Fed’s Holiday Playbook

A tactical guide to the Fed’s holiday playbook: Santa’s cuts, Krampus pauses, and bonds trying to avoid the inflation ghost lurking by the fire.

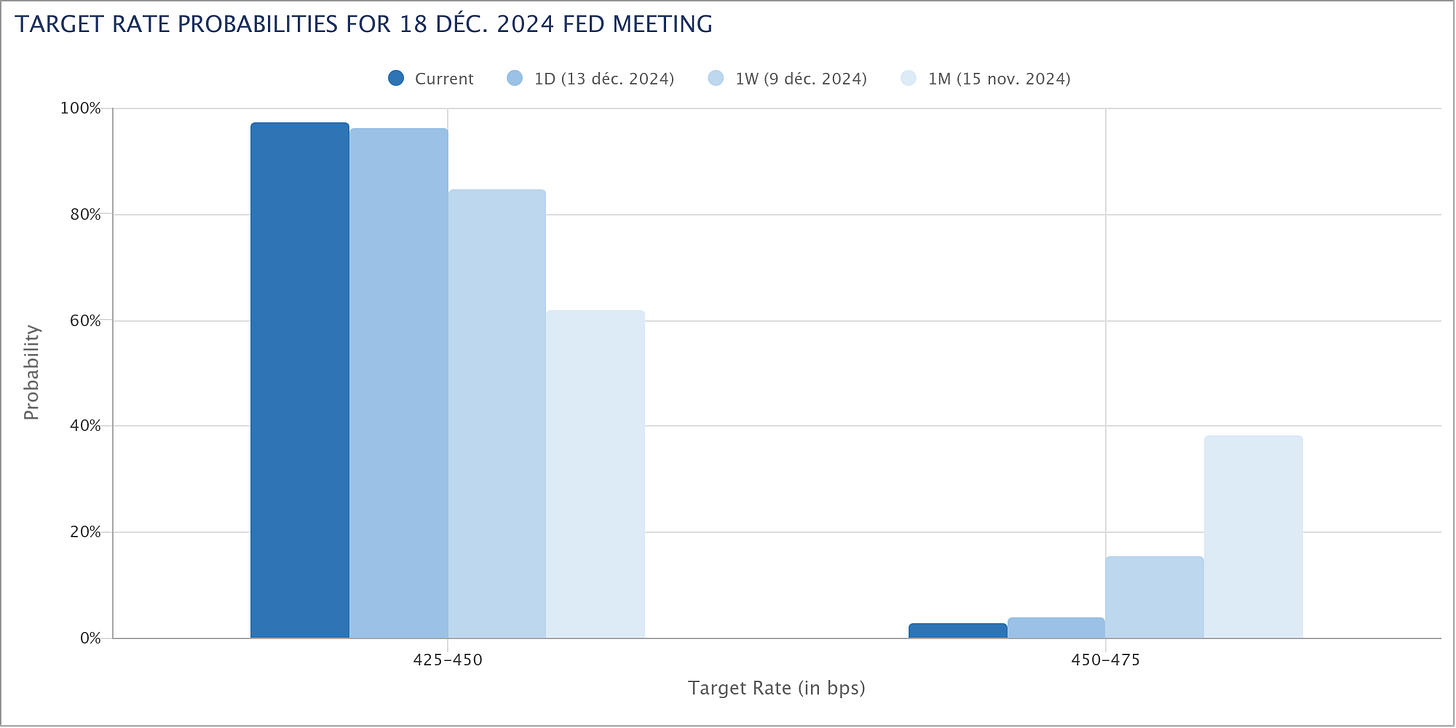

The Fed’s final meeting of the year is shaping up to be the headline act of this holiday season, and markets are already trimming the tree in anticipation. With a 25-bps rate cut priced in at a near-certain 97%, it’s as if Jay Powell has donned his Santa hat and sent advance word that the presents will be delivered on time and be plentiful. But as every good economist knows, it’s not just what’s in the box—it’s how it’s wrapped and what’s scribbled on the gift tag (and if the price tag is still on). Three scenarios sit under the tree, and each one carries its own surprises for the yield curve.

Here’s the thing: we’re not here to play Fed oracle—that’s a job for the STIR traders still obsessing over their dot plots. Instead, our job is to prepare portfolios for whatever comes down the chimney, an approach far less stressful and (hopefully) much more rewarding.

