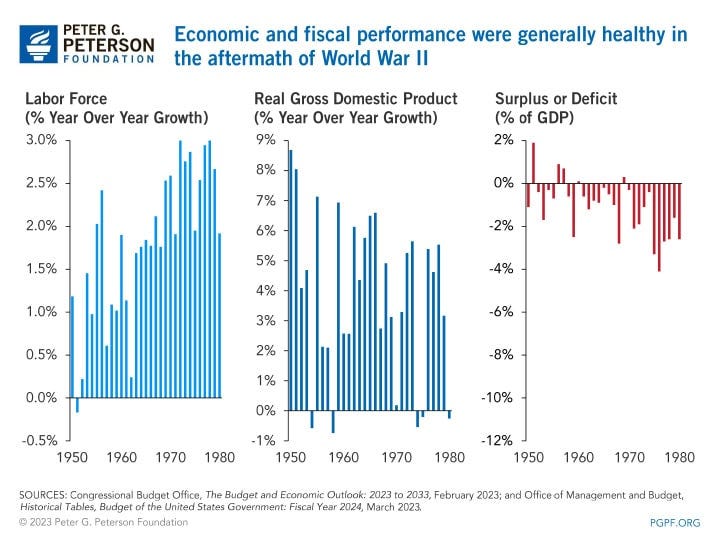

This is not the first time fiscal dominance has shaped economic outcomes. The post-World War II period offers an early example, when the Federal Reserve was compelled to maintain low interest rates to accommodate the government’s massive borrowing needs. This era saw inflationary pressures emerge as the central bank’s ability to act independently was constrained by the sheer scale of fiscal requirements. Similarly, the inflationary surge of the 1970s highlights how expansionary fiscal policy, combined with monetary policy accommodations, can lead to destabilizing price pressures when fiscal priorities take precedence.

