In the prior research report, we framed the paths for U.S. inflation and introduced a constructive view on risk assets broadly. In this note, we will provide a synthesis of the macroeconomic variables we are monitoring in the U.S. and interpret the latest economic data prints in preparation for our equity allocation views.

Fed and China go big or go home

A framework on how to think about U.S. inflation and the structural impact on rates and how to think about international capital flows in U.S. risk assets

The two following reports provide frameworks that lay some of the groundwork for thinking about the impact of consumer behavior on economic growth and an overview of monetary balance-sheet policy, which is less in focus than but equally important to benchmark rates.

What is my credit card limit?

We review the health of the American consumer and how it relates to risk assets. The constructive view provided continues to be supported by the latest employment data.

A Reverse Repo Story

We provide monetary balance-sheet mechanics that demonstrate the net easing of financial conditions, which started over a year ago via the Fed’s reverse repo facility and supported risk assets despite tight rates and a shrinking balance sheet.

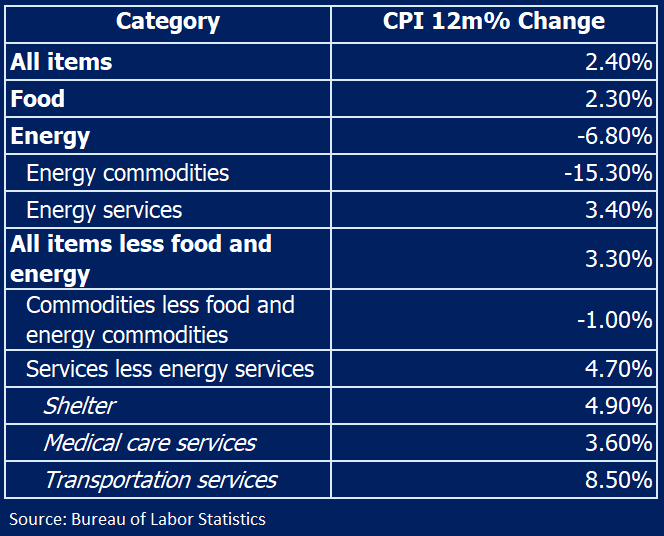

We have received both CPI and PPI numbers this week, showing a continued trajectory of broadly easing inflation but at a decreasing speed on the consumer side.

The picture becomes more nuanced by drilling into the index’s components. Here, we note that the energy component substantially contributes to the PPI’s cooler than anticipated print. Given the energy’s volatile contribution, it is helpful to look at PPI components individually. We note that services have remained on an upward trend since early this year.

It is a similar story when we look at the consumer side. Concerning factors to keep monitoring is inflation in shelter and services more broadly. This data supports our concerns over inflation volatility and our structural floor of inflation at 2% thesis. Due to this, we will continue to put a bias toward managing inflation risk over growth risk with a nuance which will be elaborated further in the note.

Putting things together and building off the conclusion from our quick rates update from Monday:

Saying that structural risks are shifting away from economic growth to inflation does not preclude economic contractions, but it does imply that a fiscal spending put (à la Fed put) is to be expected, which will attempt to limit the scope and frequency of economic contractions. Fiscal spending along with federal debt issuance can be observed in the treasury general account (TGA) which sits on the Fed balance sheet. We covered in depth the mechanics between the different accounts at the Fed and their interaction with the economy. The conclusion there is that given the expected increases in federal spending along with the debt ceiling waiver ending at the start of next year, the TGA balance will be forced to contract, injecting liquidity into the real economy and supporting inflation volatility while also supporting risk asset valuations.

This mechanic implies that signs of growth slowdowns will spur increased fiscal deficits and accelerate the TGA account’s draining, adding to the inflationary pressure and providing liquidity to risk assets. Due to this, equities will first be sensitive to changes in the speed of growth rather than inflation, conditional on the Fed’s rate cut path being along current expectations. We can expect increased equity volatility around economic growth data relative to inflation prints, while valuations and revenue growth are supported by liquidity expanding in the real economy. This expansion in liquidity will be supportive of inflation volatility and impede the Fed from reaching its two percent target.

This is why we put a focus on monitoring economic health, namely consumer health and behavior. The NFP number from the previous Friday (act. 254k, for. 147k, prev. 159k), with unemployment ticking down to 4.1% from 4.2%, supports our American consumer thesis laid out in mid-august that consumers remain broadly healthy and supportive of spending in the economy. However, concerns remain when looking at the margins with low-income households, where delinquencies are rising. We, however, can reasonably expect that the speed of rising delinquencies will decrease as monetary easing from lowering rates trickles up to higher APR debts and reduces the interest burden for low-income households.

One interesting measure to monitor is the delta between chargeoffs and delinquencies for consumer loans. We can observe that when chargeoffs start catching up to delinquencies (essentially if you are delinquent, your probability of going bankrupt increases), then that is a sign of difficult times ahead. In the 2020 covid shutdown-induced recession, the impact on delinquencies and charge-offs was muted due to the range of consumer-supporting policies implemented to mute the effect of lost incomes. The effect can however be observed in 2001 and the GFC where fiscal stimulus was slower to come and support the economy. We currently observe the rate of chargeoffs accelerating relative to delinquencies but unemployment was rapidly accelerating during the three prior recessions; something we are not observing currently.

The ISM PMI’s also help get a sense of economic growth and we note that services are still in an upwards trajectory for the year. Manufacturing however is in contraction but we can expect to see an uplift there from loosening monetary conditions.

Given manufacturing currently composes 30% of economic activity, overall growth continues supported by services.

Now that we have some confidence in the economic trajectory for growth in the U.S. we can start thinking about which equity sectors we are interested in allocating to. Sticking to the macro synthesis nature of this note, I want to quickly look at the defensive equities before doing sector-by-sector fundamental analysis in the next one.

A quick look at the flows between defensive (utilities and staples) and cyclical (energy , materials, industrials) equities shows an interesting picture of capital guided by uncertainty.

Now, we agree with the market that uncertainty is well and thriving. However, we diverge on the efficacy of defensive equities in protecting against uncertainty, given our views on inflation. In line with our framework detailed above, equities had virtually no movement from the hot CPI print. We should continue expecting a muted impact of inflation readings relative to growth for the time being. This lack of volatility pick-up coincides with the increased positioning in defensives, which have some characteristics of long-duration bonds. Given our shorts on 20+ year bonds, we also believe that defensives will underperform relative to other equity risk profiles. The increased allocation to defensives presents an opportunity to enter or increase allocation into some equities that can benefit from inflation at attractive valuations despite all-time highs for equity indices.

The rates market justified the view laid out on Sep 29th after the CPI report, with the 30y gradually selling off while the 5y quickly rallied and retraced but remained bid on Friday’s close compared to the 30y, which keeps selling off, in part an effect of inflation volatility remaining heightened. This continues to provide justification to be long below the 5 year and short above the 20 year.

I wanted to put together this synthesis on U.S. growth and inflation in one place as a reference before exploring the equity sectors of interest. In the following research piece, I will promptly tackle these equities without macro-deviations.