Here’s the game plan: First, I’ll walk you through a low-cost, asymmetric hedge that’s worth unwrapping ahead of the meeting. It’s a small price to pay if the Fed delivers the expected cut, but it provides a bit of protection in case Powell swaps the Santa suit for a Krampus mask. Then, in the next note, I’ll unveil the ultimate structural hedge—a timeless, shiny package that defends against both growth scares and inflation volatility, no matter how the Fed guides its sleigh into 2025.

So sit back, pour the eggnog, and let’s get tactical. The Fed’s message might bring holiday cheer—or it might come with a lump of coal for markets. Either way, we’ll (try to) be ready.

Recap of the inflationary ghost.

Feel free to skip this section if you also complain to your shrink about inflation…

A core position in the portfolio has been our inflation volatility hedge: a short on long-duration bonds, first unwrapped after the Fed’s September Big Mac rate cut—a gift that’s been anything but standard fare. Historically, 30-year yields tend to drop 10-50 bps in the months following the Fed’s first rate cut, like clockwork. But this time? Yields climbed a head-turning 40 bps. The last time we saw anything remotely similar was in 1995’s elusive soft landing, and even that pales in comparison.

To be clear, this is the largest post-cut rise in 30-year yields on record, a flashing neon sign of market skepticism toward the Fed’s ability to juggle growth and inflation. When markets normally roll out the red carpet for easing, long bonds have instead been met with a frosty reception. Below is a quick recap conveniently wrapped up with a bowtie of the key arguments from previous notes:

Pro-Labor Shift and Implications for Capital Markets

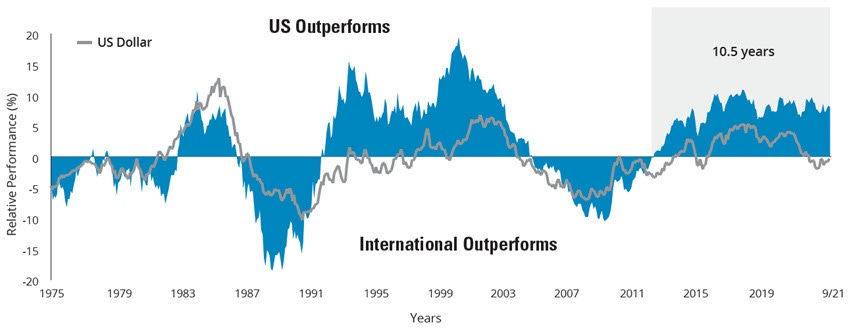

The pivot toward pro-labor policies signals a structural shift: prioritizing domestic manufacturing, reducing trade deficits, and boosting employment. This marks a sharp departure from the pro-capital, globalization-driven era that turbocharged financial assets. A labor-centric framework comes with trade-offs—higher costs, compressed corporate margins, and pressure on earnings, particularly for sectors reliant on cheap global supply chains. However, targeted fiscal stimulus to offset these labor costs could soften the blow, opening opportunities in infrastructure, energy, and industrial equities poised to benefit from reshoring and domestic investment tailwinds.Fiscal Spending Put and Inflation Volatility

The administration’s pro-labor agenda strengthens the fiscal spending put, making deficit spending the go-to tool for averting economic slowdowns and preserving full employment. What was once considered wartime-level deficit spending has become the new baseline, funneling liquidity into the real economy to provide a growth backstop—albeit at the cost of heightened inflation volatility. As a result, inflation is now structurally anchored at or above 2%, posing a persistent challenge to the Fed’s price stability mandate even as it grapples with the economic trade-offs of this fiscal shift.Reverse Repo Program and Liquidity Mechanics

The interplay between the Fed’s Reverse Repo Program (RRP) and Treasury General Account (TGA) is crucial for understanding monetary liquidity dynamics. The RRP, which has shrunk to $118b from its peak ($400b when we first talked about it!), has been a significant absorber of excess liquidity in the financial system. Concurrently, Treasury issuance and TGA drawdowns inject liquidity into the real economy. This dual mechanism offsets the liquidity-draining effects of quantitative tightening (QT) and provides a net easing effect on financial conditions. As fiscal deficits rise, the TGA balance is expected to contract further, directly supporting liquidity and creating inflationary pressures.Dollar Weakness, Inflation Risks, and Strategic Contradictions