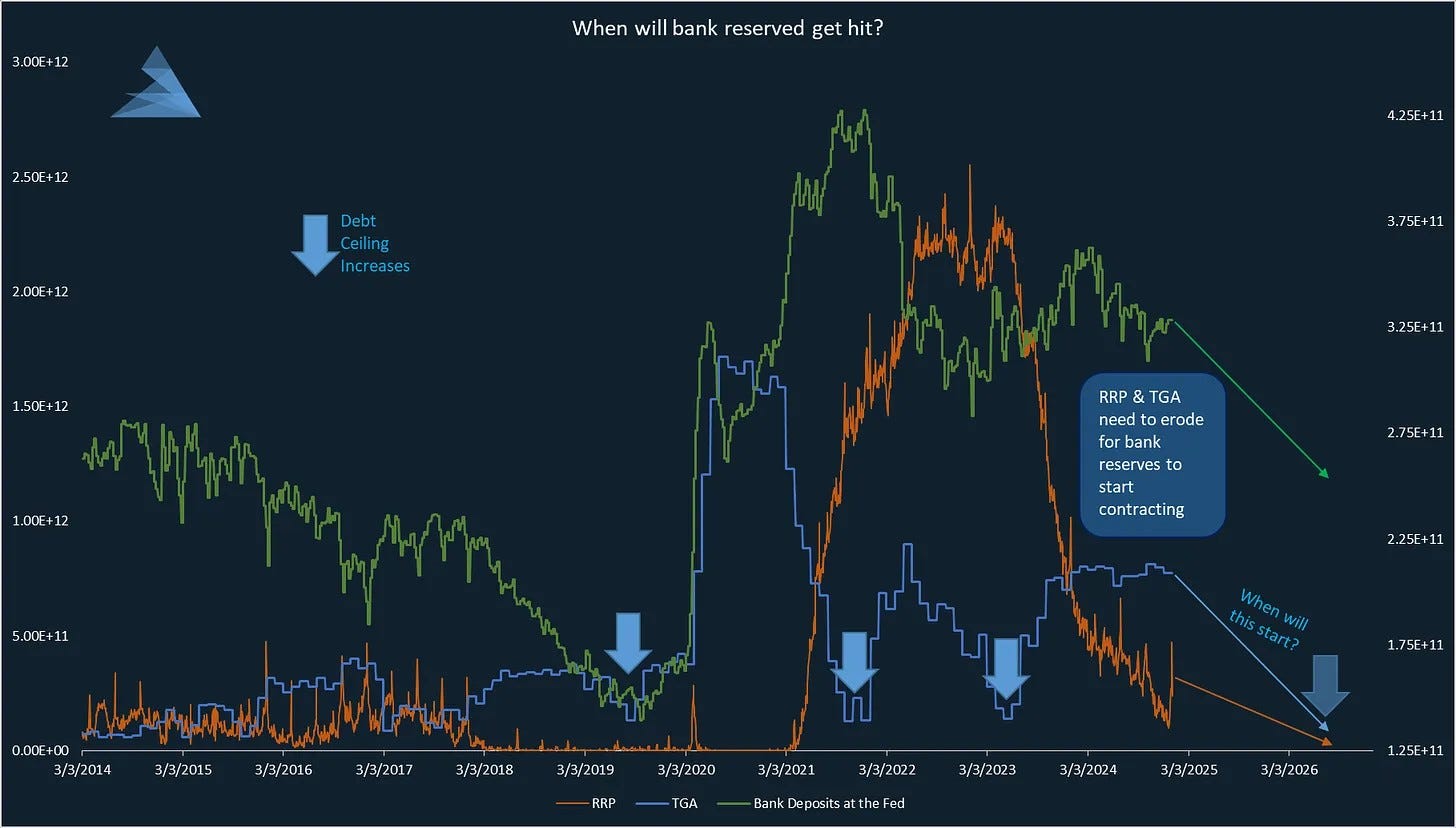

Fast-forward to today, and the dynamics are familiar. During the recent debt ceiling standoff, the Treasury was forced to draw down its TGA balance, injecting liquidity into the banking system. Every dollar spent from the TGA reappears as reserves in commercial banks, temporarily easing liquidity pressures created by the Federal Reserve’s ongoing Quantitative Tightening (QT) program. For risk assets, including the tech-heavy Nasdaq, these liquidity injections have provided a tailwind, mitigating the tightening pressures from QT and rising interest rates. Now that the debt ceiling is back in place, we already see the TGA draining with the Treasury spending down its cash without offsetting it with debt issuance to maintain cash balance, we therefore have a continued broadly bid on equities and will continue to see passive flows.

But history shows that these periods of liquidity relief are fleeting. Latin America provides a cautionary tale, with nations like Argentina demonstrating the long-term risks of fiscal dominance. Repeated cycles of government debt monetization have led to chronic inflation, currency devaluation, and economic instability. Similarly, during the debt ceiling disputes in 2021 and 2023, prolonged delays in the U.S. drained the TGA entirely, flooding the financial system with liquidity.

Once those disputes were resolved, the Treasury rapidly rebuilt its cash buffer, issuing substantial volumes of debt that pulled liquidity out of the banking system. These liquidity whiplashes left markets vulnerable, especially as the Federal Reserve’s Reverse Repo Program (RRP)—a key liquidity buffer—absorbed excess cash. However, with RRP balances now standing at just $118 billion, down from over $2.5 trillion at their peak, this buffer is nearly exhausted, leaving little room to cushion future liquidity shocks.

A Fragile Balance

The interplay between fiscal and monetary policy has reached a critical juncture. The Treasury’s liquidity injections, driven by its need to manage the TGA, have temporarily masked the tightening effects of QT, propping up asset prices and delaying the full impact of monetary policy. But as the TGA drawdown ends and the Treasury pivots to replenishment, this dynamic will reverse, intensifying the liquidity drain from QT and creating new challenges for markets.

Compounding these challenges is the structural decline in reserve balances. As reserves approach critical thresholds—historically around 8% of GDP—the risk of funding volatility rises. This echoes the 2019 repo crisis, when a sudden spike in funding rates forced the Federal Reserve to intervene to restore stability. Today’s near-depletion of the RRP further limits the system’s ability to absorb shocks, leaving markets exposed to a potential liquidity crunch.