Weakening the dollar to enhance export competitiveness aligns with the pro-labor agenda but risks stoking inflation through higher import prices. This approach conflicts with Trump’s and Bessant’s stated objectives of maintaining a strong dollar and preserving the U.S. dollar’s reserve currency status. The contradiction highlights a key tension: a strong dollar supports global confidence in U.S. financial assets, while a weaker dollar boosts domestic production at the expense of inflationary pressures. Staying alert to policy nuances and their execution will be critical in assessing the broader implications for capital flows and inflation volatility.Mispriced Term Premium Creates Asymmetry on the Long End

Long-duration bonds remain a glaring mispricing, offering meager compensation for rising inflation risks and ballooning deficits. Despite persistent inflation volatility driven by fiscal largesse and pro-labor policies, the term premium remains stubbornly low, a sign of market complacency. The irony? Rate cuts, far from easing Treasury pressures, loosen financial conditions, fueling even larger deficits and speculative excess. Investors then demand higher yields to fund the debt, creating a toxic feedback loop. The disconnect is clear: short rates fall, but long yields climb—a warning shot from the bond market that policy easing without fiscal discipline is self-defeating. This dynamic makes short positions on 30-year Treasuries (via ZB or TLT) an attractive risk/reward play, as deficits steepen the curve and structural inflation volatility takes center stage.

We tactically closed our short position on long-duration bonds—our core inflation hedge—following Scott Bessent’s Treasury appointment, a move that signaled fiscal restraint to markets. While I remain skeptical about meaningful spending efficiencies materializing (even with the D.O.G.E.’s tech-driven ambitions), I wasn’t keen on fighting the new narrative. That said, I quickly reloaded the hedge—via a May 2025, 115 put on ZB futures—just ahead of last week’s CPI and PPI prints, aligning with our inflation volatility thesis. The trade climbed 30%, and while taking profit now could prove prudent, the structural risks remain firmly intact.

Are these bond bears you talk about in the room with us?

One concern with the trade is the growing crowding in bearish bond sentiment, which has begun to undermine its asymmetric appeal. The iShares 20+ Year Treasury Bond ETF (TLT) serves as a telling proxy for investor positioning. Despite its price relentlessly falling since early 2022—a direct consequence of rising yields—it continued to attract inflows as investors sought safe havens during growth scares. This dynamic reflected a persistent belief in long bonds as a hedge against economic slowdowns and disinflation risks, even as inflation volatility surged.

Now, however, that sentiment has flipped. We are witnessing the largest outflows in TLT’s history, leading to the deepest drawdown in its assets under management since inception. This sharp reversal signals a broad capitulation on long bonds, as skepticism surrounding Treasuries becomes increasingly mainstream. With investors exiting en masse, the trade’s edge could be diminished. A crowded trade becomes vulnerable to short squeezes, sudden positioning reversals, and narrative shifts, particularly if growth fears return or the Fed signals dovish intent. While the structural case for shorting long-duration bonds remains intact, the growing consensus around this view demands a more tactical approach.

This can also be observed in the put skew for bond options. Hedging costs for a selloff in the long end of the Treasury curve have ticked notably higher over the past week. The options skew on the 30-year bond has tilted decisively toward puts—now pricing at the widest premium since early November—reflecting heightened caution among investors. This shift coincides with 30-year yields touching their highest levels since mid-November earlier this week.

A reality of historical tightness guiding the Fed…

While inflation remains a persistent concern, the U.S. economy faces a dual reality: weakening growth on one side and robust fiscal spending on the other, which risks reigniting inflationary pressures. This tension creates a tricky backdrop for the Fed’s upcoming decision, where a rate cut is a valid possibility as policymakers may tilt their focus toward the employment mandate over price stability, particularly with monetary conditions still historically tight.

The case for a 25-basis-point cut this week rests on the restrictive nature of current policy. Despite the cumulative 75 bps of easing delivered so far, the real Fed Funds rate remains near +2%—a level of tightness last seen in 2007. For context, core PCE inflation has cooled to 2.5% year-over-year, meaning monetary policy continues to run well above underlying price pressures. Historically, such elevated real rates have preceded economic slowdowns. With the labor market showing early signs of moderation, the Fed may opt to manage risks preemptively, shifting toward a neutral stance without destabilizing the broader economy.

The private sector’s resilience adds support to this approach. U.S. private sector debt-to-GDP stands at roughly 145%, the lowest level since 2003, reflecting a decade of deleveraging. Combined with robust nominal wage growth, this lowers the economy’s sensitivity to higher interest rates, giving the Fed room to ease without sparking immediate imbalances. Moreover, current market expectations see terminal Fed Funds rates settling around 3.50% in three years, a shift reflecting confidence in higher neutral rates amidst private sector resilience and nominal growth trends. However, the government’s fiscal position paints a starker picture: deficits remain stubbornly elevated at over 6% of GDP, and higher refinancing costs at current rates have added further strain.

The Fed’s final meeting of the year might not feel merry

Markets are all but certain Santa Powell will deliver a 25-bps rate cut, but the real intrigue lies in the message he leaves under the tree. Will he hand out a hawkish pause like Krampus slipping coal into stockings? Will he deliver the expected cut but pair it with a stern “don’t get greedy” warning for 2025? Or will he surprise us all and promise a deeper easing cycle, channeling his inner Santa with a sack full of future rate cuts? Each scenario brings its own curve dynamics and market implications, so let’s break down what’s at stake as Powell and his team prepare to close out the year.

The hawkish pause: Krampus comes to town

Let’s begin with the least likely—but most disruptive—scenario: the hawkish pause. Markets have assigned almost zero probability to this outcome, so if Powell decides to channel his inner Krampus and leave rates unchanged, the reaction would be swift and brutal. Short-term yields would be the first to reprice higher. Traders, caught on the wrong side of easing bets, would scramble to unwind positions, pushing the 2-year yield up 10–15 bps in a single session. This isn’t just about repricing expectations for this meeting—it would represent a broader reassessment of the Fed’s willingness to cut into an economy that, while showing signs of moderation, is hardly in freefall.

What about the long end? Here’s where it gets more nuanced. A hawkish pause might introduce some upward pressure on the term-premia as concerns about lingering inflation volatility take hold. After all, staying restrictive signals that Powell remains wary of cutting too soon while deficits run hot. However, risk-off flows—investors fleeing equities and riskier assets—could partially offset this move. Long-duration Treasuries often act as a safety net when markets get jittery, providing a counterbalance to rising yields on the short end.

The result? A bear flattening of the yield curve, with short-term yields rising faster than the long end. This is classic hawkish policy in action: monetary conditions remain tight, the curve flattens, and markets are left scrambling for cover.

The broader implications are clear. A hawkish pause would reinforce the message that the Fed isn’t in a rush to cut rates. Equities—already priced for holiday cheer—would not react kindly to this lump of coal, and risk assets across the board would likely see sharp corrections. Meanwhile, the bond market would deliver its own warning shot: restrictive policy isn’t going anywhere, and Powell isn’t here to hand out gifts just because it’s December.

The cut with a 2025 pause: santa’s here, but don’t get greedy

This is the Fed’s version of “splitting the wishbone”—a 25 bps rate cut, as expected, but with a stern message: don’t expect more goodies in 2025. Powell gets to play Santa this meeting, handing out the long-anticipated rate cut, but he’ll also drop a hawkish pause into the stocking to keep the kids (read: markets) in line. Call it a dovish cut with hawkish guidance—just enough cheer to avoid a tantrum, but a warning not to overindulge.

For the yield curve, the outcome is relatively measured. Short-term yields (think 2-year) would likely drift modestly higher—call it 5–7 bps—as traders rein in their overly ambitious rate-cut bets for next year. After all, if Powell signals a prolonged pause, there’s no need for short-term yields to keep pricing in an aggressive easing cycle. Markets would grumble a bit but stop short of full-blown disappointment.

The long end? Largely unmoved. A single rate cut is unlikely to sway the 30-year yield much, as the balance of forces at play—growth stabilization from immediate easing versus persistent inflation risks—keeps things roughly neutral. There’s no bear steepener here, no major moves in duration. Instead, we get a bear-neutral curve: the short end drifts slightly higher, while the long end remains flat, mirroring the mixed signals of a cautious Fed.

The bond market will parse every word of Powell’s guidance, searching for cracks in the Fed’s resolve. A hawkish pause signal caps just how far short-term yields can fall, limiting the upside for bond bulls. But the long end remains vulnerable to fiscal realities. Powell may want to stabilize the curve, but deficit spending isn’t slowing down, and inflation volatility isn’t going anywhere.