Adding to this delicate balance is the significant foreign ownership of U.S. equities. A substantial portion of U.S. stock market capitalization is held by international investors, who have historically sought the relative safety and growth potential of U.S. assets. However, as global macroeconomic conditions evolve, these foreign owners could look to repatriate capital back to their home markets if higher returns or improved stability elsewhere arise. Such repatriation flows would exacerbate liquidity pressures in the U.S. market, creating additional headwinds for sectors already strained by tighter domestic monetary conditions.

These patterns of fiscal dominance carry echoes of the "unpleasant monetarist arithmetic" described by economists like Sargent and Wallace. When fiscal deficits grow large enough, they force monetary policy to accommodate fiscal needs, limiting the central bank's ability to control inflation. The lessons of the 1970s remain relevant here, as persistent inflation eroded economic stability and exposed the risks of insufficient coordination between fiscal and monetary authorities.

For tech and growth equities, the risks are clear. The sector’s sensitivity to liquidity conditions makes it particularly vulnerable to the tightening cycle ahead. While fiscal dominance has temporarily insulated markets from the Fed’s tightening campaign, this insulation is rapidly eroding. The confluence of QT, TGA replenishment, and long-term debt issuance represents a powerful tightening force that could reshape the investment landscape in 2025.

The Liquidity-Market Nexus

Tech and growth equities remain highly sensitive to liquidity conditions, thriving on the availability of cheap capital as their valuations hinge on future earnings expectations. When liquidity is abundant, capital flows sustain speculative, growth-oriented investments. In the current environment, where liquidity remains supportive, risk assets continue to find a bid, even in the face of sector-specific adjustments like the recent AI capex growth forecast revision driven by DeepSeek.

The selloff in AI capex/opex growth equities was clearly driven by adjustments to growth forecasts, not a broader re-rating of equity multiples. This distinction is crucial: the downward pressure was localized to a subset of equities directly tied to AI capex themes, while broader market indices like the Dow saw no such impact. The Dow’s positive close during the same period illustrates its lack of correlation to this theme, as it remains largely insulated from the specific drivers affecting AI-linked sectors. Liquidity-driven flows into equities, particularly through passive vehicles, continue to bolster indices broadly, neutralizing isolated headwinds from sector-specific recalibrations.

Importantly, the neutral stance in crypto flows throughout this selloff further underscores that this was not a systemic liquidity event but a targeted adjustment within a niche of high-growth equities. Passive flows, which indiscriminately allocate to indices like the S&P 500 or Nasdaq, have helped stabilize markets broadly, reinforcing the resilience of risk assets in the face of localized volatility.

However, this liquidity-driven stability depends on the current fiscal and monetary backdrop. As the Treasury continues its TGA drawdown, injecting liquidity into the banking system, and passive flows sustain market demand, the immediate outlook for risk assets remains supported. Yet, this dynamic is inherently cyclical. Once the Treasury pivots to replenishing the TGA and issuing longer-term debt, the resulting liquidity drain will amplify the tightening pressures of Quantitative Tightening (QT).

The pivot toward longer-duration debt issuance under Treasury Secretary Scott Bessent could introduce new pressures. While aimed at reducing rollover risk, this strategy will increase the supply of long-term bonds, requiring higher yields to attract buyers like pension funds and insurers. This steepening of the yield curve could weigh on growth-sensitive equities, particularly those trading on elevated valuations.

For now, liquidity flows continue to support risk assets broadly, masking the impact of sector-specific corrections like those in AI capex equities; I am a buyer of this pullback with a focus on Nat-Gas names and Software. But the delicate interplay between fiscal-driven liquidity injections, Treasury issuance strategies, and macroeconomic tightening remains pivotal. Investors should monitor these dynamics closely, as any shift in liquidity conditions could significantly alter the trajectory for equities, particularly in sectors with stretched valuations.

Like ancient mariners lured by the sirens’ song, investors in tech equities are drawn to the shimmering promises of growth—mesmerized by valuation mirages that gleam under the golden light of liquidity. Yet, as Narcissus once gazed into his own reflection, transfixed, so too do many forget that the pond dries up when liquidity wanes, leaving only cracked earth where dreams of infinite returns once flourished.

Drop a <3 if you found this interesting!

Cheers!

I just flew with AC. Terrible experience, including wifi on board