For equities, this outcome is like Christmas morning with a note attached: “One gift only—don’t ask for more.” Stocks would likely cheer the rate cut, but gains could be tempered by Powell’s restraint on 2025 easing. Risk assets love dovish surprises, but this isn’t one—it’s Powell threading the needle between growth concerns and inflation realities.

So what’s the takeaway? This outcome gives us a small reprieve but no lasting solution. Short-term yields edge higher, term-premia remains steady, and markets are left hoping Santa Powell’s sleigh returns next year. But with fiscal largesse and inflation still at the party, investors would do well to temper their expectations. Powell might be cutting rates, but he’s not ready to hand out endless candy canes—and the bond bears are still lurking by the punch bowl.

More cuts for 2025, Santa decides to move in with you

Now, what if the Fed not only cuts by 25 bps but also signals a deeper cutting cycle in 2025 than the market expects? Picture Jay Powell channeling his inner Santa, delivering not just this year’s 25-bps gift but stuffing the market’s stockings with promises of more in the year ahead. Such a move would leave short-term yields hopping on the sled downhill, with the 2-year likely dropping 5–10 bps as traders price in a continued easy policy.

The long end of the curve, however, wouldn’t join the celebration. Long-duration Treasuries would likely sell off, as markets grow wary of what more cuts really mean—with inflationary pressures getting a second wind. Investors, now tasked with funding ballooning deficits amid looser financial conditions, would demand higher yields as compensation for long-term debt, steepening the curve in a bear steepener dynamic. This mechanic would be added to Bessent’s likely push towards focussing on issuing on the long end unlike his predecessor (but more on that in a following note).

This scenario creates an uncomfortable tension. The front end throws a party for easier monetary policy, while the long end sulks, skeptical that fiscal discipline will follow. It’s the bond market’s version of an extended family Christmas dinner: short-term yields toast to rate relief with a bit too much boxed wine, while 30-year yields shoot side-eye across the table, muttering about inflation risks and deficits.

For bond traders, the implications are sharp: a dovish pivot amplifies curve steepening and exposes duration to outsized downside risks. At the same time, equity markets—who, let’s be honest, never met a rate cut they didn’t like—might rally initially, only to confront rising long yields, which quietly sabotage lofty valuations.

Well… what is the trade?

To be clear, I do not hold a specific view on whether a cut or pause is the appropriate policy path; I think the tensions between economic weakness and inflation provide plenty of ambiguity and nuance to meditate through. That being said, with a cut fully priced in and our extensive work building the case for structural inflation, a pause appears underpriced at the market-implied probability of just 3%.

To balance the near-term risks of hawkish surprises with the longer-term structural pressures, I’m structuring a two-legged hedge as follows:

Short ZT (2y bonds) via Jan 24 ATM puts

Objective: This leg hedges against a hawkish outcome—either a pause or a cut with hawkish guidance. In both cases, short-term yields would reprice sharply higher as markets unwind aggressive easing bets. A pause, in particular, could trigger a swift repricing of 10–15 bps on the front end, offering strong asymmetric risk/reward.

Short ZB (30y bonds) - taking profits on our short and allocating to the 2y leg

Objective: This leg targets the third scenario—a dovish Fed that signals deeper cuts in 2025. While short-term yields would drop, the long end remains highly vulnerable to rising term premium and deficit-driven issuance. Deeper cuts would loosen financial conditions, exacerbating fiscal pressures and stoking inflation volatility, forcing long-duration bonds to sell off in a bear steepener dynamic.

Bonus Protection: This position also serves as a hedge against a “Liz Truss moment”—where additional tax cuts or fiscal stimulus are implemented without a commensurate reduction in spending. Such policies would amplify deficit pressures and demand for long-term debt, causing a rapid repricing higher in yields.

I will have equal duration adjusted exposure on both legs (to keep things simple) and have the whole structure at 85bps of NAV.

This approach creates a balanced trade that navigates both near-term volatility and longer-term trends. It’s a hedge against complacency on the front end and a reassertion of our core thesis: inflation volatility, fiscal realities, and policy risks leave duration highly vulnerable to repricing. The hedges I put on are always executed with the idea of hedging a lazy long equity book, the first two scenarios we laid out might continue the equity weakness we have seen today. I will however keep my tap-dancing shoes on and take off the 2y leg if Santa decides to move in with us.

Typical financial disclaimers, use your brain or a financial advisor. This article is just jolly good fun and not financial advice etc etc…

Cheers!